Money & Markets Week Ahead for the week of February 14, 2021: Shopify’s earnings and the pace of growth for the IPO market.

This is a short week as the markets are closed on Monday for the Presidents Day holiday.

Earnings are winding down, and there’s even quiet on the IPO front.

Here’s what to look for in the week ahead on Wall Street:

On the IPO Front

There are no initial public offerings (IPO) scheduled on the calendar this week.

However, there are three pieces of IPO news from last week I took an interest in.

It all relates to the fact that companies are starting to raise the deal size of their IPOs ahead of pricing.

Here are three examples:

- Roth CH Acquisition III (Nasdaq: ROCRU) — This is the third blank check company formed by Roth Capital and Craig-Hallum. Last week, they raised their IPO deal by increasing the number of shares they were offering. They aim to raise $150 million by offering 15 million shares at $10 per share. The initial deal was for 10 million shares at the same price.

- NexImmune (Nasdaq: NEXI) — This company specializes in developing T-cell immunotherapies for cancer. Before their IPO last week, they raised their deal size by 25%. The initial deal was to offer 4.7 million shares at a price range of $15 to $17. They changed it to offer 5.9 million shares — increasing the deal size to $94 million.

- AFC Gamma (Nasdaq: AFCG) — A commercial mortgage real estate investment trust (REIT) focused on the cannabis industry. It initially filed to offer 5.6 million shares at a range of $17 to $19 per share. They changed that to offer 6.3 million shares at $19 — raising the deal to $119 million.

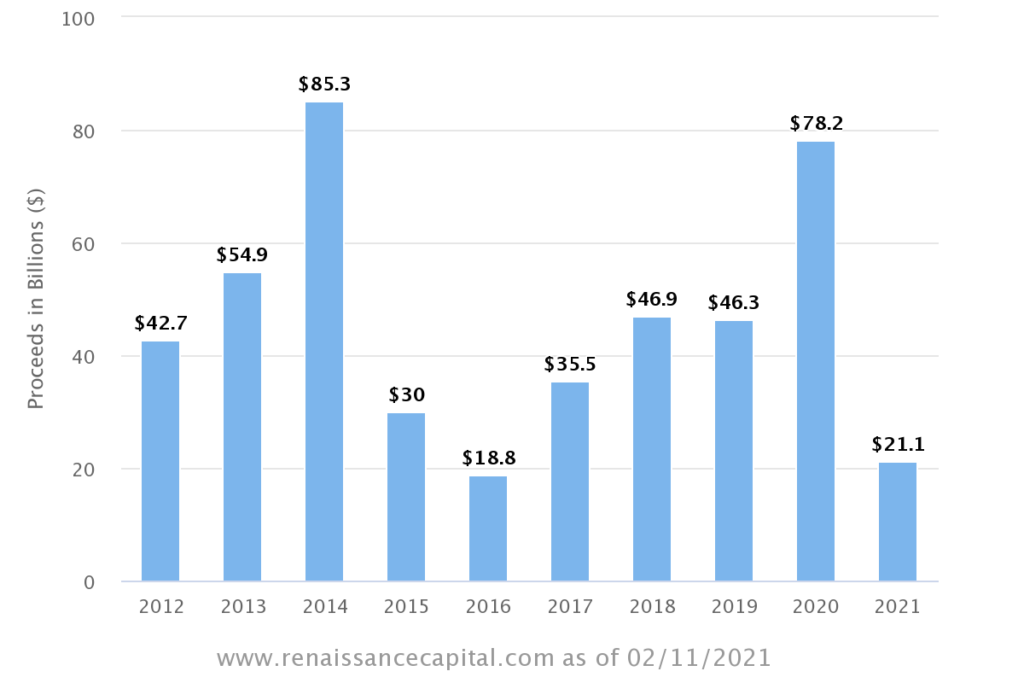

The deal increases come at a time when IPO proceeds for 2021 have already hit $21.1 billion — that’s more than all of 2016 and nearly half the proceeds raised in 2018 and 2019, according to Renaissance Capital.

IPO Proceeds Start Strong in 2021

There have already been 50 IPOs priced in 2021. To put that into context, there were 218 priced in all of 2020.

