Last week was absolutely brutal.

President Trump’s “Liberation Day” announcement immediately sent stock markets around the world into a tailspin.

The S&P 500 lost 14% between Thursday and Friday, marking the sharpest two-day decline we’ve seen since the throes of the COVID Crash in March 2020.

As of this morning’s open, three major stock indexes — the Russell 2000, the Nasdaq 100, and the S&P 500 — are officially in “bear market” territory, having fallen more than 20% from their highs.

Note: As we put the final touches on this email, we’re seeing some strong buying activity mixed in with selling in the morning session. Whether that holds or fizzles will determine the best moves to make ahead … and you can be certain that the Money & Markets team is sizing things up in real-time.

The best advice we can give you here and now is to focus your efforts on identifying relatively “strong” stocks and avoiding the weakest ones.

That’s what our Monday edition of What My System Says Today is all about.

Let’s dig in!

Today, my team and I will…

- Show you the market’s best and worst sectors last week…

- Offer a “Top 10” list of strong stocks from the best sector, according to a simple momentum screen, and…

- Offer a list of 10 “worst” stocks from the sector that suffered the largest decline.

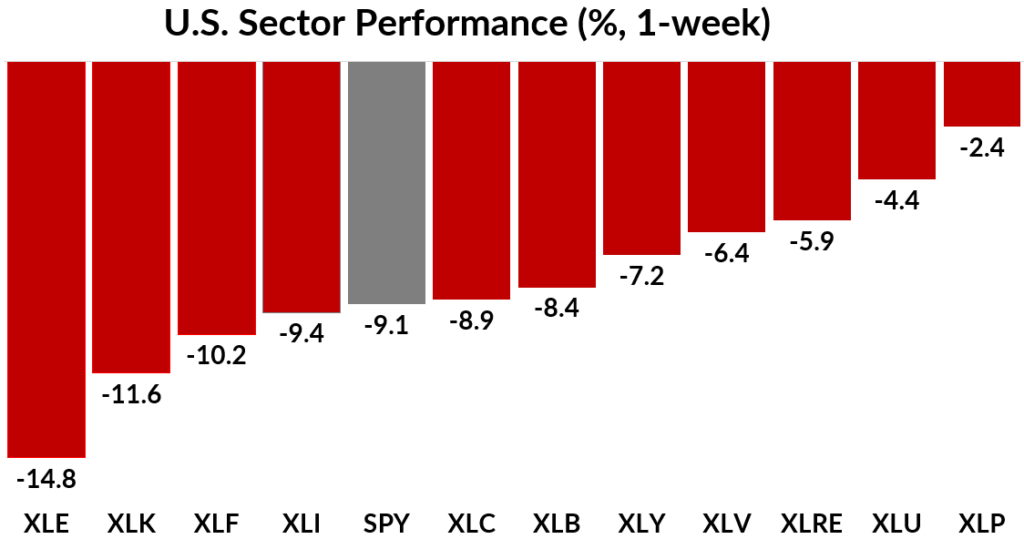

Here’s how each sector fared during last week’s historic market rout:

Key Insights:

- The S&P 500 (SPY) lost a massive 9% for the week.

- 4 out of 11 sectors lost more than the S&P 500.

- None of the 11 sectors showed positive returns last week.

- Consumer Staples (XLP) squeaked by with the smallest loss (-2.4%).

- Energy (XLE) was the worst-performing sector (-14.8%).

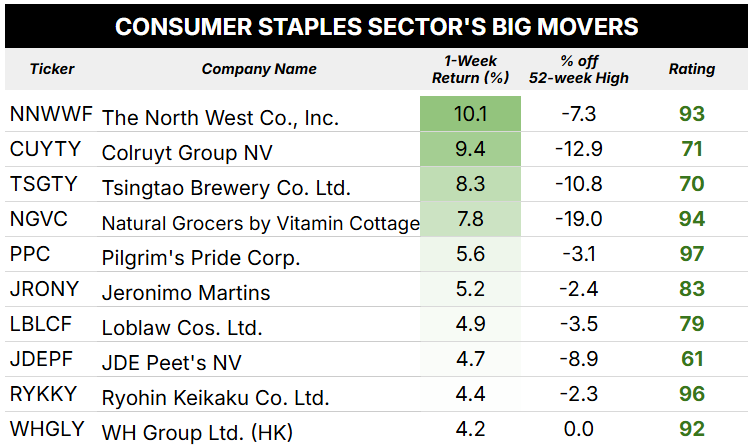

The Best-Performing Sector: Consumer Staples

The Consumer Staples (XLP) sector managed to weather the storm relatively well, losing only -2.4%. By comparison, the S&P 500 lost almost 4X that!

