Stock market investors are sometimes divided into two groups: An investor is either sophisticated — also known as “smart money” — or unsophisticated.

Sophisticated investors include fund managers responsible for billions of dollars. They include people like Warren Buffett, who holds almost $140 billion in cash after selling billions of dollars’ worth of airline stocks in the recent market decline.

Unsophisticated investors include the 23,294 accounts at Robinhood, the free brokerage app, who bought airline ETFs as Buffett was selling.

In the long run, sophisticated investors have done better than the unsophisticated group. That’s why many analysts call them “sophisticated,” or smart money.

Smart Money Hints at Another Stock Market Crash

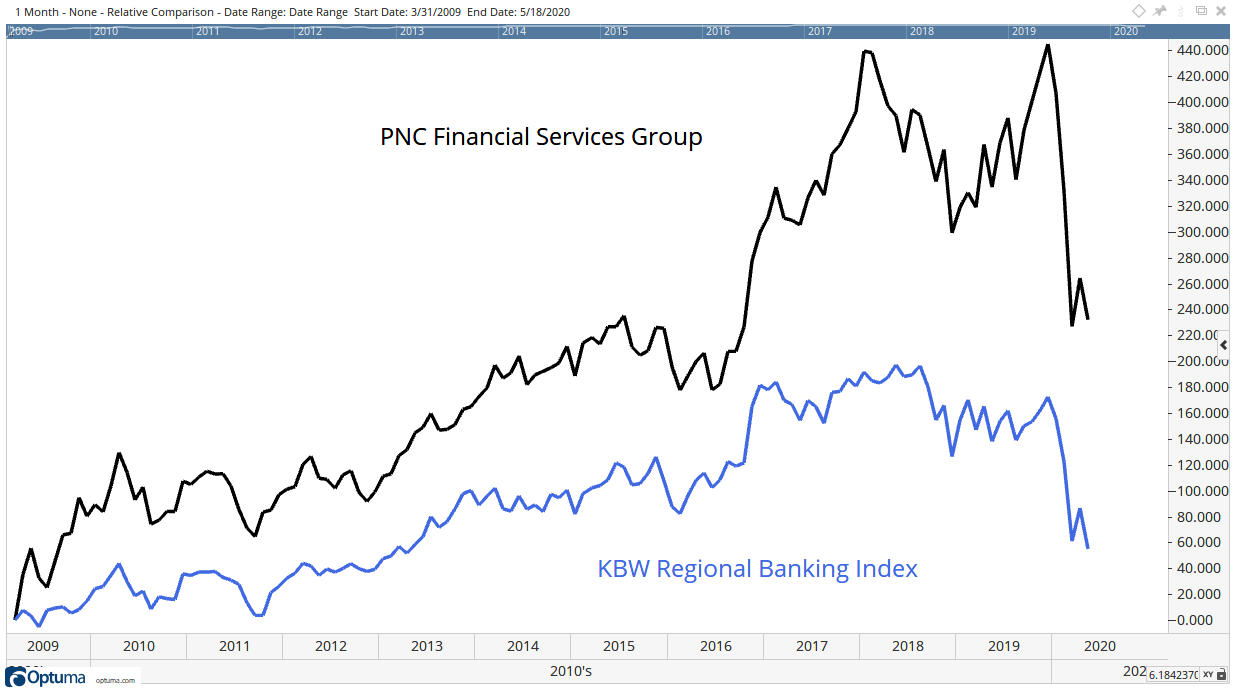

Another example of smart money is the CEO of The PNC Financial Services Group, Inc. (NYSE: PNC), Bill Demchak, a regional bank that has significantly outperformed its peers since the financial crisis ended in 2009. Shares of PNC beat a benchmark index of regional banks by more than 310% over that time.

Part of PNC’s strong performance is because of an acquisition made at the beginning of the financial crisis in 2008. The company paid $5.6 billion to acquire National City Bank, a larger rival that suffered big losses on mortgages. PNC paid about 40% of National City’s book value in that deal — smart money.

Now, PNC is hunting for bargains again.

Demchak recently announced he is selling the bank’s $17 billion stake in BlackRock, the world’s largest asset manager. PNC held that position for 25 years.

By selling now, the goal is to create a “bulletproof” balance sheet to fund the purchase of distressed assets.

“As we entered this crisis, it became clear that everything we thought we knew was proven incorrect,” Demchak told Financial Times. “We’re in this economy where everybody bases their models predicting the future on the past and of course we’ve never been in a situation where (we) effectively have been forced to shut down on the economy with this much fiscal stimulus.”

In a comment that could have been directed to individual investors, he noted, “I can’t stress the importance of being able to play offense into that environment.”

This decision isn’t free of risk.

BlackRock provided about 15% of PNC’s earnings last year. If the economy recovers quickly, PNC will be left with a large cash balance and lower earnings. That will send the stock price down and could cost Demchak his job.

In effect, he is betting his job on raising cash. That’s a big bet for someone with a salary of $7.1 million last year.

It’s the same bet Warren Buffett is making at Berkshire Hathaway Inc. (NYSE: BRK.B) by selling stocks and sitting on a record amount of cash.

As these two “smart money” investors build cash, individual investors should consider the same strategy.

• Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at New York Institute of Finance. Mr. Carr also is the former editor of the CMT Association newsletter Technically Speaking.

Follow him on Twitter @MichaelCarrGuru