We talk a lot about American and Middle Eastern oil.

Oil prices, oil exports, pipelines, tankers, midstream, downstream. If you can think of it, we’ve probably covered it here in the Stock Power Daily.

There’s one big reason: Oil and natural gas drive the energy bull market we’re in.

However, we can’t forget about the other countries that benefit from this broader energy surge.

The chart below shows the weekly price of Western Canadian crude oil since 2020:

In the last two years, the barrel price of Canadian oil has jumped 109.8%. The country is also exporting more.

As you know, when the price of oil goes up … oil company stocks go up too.

Today’s Power Stock is a $1.6 billion producer of Canadian oil and natural gas: Spartan Delta Corp. (OTC: DALXF).

Based in Alberta, Canada, Spartan Delta taps the Montney Shale (where it is the largest producer and landowner for oil) and the Deep Basin in Western Canada.

Fun fact: In 2016, the Montney Shale held 449 trillion cubic feet of marketable natural gas — just under half of Canada’s total natural gas resources.

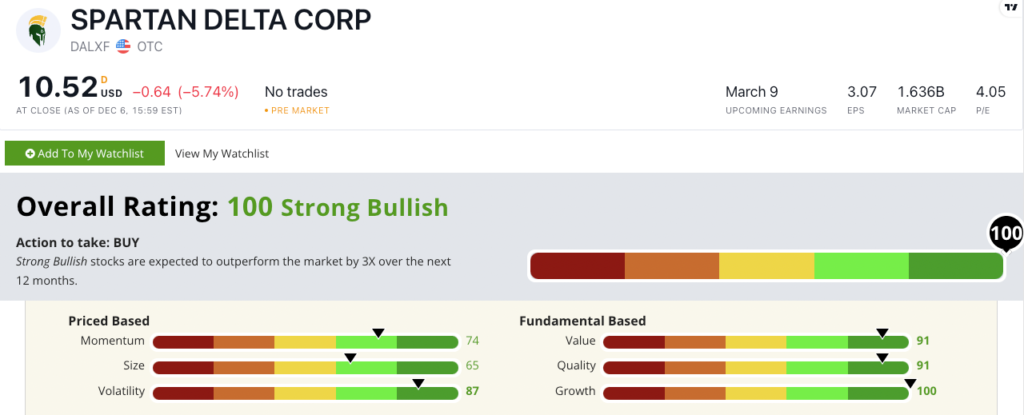

DALXF stock scores a “Strong Bullish” 100 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

Spartan Delta Stock: It’s All Green

Spartan Delta just released a strong quarterly report.

Highlights include:

- Net quarterly income was $285 million — a 125% increase from the same period a year ago!

- Its oil production jumped 56% in the quarter to 72,134 barrels per day.

DALXF’s growth is strong, as you can see from those revenue figures.

It’s also an outstanding quality stock, with a return on equity of 62.4%.

Compared to the industry average of 28.7%, we see why Spartan Delta scores a 91 on our quality factor.

Its price to ratios (earnings, sales and cash flow) are all lower than the fossil fuel exploration industry averages.

These green fundamental scores tell us DALXF has its financial house in order and is poised for even more growth in the future.

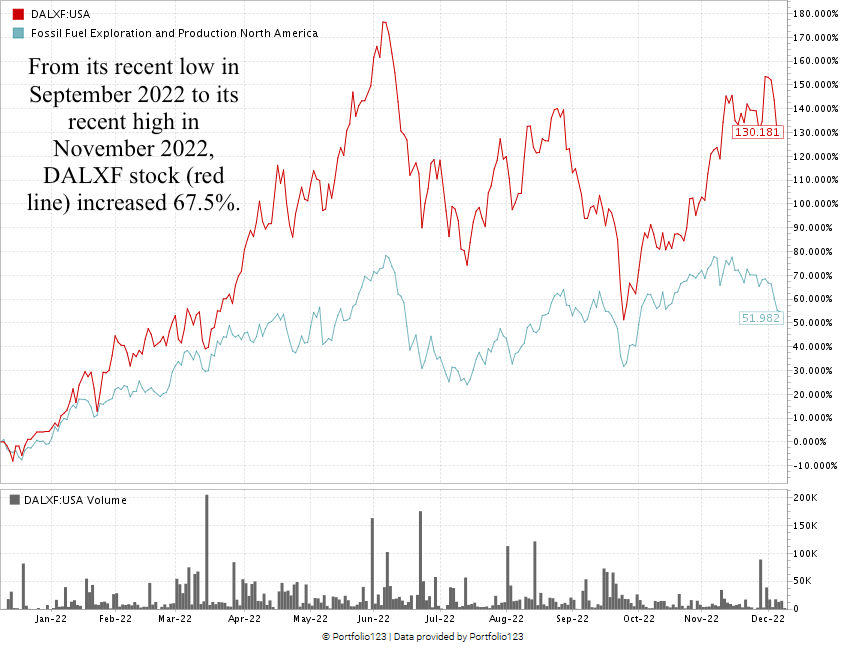

Created in December 2022.

From its recent low in September 2022 to its November 2022 high, DALXF stock jumped up 67.5%.

Over the last 12 months, the stock is up 130.2% compared to its industry peers … which are averaging a 52% increase over the same time.

Spartan Delta stock scores 100 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

Oil from America and the Middle East gets all the financial news headlines.

However, Canadian oil has had a resurgence in the last 12 months.

As a leader in Canadian oil exploration, DALXF is a strong contender for your portfolio.

Stay Tuned: Italian Gas Supplier Works to Save the EU

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on an Italian natural gas supplier that’s helping the EU navigate a massive energy crisis — while raking profits in along the way.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. My colleague Adam O’Dell is watching the oil market closely. He sees a “super bull” forming in the coming months. And when it hits, he expects his No. 1 stock to soar 100% higher in just 100 days.

Adam and the rest of the team are putting the final touches on a presentation that will show you everything you need to capitalize on the next oil super bull market. Click here to put your name on the list for his December 28 presentation.