Ever use a company’s product so much that you forget to stop and think about investing in its stock?

It happened to me this week when the 2024 edition of Spotify Wrapped dropped.

Spotify Wrapped is a yearly round-up that the music streaming service compiles each December. It lets Spotify’s 640 million users see how their listening habits played out over the year.

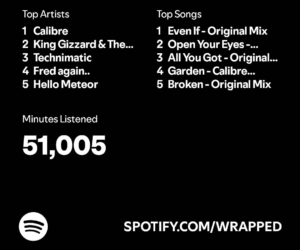

If you’re on Facebook, these round-ups have likely dominated your feed this week. Here’s the damage for me:

What can I glean from this data?

- I listened to A LOT of music this year. At 51,005 minutes, that’s just under 2.5 hours on average per day. I’m not sure if this is me bragging or a call for help…

- One jam band (King Gizzard & The Lizard Wizard) and electronic music (the rest of my Top 5) were my soundtrack for 2024.

- I need to see how Spotify Technology SA (NYSE: SPOT) stacks up in Green Zone Power Ratings…

Let’s get to it.

More Than Music

Over the last 16 years, Spotify has grown from a simple music streaming service into a go-to platform for everything audio.

By branching out into podcasts and audiobooks, Spotify clearly wants to be a one-stop shop for your ears.

Add in features such as daily AI-curated playlists, free audiobooks for premium subscribers and engaging community events like Spotify Wrapped, and you can see why the service boasts 640 million users. At the beginning of 2021, that number sat at 365 million. That’s a 75% growth rate in just under four years!

Digging a little deeper, Spotify’s premium subscriber base grew 12% year over year to 252 million in the third quarter.

It’s impressive enough to have a product that more than 7% of the global population uses. Converting almost 40% of that audience into paid subscribers is insane!

The mix of all things audio with a splash of social media features is working for Spotify.

So, how does SPOT stock stack up in Green Zone Power Ratings?

SPOT Stock Ratings

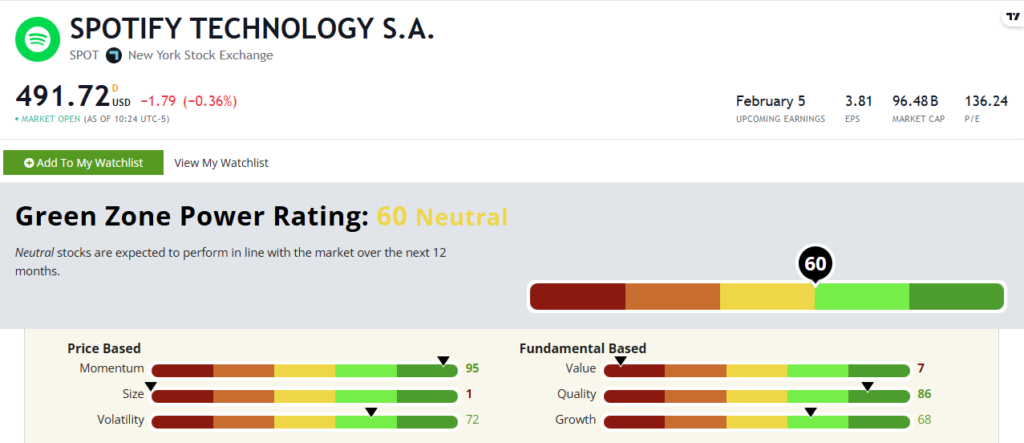

Back in April, Spotify Technology SA (NYSE: SPOT) rated a Neutral 44 out of 100 in our system. But that number has improved in a significant way over the last eight months:

SPOT’s Green Zone Power Ratings in December 2024.

SPOT now rates a 60 out of 100. That’s just below our “Bullish” zone, but this is one to watch very closely.

Why? Because of its fantastic scores on our Momentum, Volatility, Quality and Growth factors.

Taking a closer look at its Growth rating of 68, Spotify’s quarterly sales have almost doubled to $4.4 billion in the last four years. It reported revenue of $3.9 billion from premium users alone in the third quarter, an 18.8% year-over-year increase as well. I noted back in April that Spotify was raising its subscription prices, and it’s clear that the strategy is paying off.

As it converts more of its massive free subscriber base into premium subscribers, underlying revenues should grow substantially.

Operating income increased 1,300% compared to a year ago, highlighting SPOT’s 86 rating on Quality.

Of course, I can’t ignore its Value rating of 7 out of 100. This is a tech stock through and through. And investors have bid SPOT up to exorbitant valuations. It trades at a P/E ratio of 131.9, almost triple the internet and data services industry average of 45.2. Investors are banking on growth continuing to fuel SPOT’s share price, and those valuations drag its overall rating down.

This is where its 95 rating on Momentum comes in. Over the last year, SPOT has gained a massive 154%, trouncing the broader S&P 500’s 33% gain over the same period.

SPOT’s ratings have improved as the stock has soared higher. I’d keep a very close eye on this one.

Now, back to blasting King Gizzard’s b741 on repeat. (If you like classic rock/blues, check it out!) I think I can beat 51,005 minutes next year…

Until next time,

Chad Stone

Managing Editor, Money & Markets