When Russia invaded Ukraine in 2022, renewables instantly became critical for political leaders all over the world.

With extensive sanctions on Russian oil and natural gas, renewable alternatives were suddenly more than just a popular cause. They became a matter of necessity.

At last week’s COP28 meeting in Dubai, 118 governments pledged to triple global renewable energy capacity by 2030 to cut overall dependence on fossil fuels.

But so far (at least for one type of renewable energy) the initiative has gotten off to a dubious start.

Today, I’m going to share how renewable energy sources are pitted against each other in the race for independence from fossil fuels.

Wind Power Installations Fall Short While Solar Runs Away

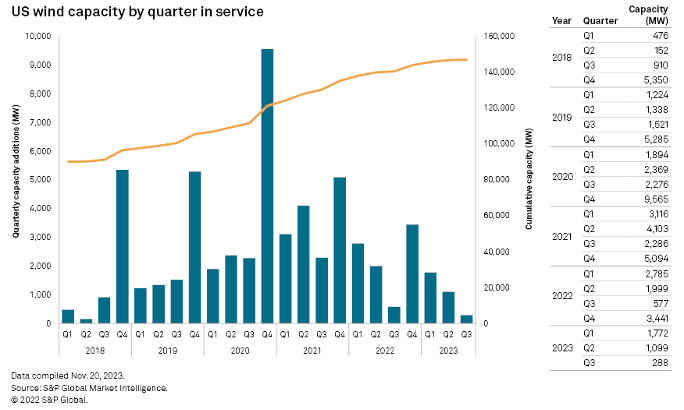

In the first three quarters of 2018, the U.S. only installed 1,538 megawatts (MW) of wind power.

That includes just 152 MW of wind generation in the second quarter of that year.

Since then, wind capacity installation has been chugging along … until now.

According to S&P Global Market Intelligence, the third quarter of 2023 saw the least amount of wind power capacity connected to U.S. power grids … at only 288 MW … since second-quarter 2018.

That’s a massive drop-off from the 2,871 MW of wind power commissioned in the first two quarters of the year.

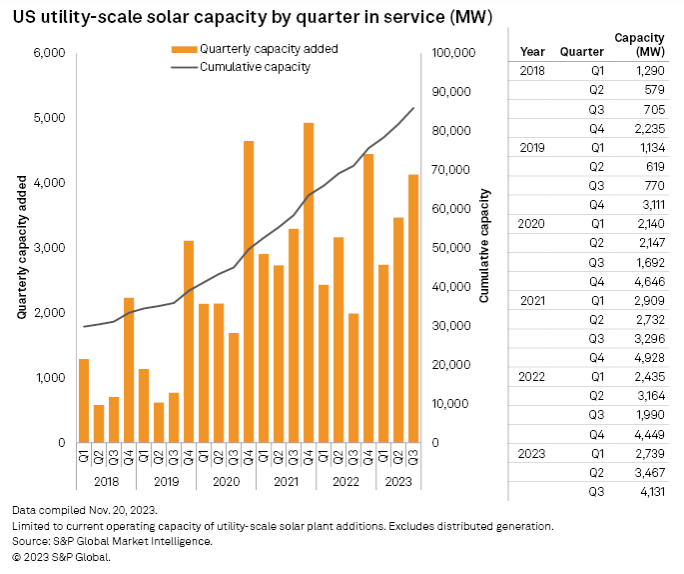

All while new solar capacity was having one of the best quarters since 2018:

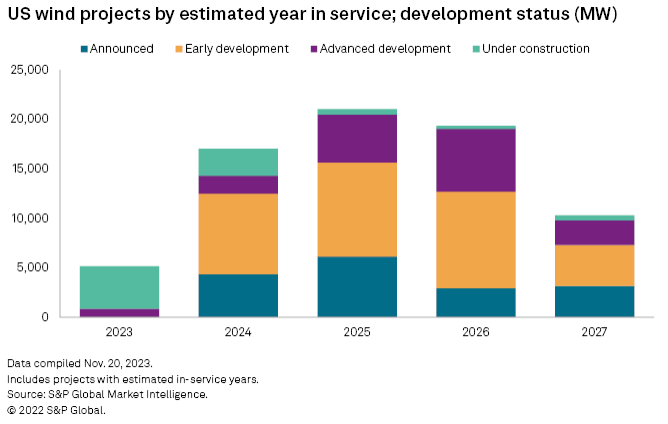

But the wind power industry is swinging back with massive development on the horizon for 2024 and 2025:

More than 17,000 MW of wind power production is scheduled for commissioning next year, thanks in large part to federal incentives in the form of investment tax credits and Energy Department financing from the Inflation Reduction Act.

Solar developers are punching right back with 10.3 gigawatts of projects in advanced development and 37.7 GW already under construction through 2026.

Both Sides Still Winning the Energy War

Back in April this year, Chief Investment Strategist Adam O’Dell touted the idea that both sides in the Energy War — “old” fossil fuels and “new” renewable sources (like solar and wind) — will profit.

Anyone picking sides and choosing to invest in just one side of this war is missing the big picture. Untold billions of dollars are pouring into both industries simultaneously. At the same time, the demand for any energy, no matter its source, is accelerating.

That idea is just as true today as it was in April.

Because while solar and wind are duking it out to increase their share of the U.S. utility market, Adam’s guiding subscribers to massive oil and gas gains in both Green Zone fortunes and 10X Stocks.

Billions are going into new solar and wind power generation … all while we continue to spend billions on oil and natural gas.

We’re in a critical moment right now for the Energy War, where the $6 trillion global energy industry is transforming before our eyes.

Over the next few years, investment in renewables will continue to rise, but so will investment in fossil fuels — creating some of the strongest investing tailwinds in market history.

Which is why our Chief Investment Strategist Adam O’Dell is ringing the alarm and urging everyone to invest in a few key energy stocks as soon as possible.

For the full story on Adam’s No. 1 oil stock, and why he’s positive it’s on track for 10X gains starting in 2024, go HERE.

Tomorrow, Adam will share a few details on this year’s biggest Green Zone winners and losers, and where he’s setting his sights for 2024.

Until then…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets