Do you ever wonder why small-cap stocks can deliver such large gains?

It’s the same reason we get excited at T-ball games.

It’s spring. That means baseball is back at all levels. T-ballers to major leaguers are all swinging as fans cheer them on.

T-ballers might make contact and send the ball just a few feet, while we’ve already seen a 485-foot home run in the major leagues in the first week of the season.

But the distance of the hit isn’t important to the players or fans in T-ball. While we’re in awe of the pros’ home runs, we’re even more excited when the tiny slugger connects after a few tries.

That’s because those hits can mean so much to the pint-sized batters.

This idea follows the fledging ballplayer throughout their life…

A small essay in third grade is as meaningful at that time as a PhD dissertation will be 20 years later. The amount of work required for success changes, but every milestone is a cause of celebration.

Looking back, we often find the World Series celebrations aren’t as memorable as the pizza party after a T-ball game. Success of little guys and girls on the field just feels more meaningful.

Companies experience the same trajectories. Success means different things at different levels.

This is the reason small-cap stocks can deliver such large returns … and why now is such an important time to focus on them.

How Sales Juice Small Caps

Think of a small company that makes plush toys. Let’s say its sales are about $1 million a year.

Walmart discovers the company and places a $1 million order. Sales just doubled with one transaction.

Now consider a larger toy company, with sales of almost $6 billion. Walmart makes the same order, but a $1 million order is almost meaningless to the larger company.

This might be the primary factor driving small-cap stocks to outperform. Any increase in sales makes a significant difference to the company, and investors push the price of the stock up to recognize that.

Let’s say that small toy company keeps growing. In 10 years, sales top $90 million and the company is listed on the Nasdaq with a $108 million market cap.

Toy companies such as Mattel Inc. (Nasdaq: MAT) or Hasbro Inc. (Nasdaq: HAS) trade at about 1.2 times sales. This means the value of all the company’s shares (aka its market cap) adds up to a value equal to about 1.2 times the amount of sales in the past 12 months.

A $10 million contract adds for our small company $12 million to the market cap. That’s a 11.1% increase in the stock price. For a big toy company, that same contract might add just 0.5% or even less to its market cap.

This is why small caps have so much potential. If their products or services are good, sales will increase. Orders will get bigger and bigger. And new orders can have an immediate and large impact on the stock price.

Tech stocks can offer even larger gains. Many tech companies trade at three times sales, or even more. New sales can have an immediate, much larger impact on the stock price.

But there’s also a risk… When sales drop, that multiple cuts the other way and makes the stock worth less.

This is a greater risk in small caps than large caps, because that $10 million contract in our example makes up a larger percent of overall sales. That explains why small-cap indexes don’t outperform all the time.

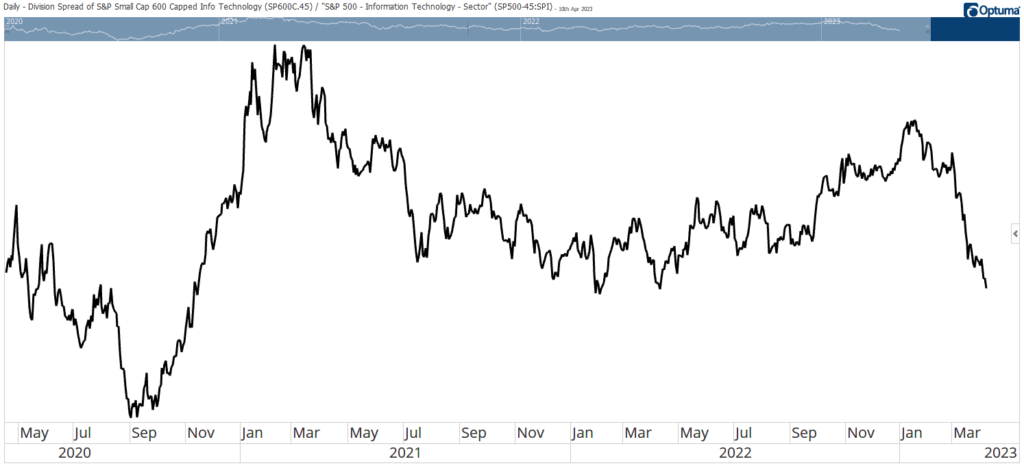

The chart below shows the opportunity — and the risks — of small caps. The chart compares small-cap tech stocks to large-cap tech. It’s a ratio of the small-cap focused S&P 600 Information Technology Index to the large-cap S&P 500 Information Technology Index. When the line is rising, small caps are outperforming.

The Ebbs and Flows of Small Caps

Through the end of 2020, small stocks roundly beat large caps. Then large caps came into favor in the first half of 2021. For most of 2022, it didn’t matter which index you selected. There was no clear winner.

Throughout the time displayed in this chart, the story about small caps was compelling. They were smaller and nimbler than large caps, but they only outperformed in brief periods.

This demonstrates why small caps aren’t a “set it and forget it” investment. The stories of individual companies determine the success of the investment.

However, this active element comes with a huge reward, as small-caps have historically outperformed large-caps after bear markets by a big margin. You just have to learn how to pick the right ones.

That’s why my colleague, Adam O’Dell, just developed a strategy that targets these small companies that are set to outperform over a shorter time frame. (For more reasons why stock size matters, click here to catch up on Adam’s piece from yesterday.)

He’s drilled down to find only the stocks he believes could hit a 500% gain this year. And he’s done it by focusing on high-quality businesses trading at cheap valuations.

They’re the “T-ballers” — and Adam wants you to become a fan cheering along the way.

Tomorrow, he’s going to release a big list of stocks that his initial screen identified. You’ll find out how to access that in Stock Power Daily, so keep an eye on your inbox.

Until next time,

Mike Carr

Senior Technical Analyst

P.S. I can’t share everything right now, but I must say something about this list that makes it totally unique.

Each of the stocks trades under $5 per share or less. That’s critically important. Adam will show you why tomorrow.