Editor’s Note: Today’s Money & Markets Daily is all about investing in what you know, and Adam O’Dell knows the artificial intelligence (AI) mega trend. If you want to follow his guidance on his top AI stocks to buy, click here.

When it comes to picking a new stock for your portfolio, there are countless ways to narrow your search down.

You can go off recent news and look for stocks that are trending in headlines.

You can Google just about any word and add the word “stock” to your search. (Surprisingly effective, especially with topics outside of your expertise.)

Heck, you can even flip a coin: Heads you’re investing in Stock A, tails it’s Stock B. Maybe not the best risk-adjusted approach, but it’s at least a consistent strategy!

Another option is to stick to what you know.

You’ve maybe heard this adage throughout the years: “Invest in what you know.”

When Warren Buffett, Peter Lynch or any other expert talk about this approach, they don’t mean to just go out and buy Walmart stock because you shop there every week or Coca-Cola stock because you like the way it tastes on a hot summer day.

But with a tool like Green Zone Power Ratings, we can learn a lot more about what we know before buying a single share.

Let’s see how…

The Perfect Starting Point

When Adam O’Dell set out to design his proprietary Green Zone Power Ratings system, he had one goal: Identify stocks that can crush the broader market by 3-to-1 over the next year. These are the stocks that fall into the coveted “Strong Bullish” category:

- Strong Bullish (81 to 100): Expected to outperform the market by 3X.

- Bullish (61 to 80): Expected to outperform the market by 2X.

- Neutral (41 to 60): Expected to perform in line with the market.

- Bearish (21 to 40): Expected to underperform the market.

- High-Risk (0 to 20): Expected to significantly underperform the market.

Within seconds of searching for a ticker here, you’ll know how that stock should perform over the coming months.

You’ll also find out what individual factors are boosting a stock’s prospects — or weighing it down.

Now, you’ve gone from someone who just knew they liked shopping at Walmart to learning that Walmart Inc. (NYSE: WMT) stock boasts a “Strong Bullish” 82 out of 100 rating, with solid individual factor ratings on Momentum, Volatility, Quality and Growth.

Walmart stock is trending higher (Momentum) at a steady clip (Volatility), its business is raking in revenue (Growth) and it has plenty of cash in its coffers (Quality).

Are we now experts on WMT stock? Of course not! We’d have to spend a lot more time digging into these numbers if we wanted to reach that level.

But I’ll feel better about investing in WMT (or any stock) after that initial screen using Green Zone Power Ratings.

Let’s try it again with a company that I “know.”

I’m a Spotify Fan: Should I Buy SPOT Stock?

I live on Spotify.

I average about three hours a day listening to music on the app. And that’s a modest estimate. (If you have any good work focus tunes, I’m always looking for suggestions. Email me at Feedback@MoneyandMarkets.com with your recommendations.)

When it comes to the app, I at least know what I do and don’t like after being a subscriber for 10 years.

But that’s not enough for me to open up my Fidelity account and dump a bunch of money into Spotify Technology SA (NYSE: SPOT).

That’s why we turn to Green Zone Power Ratings…

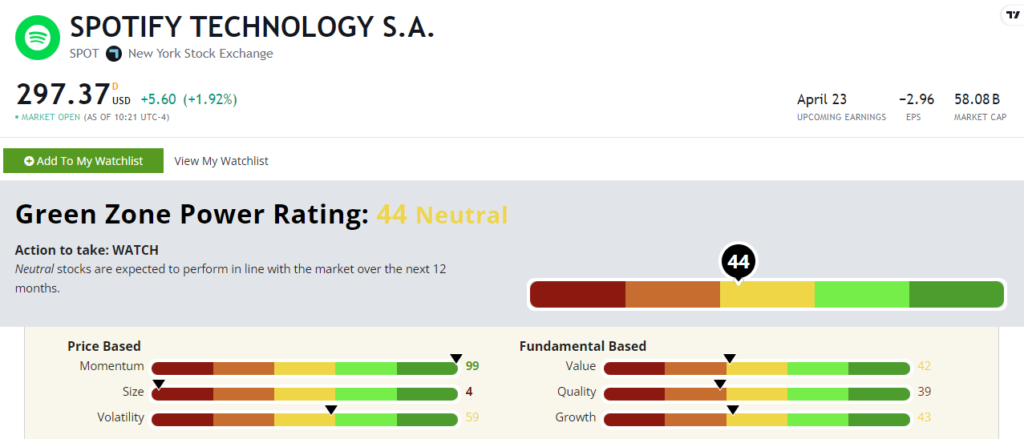

Spotify stock rates a “Neutral” 44 out of 100 right now. So, in seconds, I learned SPOT is one to watch.

Digging deeper, I see a lot of middle-of-the-road ratings on individual factors. Lower ratings on Quality (39), Growth (43) and Value (42) mean the company isn’t bringing in enough business to support its stock price.

Of course, it’s impossible to ignore that near-perfect Momentum rating.

SPOT stock has benefitted in a big way from the tech-driven bull market. Shares are up 120% over the last year. Heck, shares jumped 8% this week after the company reported it was raising its subscription prices.

But Green Zone Power Ratings has this listed as a “Watch” for a reason. Those low ratings on fundamental factors mean one lackluster earnings or a bearish headline could trigger a sell-off. Time will tell.

Am I an expert on SPOT stock now? Nope!

But Green Zone Power Ratings just gave me a crash course in the basics. And it can do that for thousands of other companies you may know.

Now, back to blasting my eardrums with more drum and bass. Sorry, mom!

Until next time,

Chad Stone

Managing Editor, Money & Markets