Gold miners have more information about the gold market than I do. That’s not surprising.

Miners move metal to market for a profit. A miner’s management team should know how much gold its company produces and how much gold customers want.

With this information, miners sell gold when prices are high. They do this in futures markets. Their selling can be seen in an obscure report issued by the Commodity Futures Trading Commission (CFTC).

Every week, the CFTC publishes the Commitment of Traders (COT) report.

This report tells us who is buying gold, soybeans and other commodities. In the gold market, regulators know who buys a futures contract: a mining company, a hedge fund or an individual investor.

How ‘Smart Money’ Is Buying Gold

Analysts call one group “smart money.” This group is right about major trends more often than not. In the report, this group is known as “commercials.” For gold, commercials are miners and jewelry companies that produce and use large quantities of the metal.

Hedge funds are called “large speculators” in COT data. They buy when prices are rising, and sell when prices fall. The third group in the report includes small speculators. These are individual traders with small positions. When analyzing gold, we can ignore small speculators.

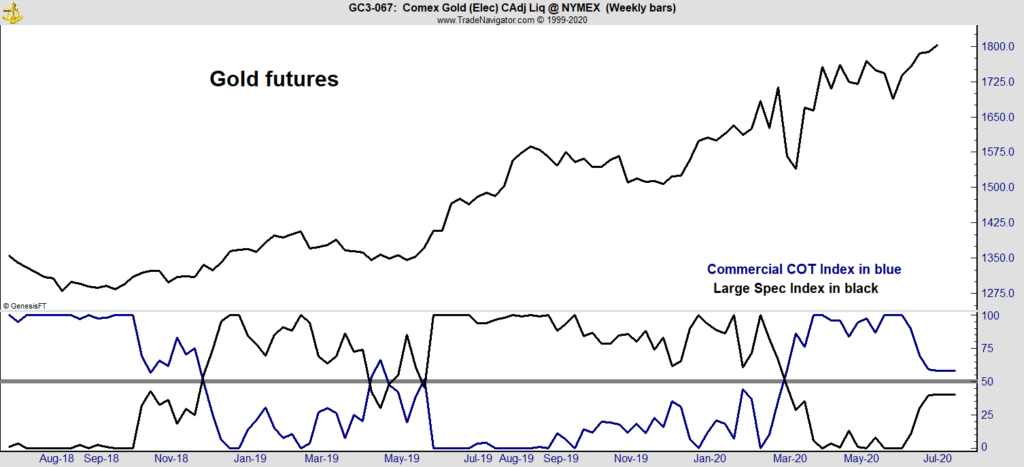

You can see the positions of commercials and large speculators at the bottom of the chart below. The price of gold is at the top.

‘Smart Money’ Moves in the Gold Futures Market

Source: Trade Navigator

In the chart, raw data from the COT report is converted to an index that ranges from 0 to 100, with 100 being the most bullish. The solid gray line in the chart marks the midpoint of the range.

While the price of gold moved up over the past couple of months, commercials were buying. They usually buy before big price increases. These purchases show commercials thought gold was a bargain at $1,800.

But in the past few weeks, commercials stopped buying aggressively. This usually happens before a price move accelerates.

At the same time, large speculators ramped up orders. Their buying should cause the recent uptrend to accelerate.

So the two most important groups in the futures market are both positioned for higher prices. COT data, an obscure indicator, tells us gold is a great investment right now.

• Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at New York Institute of Finance. Mr. Carr also is the former editor of the CMT Association newsletter Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.