If there was one thing the COVID-19 pandemic has taught us, it’s flexibility.

Being locked down for several months enhanced the need for flexibility, not just in our personal lives but in business as well.

As employees transitioned to the home office, thousands of companies were forced to change business operations.

This encouraged companies to be flexible in how they stored and accessed data.

It became unrealistic to house data on internal servers as employees working from home would have no way to access the information. This spurred a transition to cloud data storage.

The pandemic boosted data storage companies. And the trend of external servers and cloud storage is only going to get bigger.

Companies are going to spend more and more on technology storage.

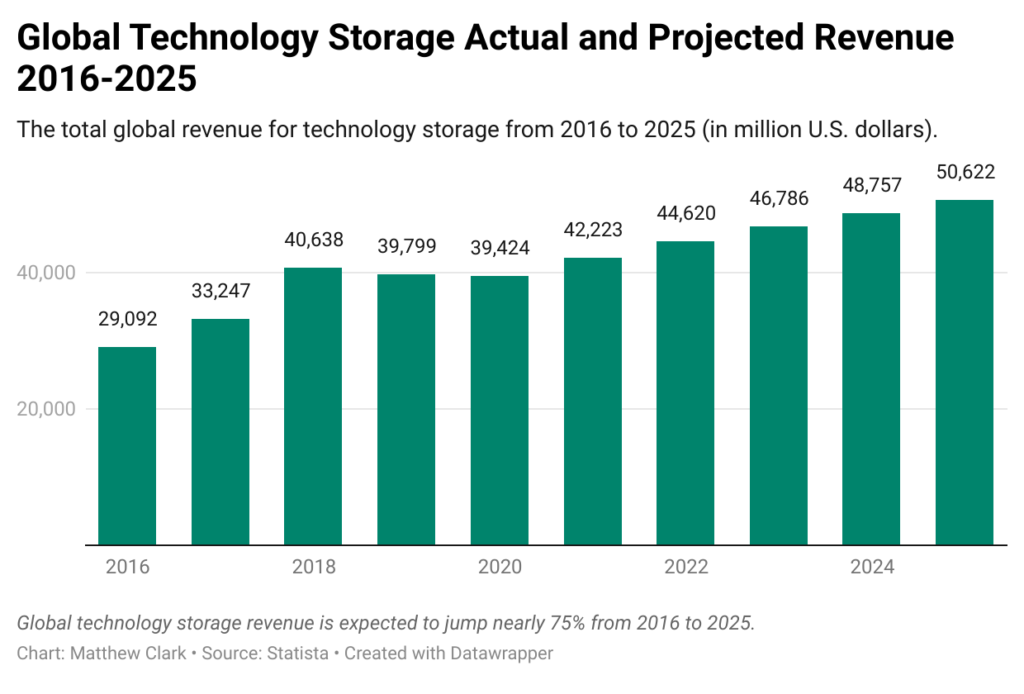

In 2016, the global revenue for technology storage companies was $29 billion.

That number is expected to reach more than $50 billion by 2025.

Smart investors who recognize the growth potential of data storage companies will benefit from this increased revenue.

One Data Storage Stock to Buy

The data storage company I am recommending today is Super Micro Computer Inc. (Nasdaq: SMCI).

The company develops and manufactures high-performance server and data storage products.

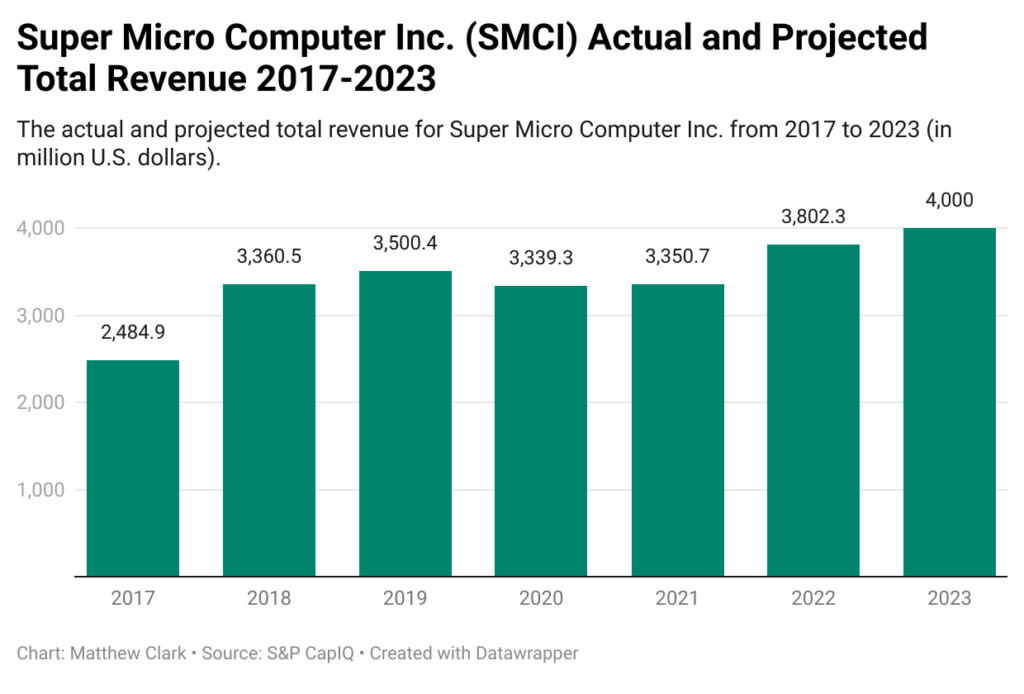

SMCI was on a solid revenue growth track until COVID-19, but it still managed $3.3 billion in total revenue in 2020.

