2025 is the twelfth consecutive year in which small-cap stocks have underperformed their blue-chip counterparts.

Driven by index investing and the meteoric rise of the “Magnificent Seven” mega-cap tech stocks, this cycle of small-cap underperformance has become one of the longest since the Great Depression.

Inevitably, this cycle will turn around — unleashing a massive wave of opportunity for both Wall Street and Main Street investors.

Based on my latest screen, that “Small-Cap Surge” moment may have just arrived…

Because this week, we’re looking at 31 “New Bull” stocks, including 10 stocks in the small- and micro-cap space.

And only ONE of those stocks is on the S&P 500 index…

Green Zone Spotlight Shines on TKO

For a quick review, the criteria for this S&P 500 screen are:

- The stock must currently rate 60 or higher (that is, “Bullish” or “Strong Bullish”).

- The stock must have been rated less than 60 for each of the last four weeks.

After running my screen, only one stock passed the 60-point threshold:

TKO Group Holdings Inc. (TKO), a combat sports entertainment company, has made waves after going public in September 2023, coinciding with its merger of the two largest combat sports promotions in the world: the Ultimate Fighting Championship (UFC) and World Wrestling Entertainment (WWE).

It now has multiple media deals, including one with Netflix to stream its WWE Monday Night RAW promotion weekly. Just last month, the company announced a massive five-year partnership with Disney to stream all of its WWE Premium Live Events, including WrestleMania, the Royal Rumble, and SummerSlam.

And investors are catching on … TKO stock has gained 51% over the last year, almost tripling the S&P 500’s 16.5% gain over the same time and translating to an 81 rating on my Momentum factor in the Green Zone Power Rating system.

I’m still a little wary of TKO’s debt load, with the company reporting roughly $3 billion in total debt at the end of the second quarter 2025. But with these massive deals and sell-out crowds at major events, the cash is flowing in…

Now that TKO has a “Bullish” rating in my system, I expect outperformance to continue in the coming months.

Let’s turn to stocks outside of the S&P 500…

30 “New Bulls” Outside of the S&P 500

While the S&P 500 didn’t provide many “New Bulls” this week, the same can’t be said for stocks outside of the major index.

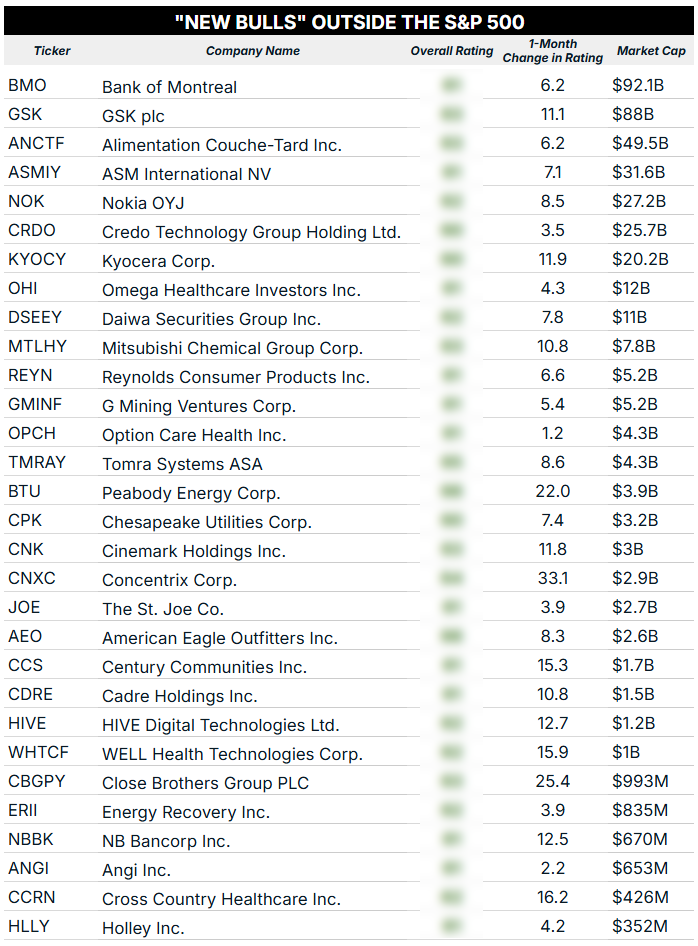

After running the numbers, 30 stocks hit the “Bullish” zone of my rating system:

I’ve organized this week’s list by market cap. As you can see, another 10 micro- to small-cap stocks are now set to outperform the S&P 500 over the next 12 months.

There are also some notable names outside of the U.S., including the Canadian banking giant Bank of Montreal (BMO) and Nokia (NOK), the Finnish telecommunications company best known for making indestructible cellphones.

As I’ve mentioned before, it never hurts to take “home bias” out of the equation and look for outperforming stocks abroad.

If you want to see how any of the 31 stocks that hit “Bullish” status this week, click here to find out how you can join my flagship investing service and gain unlimited access to my rating system today.

To good profits,

Editor, What My System Says Today