When I first moved to Florida, I noticed that a huge grocery store anchored a shopping center across the street.

However, the rest of the center was vacant.

Today, that shopping center is filled, and the parking lot is always packed.

That leads me to today’s Power Stock.

The chart above shows that U.S. shopping center vacancy dropped from January 2021.

That’s promising for today’s Power Stock, a real estate investment trust (REIT) specializing in supermarket-anchored shopping centers: Slate Grocery REIT (OTC: SRRTF).

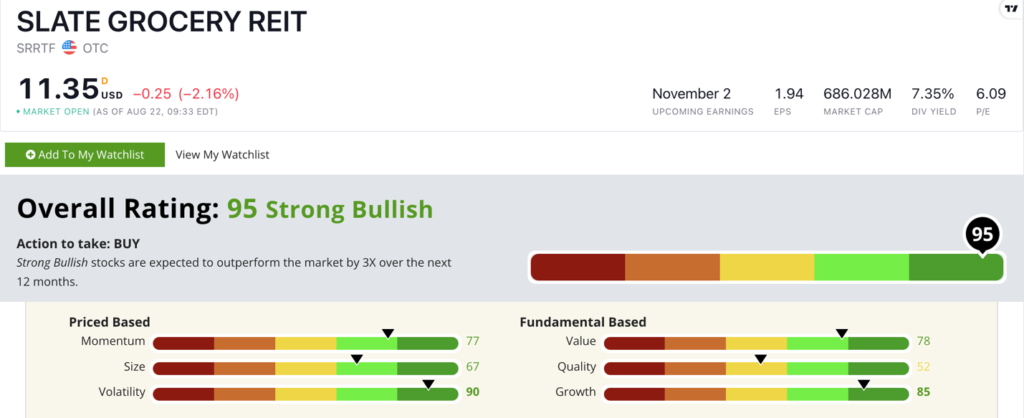

SRRTF Stock Power Ratings in August 2022.

Slate is based in Canada but owns and operates $1.3 billion of real estate across the U.S.

Slate scores a “Strong Bullish” 95 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

SRRTF Stock: Green in 5 Factors

I discovered two compelling items when I dove deep into Slate stock:

- In the second quarter of 2022, Slate generated $59.4 million in income — a 2,016% increase from the same period a year ago.

- The company owns 131 properties covering 15.6 million square feet in the U.S.

SRRTF scores in the green on five of the six factors that make up the Stock Power Ratings system.

When it comes to our fundamental factors, it scores highest on growth.

Its one-year annual earnings-per-share growth rate is an impressive 70%, and its sales growth from the first quarter to the second quarter is a solid 22%.

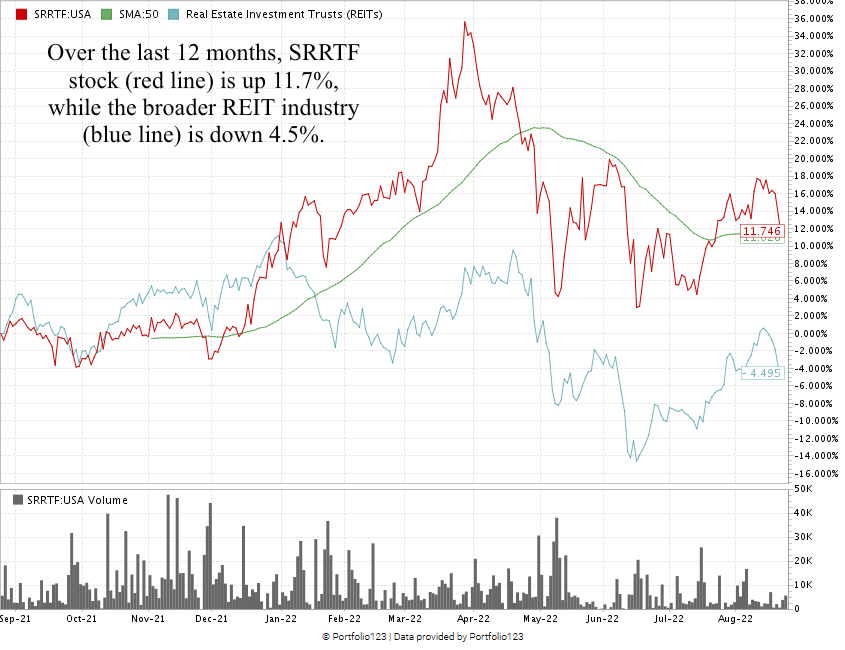

The stock is up 11.7% over the last 12 months, beating the broader REIT industry, which is down 4.5% over the same time.

Slate Grocery REIT stock scores a 95 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

The shopping center across from where I live is not the exception — it’s the rule.

Once-vacant developments are filling up with viable tenants and strong businesses.

Slate grocery store REIT is a top contender for your portfolio.

Bonus: Shareholders earn a healthy 7.4% dividend yield, meaning the company will pay you $0.86 per share, per year to own the stock.

Stay Tuned: “Strong Bullish” Electronics Manufacturer

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on an excellent company that makes electronic components.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Love Stock Power Daily? Don’t forget to check out The Stock Power Podcast, where I dive deep into one of our “Strong Bullish” Power Stocks and tell you why you should consider it for your portfolio.

Best of all? This is a separate stock from the ones I share five days a week in Stock Power Daily!

Check out the podcast on our YouTube channel or your favorite podcast provider.