Its total revenue is projected to take off in 2022 and 2023.

By 2023, SMCI’s total projected revenue is expected to reach $4 billion — a 21% increase in total revenue in three years.

That is a pretty strong growth trajectory for a company within the data storage field.

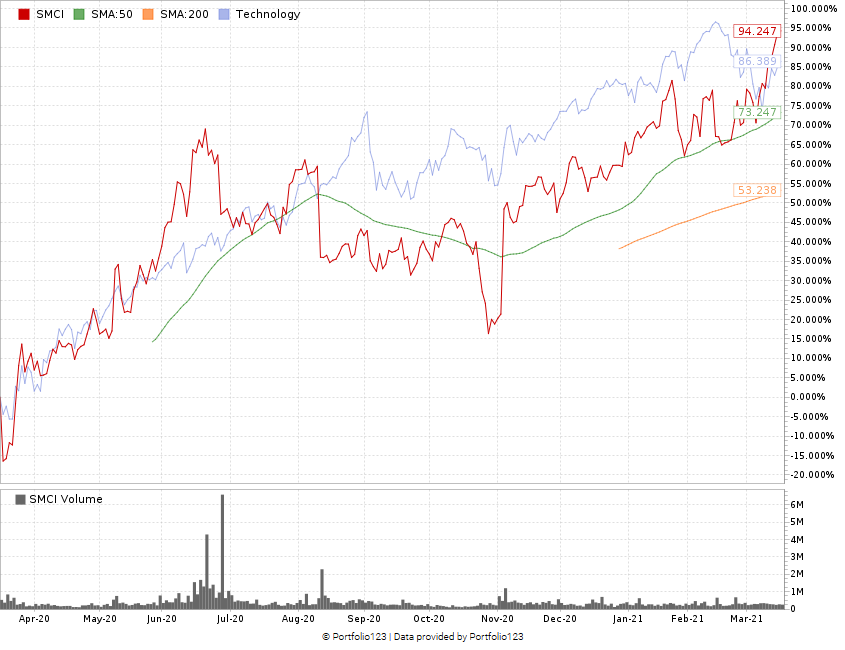

SMCI (red) Jumps 139% in 12 Months

The stock hit a low of $15.98 back during the March 2020 crash. But it had a major comeback later in the year. After hitting around $22 per share in October, the stock took off again.

Now, SMCI is priced at more than $38 per share — a 139% positive bounce off its March 2020 lows.

SMCI’s Green Zone Rating

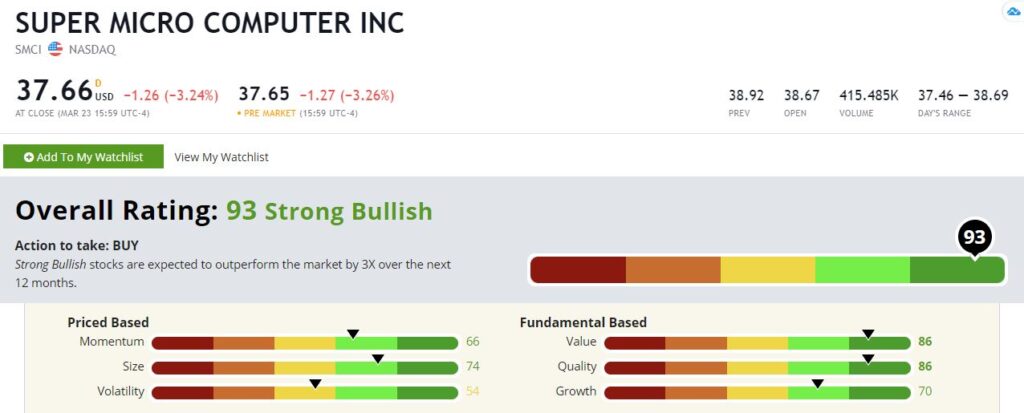

If we look at Adam O’Dell’s six-factor Green Zone Ratings system, Super Micro Computer Inc. rates a 90, which means only 10% of all stocks we rank are higher.

SMCI’s Green Zone Rating on March 23, 2021.

Here’s a breakdown of SMCI’s overall score:

Value — SMCI rates an 87 on value as its price-to ratios fall below the rest of the tech sector, which means the stock is valued much better than its competitors.

Quality — SMCI rates an 86 on quality. Its returns on assets, equity and investments are all positive and higher than the rest of the sector.

Growth — With a three-year annual sales growth rate of 10.35%, the company rates a 70 on growth.

Size — With a market cap of $1.88 billion, SMCI rates a 68 on size.

Momentum — With momentum, keep in mind that our model looks backward. Remember the stock’s sideways trading pattern over the last 12 months? That’s why you see the score at only 66.

Bottom line: Data storage companies are only going to grow in the coming decade. Overall, I think Super Micro Computer Inc. is poised to take advantage of the new ways we conduct business. SMCI is certainly a technology stock worth looking at for your portfolio.

Safe trading,

Matt Clark

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.

P.S. Check out The Bull & The Bear podcast every week for more picks from Adam, Charles and me. You can listen on Apple Podcasts, Spotify, Amazon and Google Podcasts. You can also catch episodes on our YouTube channel here.