Now let’s have a quick look at some of the top-performing stocks in this “defensive” sector …

To construct this table, my team and I ran a scan of all consumer staple stocks that closed on Friday within 20% of their 52-week highs. Of those stocks, you’re seeing the top performers from last week.

Buying top-performing stocks … from a top-performing sector … while they’re flirting with “new highs” territory …

Well, that’s a classic “momentum” strategy.

It’s difficult to think about running a “long” momentum strategy just as we slip into bear market territory, but if you’re looking to put money to work in this environment … these are stocks that are certainly worth consideration.

You should note two things about this list …

First, 8 of the 10 are foreign stocks. Trump’s trade war is aimed, of course, at bolstering America’s economy and markets. But for now, at least, we’re seeing relative strength in pockets of markets outside the U.S.

Secondly, you’ll see that all 10 of last week’s top-performing consumer staples stocks are rated “Bullish” (60-80) or “Strong Bullish” (80-100) by my Green Zone Power Rating system. This means they’re currently poised to beat the market by 2X to 3X ahead.

That’s the first silver lining I see today!

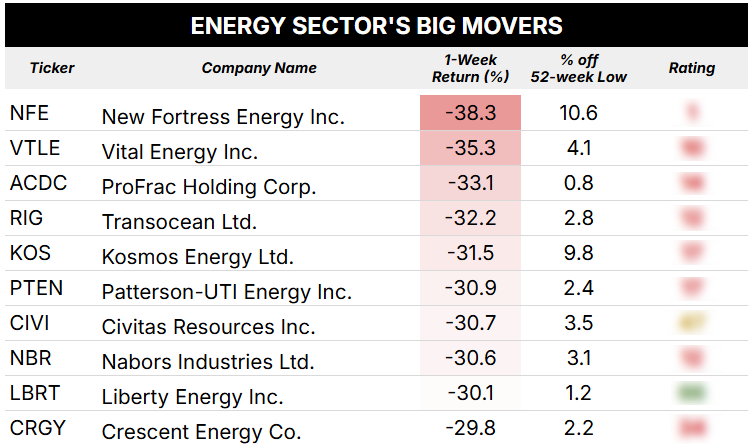

The Energy Sector’s Bright Spot

Moving on to the market’s worst performers, the broader energy (XLE) sector fell -14.7% last week, but individual energy stocks suffered far steeper declines…

To construct this table, my team and I ran a scan of all energy stocks that closed on Friday within 20% of their 52-week lows. Of those stocks, you’re seeing the worst performers from last week.

Shorting the worst performing stocks … from a poorly performing sector … while they’re flirting with “new lows” territory …

That’s also a classic “momentum” strategy.

Of course, playing the downside isn’t for novices. I’ve successfully helped subscribers to my Max Profit Alert service “short” stocks safely (with options) since I released a presentation in early February warning of trouble in “Big Tech” land. But I don’t recommend you go it alone.

For long-term investors, the silver lining is that this isn’t the first time we’ve seen energy stocks overshoot to the downside during a panic. In March 2020, crude oil futures went negative, leaving a slew of grossly undervalued energy stocks ripe for the picking.

Of course, you have to know which energy stocks will rebound once the panic subsides and which are better to avoid.

Thankfully, that’s where my Green Zone Power Rating system comes in … as it does just that!

The list above includes stocks rated across the gamut, from “bearish” (20-40) and “high risk” (0-20) … to “bullish” or better (60+). While I don’t recommend you step in today and buy energy stocks with both hands, I hope you’ll consider setting yourself up for success in the next bull market by taking a subscription to my flagship newsletter, Green Zone Fortunes.

We already own several highly rated energy stocks, and I’m betting that we’ll be picking up bargains as a new bullish trend takes hold in the months ahead.

That’s the second silver lining I see!

That’s all for today…

Otherwise, enjoy your Monday and look for the next edition of What My System Says Today to land in your inbox tomorrow!

To good profits,

Editor, What My System Says Today