Small-cap stocks appear likely to lose the most in the next market decline. Now is probably the time to prepare for that.

Uncertainty is high right now. But there is one certainty: The future will be very different from the past.

To see one part of our future, stop by a local business. Customers are scarce. Employees are masked. Many of them wear gloves. Hand sanitizer is available. You might see a plexiglass or plastic shield at the checkout counter.

Local businesses face an uncertain future with the certainty of higher costs. We know costs are higher because someone is paying for all those masks, added safety measures and cleaning supplies.

It’s only logical that every business faces higher expenses. It’s also logical that some businesses will struggle with higher costs more than others. In fact, suffering is likely to be proportional to size, with smaller businesses hurting the most.

Small-Cap Stocks Most at Risk During Next Market Crash

In the stock market, this means small-cap stocks should see profits contract more than large-cap stocks.

After a strong rally in prices, lower earnings lead to higher price-to-earnings (P/E) ratios for smaller companies and potentially greater risk.

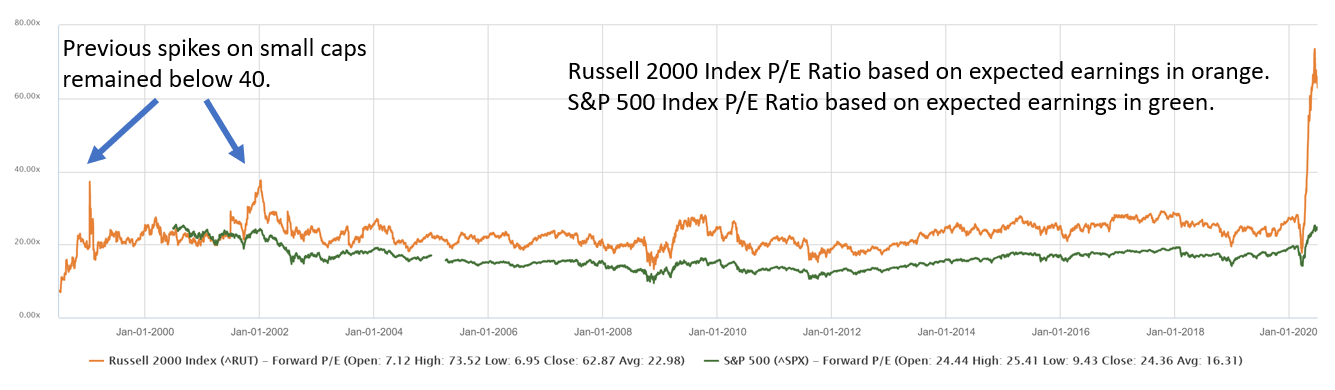

Below is a chart of the P/E ratio of the Russell 2000 Index compared to the P/E ratio of the S&P 500 Index. The Russell 2000 tracks small-cap stocks. The S&P 500 tracks large-cap stocks. The difference between the two is at record highs.

Source: Standard & Poor’s

High P/E ratios indicate that stocks are overvalued. They warn investors that a decline in prices is likely. With price-to-earnings ratios of both large- and small-cap stocks near record highs, investors should be on alert for a market crash.

A crash in price is the only realistic way for the P/E ratio to decline at this point. Earnings estimates are likely to come down in the next few weeks as companies deliver their latest quarterly results and explain how much expenses will increase. This will mean P/E ratios will be even higher unless prices fall.

Small-cap stocks appear likely to lose the most in the next market decline. Now is probably the time to prepare for that.

• Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at New York Institute of Finance. Mr. Carr also is the former editor of the CMT Association newsletter Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.