Is Southern Company stock the one energy sector purchase you need to make in 2023?

We’ve all heard about the energy giant, Southern Company (NYSE: SO). It is one of the largest electric utility companies in the United States and has been around for decades.

But what does its future look like in 2023? Let’s take a look using our proprietary Stock Power Ratings system.

Business and Outlook

Southern Company was founded in 1945 and operates primarily as an electric utility company with offices located throughout the Southeastern U.S.

It serves approximately 9 million customers and generates over 44,000 megawatts of electricity annually.

The company has invested heavily in renewable energy sources such as solar and wind power, which have helped to reduce its emissions by 40% since 2005.

Additionally, Southern Company has partnered with various technology companies to develop smart grid solutions that will help improve efficiency and customer service.

In terms of financial performance, Southern Company has seen impressive growth over the past several years. In 2021, its revenues increased by 13% to $23.1 billion.

This strong performance is expected to continue into 2023 as the company plans to invest $21 billion into new projects and expand its reach into newer markets across North America and Europe.

In addition, with increasing demand for renewable energy sources, Southern Company expects to benefit from this shift in focus towards sustainability-driven technologies.

Southern Company also stands out from other comparable companies due to its commitment to corporate social responsibility.

The company puts significant effort into providing safe working environments for employees and investing in local communities through philanthropic activities such as education initiatives and job training programs.

These efforts have helped create a positive public image for Southern Company and strengthen relationships with customers, partners, shareholders and employees alike.

But does that mean Southern Company stock is a buy for 2023?

Let’s see what Stock Power Ratings says.

Southern Company Stock Power Ratings

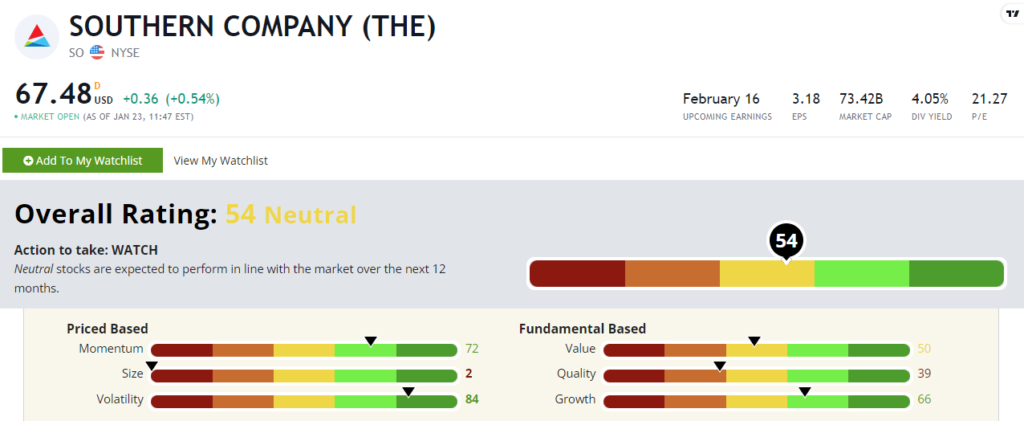

Southern Company stock rates a “Neutral” 54 out of 100. That means our system expects the stock to perform in line with the broader market over the next 12 months.

Revenues for the trailing 12 months at the end of the third quarter of 2022 show a 21% increase from the year before. That’s fantastic and shows why SO rates a 66 out of 100 on our growth factor.

Southern Company stock has gained 50% over the last five years. But after a year of up and down trading, SO is right around where it was one year ago. That explains its 72 rating on the momentum factor.

This is also a lower value stock compared to some if its peers. It trades at a 21.2 price-to-earnings ratio, which is much higher than its competition. Exxon Mobil Corp. (NYSE: XOM) trades at 9.1, while Chevron Corp. (NYSE: CVX) trades at 10.2 P/E. And that’s just two of the biggest energy companies.

You can see why SO only rates a 50 on value.

Bottom Line: Overall, Southern Company looks well positioned heading into 2023 thanks to a strong financial performance over the past few years.

But Stock Power Ratings says Southern Company stock won’t wow anyone over the next 12 months.

P.S. If you want to know more about the renewable energy mega trend…

Adam O’Dell’s “Infinite Energy” presentation highlights the largest untapped energy source in the world.

This source is worth trillions of dollars and makes massive oil fields look tiny in comparison.

We’re still in the early stages, but this breakthrough is set to turn the global energy market on its head.

Make sure to watch his presentation for more information about this revolutionary new renewable tech (and the one company behind it all).