Are you tired of REITs yet?

With the economy recovering and interest rate hikes on the horizon, real estate investment trusts are attractive investments.

And Adam O’Dell’s proprietary Green Zone Ratings system agrees with that logic, considering how many REITs have turned “Bullish” or even “Strong Bullish” in his system over the last few weeks.

Note: Read about two that Adam likes here.

This week, I’ve got another favorite to dive into: STAG Industrial Inc. (NYSE: STAG).

STAG — which is an acronym for “single-tenant acquisition group” — checks all the right boxes for me:

- As a landlord to gritty logistics and light industrial properties, its business is stable and almost immune to the ups and downs of the economic cycle.

- It’s also a low-maintenance business. It costs a fortune to keep a high-end office building or hotel up to high standards. But no one cares if a warehouse has a few nicks in the paint.

- STAG Industrial is also future-proof. The properties it owns are not at risk of being put out of business by Amazon or other e-tailers. If anything, logistics properties will be more important as e-commerce becomes a larger and larger segment of total retail.

Here’s the kicker: It pays its dividend monthly.

Your mortgage, your car payment, your electric bill… Most of your expenses are due monthly. Yet most dividend stocks make quarterly payments, and most bonds pay semiannually.

STAG’s monthly dividend is better aligned with your actual income needs.

STAG Industrial Yield and Stock Rating

At current prices, STAG yields 3.2%. That’s not a monster dividend, but it’s competitive with investment-grade corporate bonds. And, unlike bonds — which have a fixed payout over their life — STAG raises its dividend regularly.

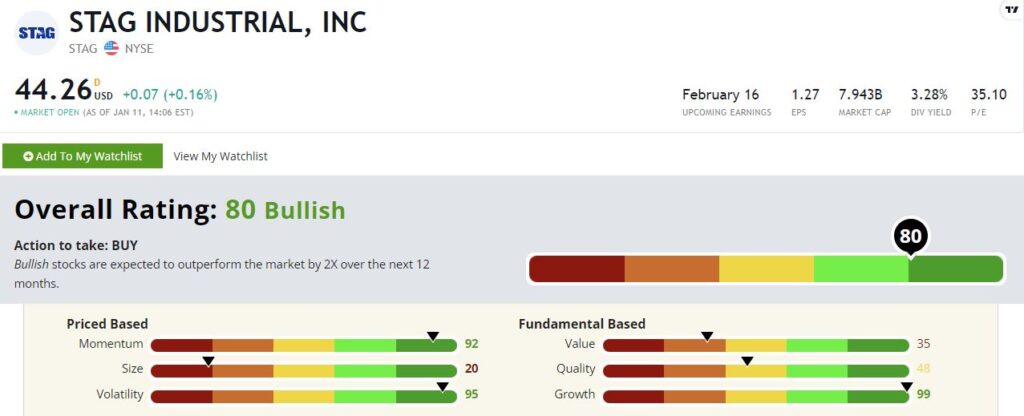

STAG Industrial rates an 80 on our Green Zone Rating System, putting it in “Bullish” territory.

That’s rare for a REIT. Here’s why:

Growth — STAG rates a near-perfect 99 on our growth factor. We expect to see in a high-flying tech stock rather than a gritty old REIT. But that’s just it. STAG’s portfolio might look “old economy” and boring, but fast-growing e-commerce companies need its properties. So, don’t be surprised to see STAG’s growth rating remain high for years to come.

Volatility — Despite being a fast grower, STAG has a stable, predictable business. This contributes to its high volatility score at 95. Remember, the higher the volatility score, the lower the stock’s volatility. I like rip-roaring capital gains, of course. But considering that I’m buying a REIT like STAG for the income stream, I consider stability to be most important.

Momentum — Given STAG’s high growth rates and investors’ general thirst for yield these days, it’s not too surprising to see STAG rating well on our momentum factor at 92. High momentum and low volatility are the best of all possible worlds. This is a stock that chugs higher with minimal heartburn along the way.

Quality — STAG rates a middling 48 on our quality score. That’s not surprising because REITs are penalized within Green Zone Ratings due to quirky accounting. Our quality score is influenced most by profitability, and REITs tend to have low official earnings numbers due to high non-cash expenses like depreciation. REITs also carry a lot of debt, which further penalizes them on this factor.

Value — It’s the same story on value. STAG rates a 35 here, but most REITs are penalized on our value metric due to low reported earnings. The price-to-earnings ratio is an important value metric, so low earnings hurt them here. This is not to say that STAG is cheap. But it’s not as expensive as its factor rating here suggests.

Size — STAG rates a 20 on size. With a market cap of nearly $8 billion, STAG is a large REIT. Though, I’d argue it’s still small enough to sneak under most investors’ radars.

Bottom line: STAG, like many REITs got 2022 off to a rocky start.

The stock is down a little over 8% from its recent highs. That’s normal, as investors are skittish about how the Fed’s plans to raise rates will affect markets.

The key point to keep in mind is that bond yields would have to rise substantially from here to be competitive with REITs. So, any weakness here is a nice buying opportunity for a REIT you can buy and hold for the rest of your life.

To safe profits,

Charles Sizemore

Co-Editor, Green Zone Fortunes

Charles Sizemore is the co-editor of Green Zone Fortunes and specializes in income and retirement topics. He is also a frequent guest on CNBC, Bloomberg and Fox Business.