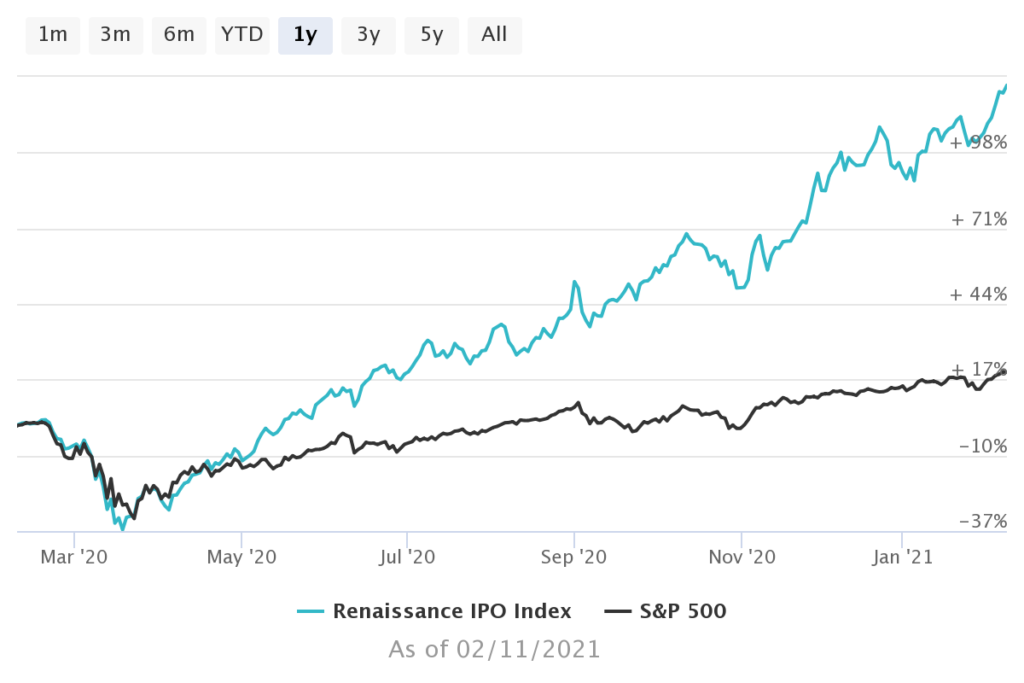

The Renaissance Capital IPO Index shows a trailing 12-month gain of 122% compared to the S&P 500’s gain of around 19%.

IPO Index On Fire

The index tracks the pricing of U.S. IPOs on the market and shows just how strong IPOs have been since early 2020.

Deeper Dive: Shopify (SHOP) Earnings

We’re in the home stretch of the quarterly earnings season, but there are still some big companies reporting earnings this week:

- CVS Health Corp. (NYSE: CVS).

- Occidental Petroleum Corp. (NYSE: OXY).

- Shopify Inc. (NYSE: SHOP).

- Garmin Ltd. (Nasdaq: GRMN).

- Walmart Inc. (NYSE: WMT).

- Roku Inc. (Nasdaq: ROKU).

I’m going to focus on Shopify’s earnings.

The Canadian company is a cloud-based e-commerce platform that allows merchants to set up and manage their “stores” through web, social media, brick-and-mortar and pop-up shops.

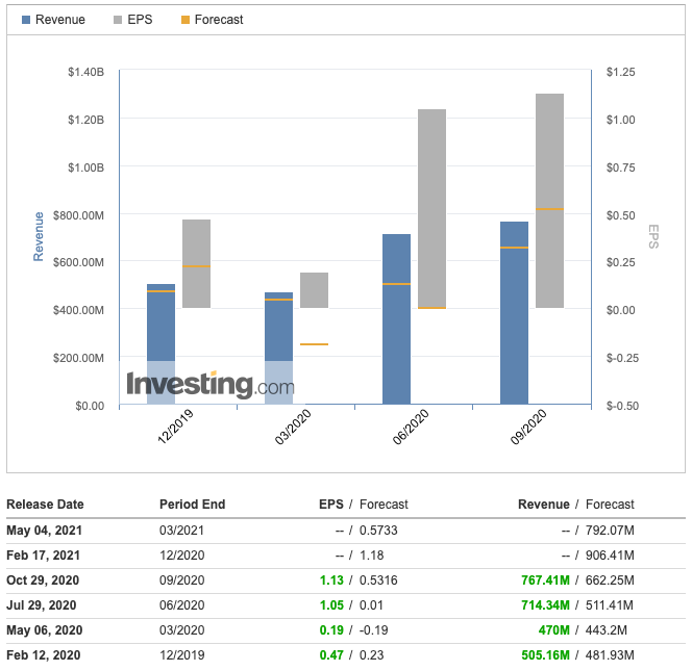

In the last quarter, Shopify blew away consensus estimates for both earnings per share and revenue.

The company reported $1.13 earnings per share on $767.4 million in revenue. Consensus estimates were earnings of $0.53 per share on revenue of $662.2 million.

SHOP Earnings Blow Past Consensus Estimates

It was the fourth straight quarter the company beat the pants off Wall Street estimates.

Since May 2020, Shopify’s revenue has been on the rise. In quarter two of 2020, the company posted revenue of $470 million — beating estimates of $443.2 million.

Revenue jumped to $714.3 million in the third quarter of 2020 and to $767.4 million in the fourth quarter.

Wall Street seemed to get wise about underestimating Shopify’s performance.

Consensus estimates for this quarter are for earnings of $1.18 per share on revenue of $906.4 million.

I suspect that, even with revised consensus, Shopify’s earnings will again beat Wall Street estimates.

Earnings Whispers has the number at $2.17 per share. I don’t think it will be that high, but it could reach $2 per share.

Money & Markets Week Ahead: Data Dump

The weekly data dump begins on Wednesday; the market is closed for the Presidents Day holiday.

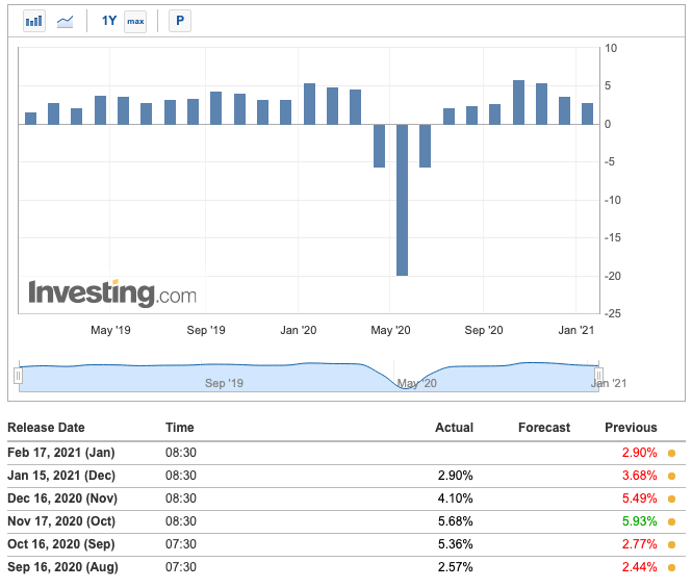

The Census Bureau will release its month-over-month and year-over-year retail sales figures on Wednesday.

The retail sales report measures the change in the total value of sales at the retail level. It’s a big factor in consumer confidence.

After increasing as much as 5.68% in October 2020, retail sales have started to taper off.

Retail Sales Have Declined in the Last Three Months

In November, sales only increased by 4.1%. That uptick was even lower in December (2.9%).

Another decline could suggest the economic recovery from the coronavirus pandemic continues to slow.

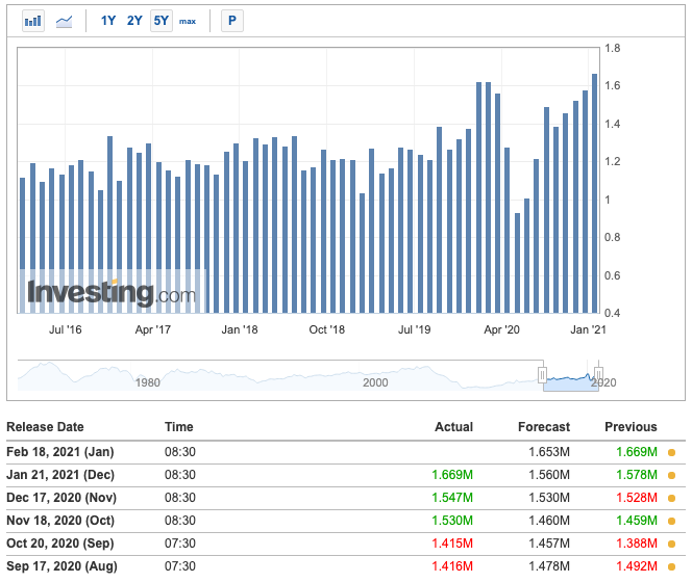

We’ll get a glimpse into how the year started regarding new home construction Thursday when the Census Bureau releases its housing starts report for January.

Over the last three months, new home construction has steadily increased from 1.5 million in October 2020 to 1.66 million in December 2020.

New Home Starts Continued to Increase In December 2020

Analysts project new home construction starts to fall only slightly — to 1.65 million — in January.

Finally, on Friday, IHS Markit will release its manufacturing purchase manager’s index (PMI).

This PMI measures the activity level of managers in the manufacturing sector. Any reading of the index above 50 indicates expansion. Below 50 signifies contraction.

The index hit a bottom of around 36 earlier in 2020 but has started to build back up.

It has read above 50 since August 2020.

Manufacturing PMI Continues Uptrend

In January 2021, the index read 59.2, its highest reading in a year.

Projections are for the PMI to dip slightly to 56.5 as manufacturing firms are in the midst of typical first-quarter slowdowns.

Earnings Reports

To finish off the Money & Markets Week Ahead, here’s a look at some of the key earnings reports due out this week:

Monday

Neptune Wellness Solutions Inc. (Nasdaq: NEPT)

Just Energy Group Inc. (NYSE: JE)

Tuesday

CVS Health Corp. (NYSE: CVS)

American International Group Inc. (NYSE: AIG)

Occidental Petroleum Corp. (NYSE: OXY)

Devon Energy Corp. (NYSE: DVN)

Wednesday

Shopify Inc. (NYSE: SHOP)

Rio Tinto ADR (NYSE: RIO)

Waste Connections Inc. (NYSE: WCN)

Garmin Ltd. (Nasdaq: GRMN)

Thursday

Walmart Inc. (NYSE: WMT)

Roku Inc. (Nasdaq: ROKU)

Applied Materials Inc. (Nasdaq: AMAT)

Newmont Corp. (NYSE: NEM)

Friday

Deere & Co. (NYSE: DE)

Magna International Inc. (NYSE: MGA)

That’s all for this week.

Until next time…

Safe trading,

Matt Clark

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.