Editor’s Note: Following the election and the Fed’s second interest rate cut since September, it’s been a wild week of massive and bullish stock moves. We thought it was a perfect time to revisit a stock Chad covered in August.

Starbucks is no stranger to event-driven stock rallies, but SBUX still rated “High-Risk” Green Zone Power Ratings following the news that Brian Niccol was coming on as CEO.

Our system was right on the money. SBUX stock is up just over 1% since Chad first reported on this stock in August. Over that time, the S&P 500 has gained 7.5%!

Read on to see how Starbucks stock rates now, why volatility matters, and why you should always check a stock’s Green Zone Power Ratings…

Click here to learn how you can access Adam’s powerful system (and so much more).

This Coffee Stock Still Needs a Pick-Me-Up…

Nothing screams “discretionary spending” quite like a $6 cup of coffee.

In keeping with Matt Clark’s theme of consumer stocks in an earlier edition of Money & Markets Daily, I wanted to dig a little deeper into one of America’s favorite little indulgences…

I’m talking about Starbucks Corp. (Nasdaq: SBUX), of course.

Starbucks is like a candy store for grown-ups. It satisfies your sweet tooth cravings with caramel, chocolate and whipped cream while simultaneously delivering a caffeine fix to keep you going.

The chain has always been one of my guilty pleasures. If I need a boost while out and about, it’s hard to beat a shaken oat milk espresso or cold foam cold brew.

But as I get older (and as prices keep creeping up), I find it harder to justify the occasional splurge. Going off Starbucks’ recent earnings reports, I’m not the only one brewing more of my coffee at home.

Following a run of disappointing sales and with its stock in the dregs of the market, Starbucks appointed a new CEO earlier this year.

So let’s see how SBUX looks now through the lens of Green Zone Power Ratings.

A Much-Needed Caffeine Boost for SBUX

Back in August, Starbucks announced that Brian Niccol would replace former chief Laxman Narasimhan. The latter failed to turn the business around in his brief 17-month stint.

Niccol knows a thing or two about fast food. He helped turn Taco Bell’s fortunes around before taking charge of Chipotle in 2018, growing it into the burrito-rolling empire that it is today.

Investors were bullish on the move. SBUX shares soared 23% higher in one day following the news.

But now, three months later, our Green Zone Power Ratings system says SBUX still needs a pick-me-up…

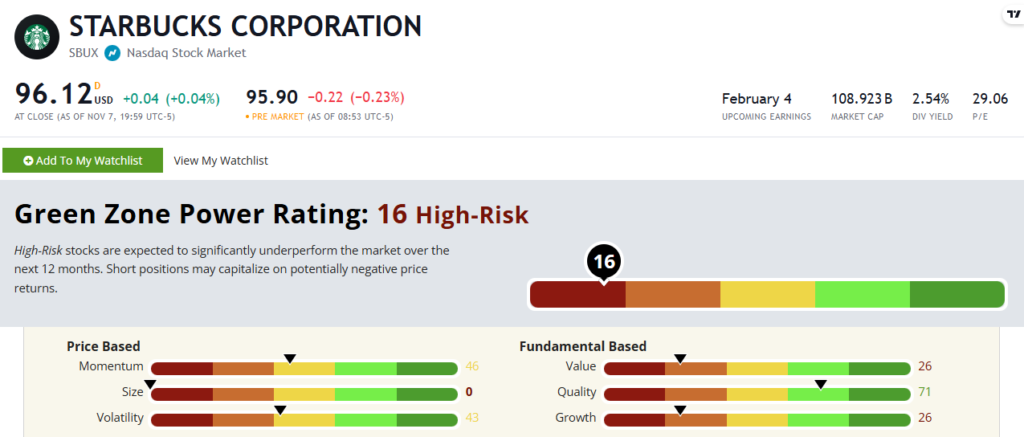

SBUX’s Green Zone Power Ratings in November 2024.

Starbucks stock rates a “High-Risk” 16 out of 100, which means it’s set to underperform the broader market over the next 12 months.

You may be wondering … how the heck a stock that jumped 23% in a day still rates so poorly.

Adam O’Dell designed this system to consider 80+ metrics spanning multiple time frames. While significant events like a CEO change can trigger massive daily moves like we saw earlier this week, this system is more interested in the bigger picture.

And there’s one big red flag when we do that.

SBUX’s Volatility Is Like a Quad Shot of Espresso

I want to focus on SBUX’s Volatility rating of 43. Stocks that rate poorly on this factor have more volatility than the broader market.

After doing a little digging, I enlisted Matt to help me figure out what’s going on with SBUX’s price swings. He dropped a bomb of a chart in our group chat:

This chart shows the correlation between SBUX’s stock price and company announcements over the last two years. Any gold “E” on the chart marks an earnings call, red “M”s are management announcements, and gray “2”s demark days where both occurred. The secondary chart along the bottom is the stock’s average true range (ATR).

Here’s Matt with a breakdown:

The ATR of a stock measures volatility by doing just what it says… averaging true ranges over a specific period. When the range moves higher, it indicates a rise in volatility.

What I see with SBUX is a 14-day ATR that moves up and down frequently over the last two years, noting a high degree of volatility.

And you see more volatility occurring alongside major company events (earnings and leadership changes, specifically). If you buy this stock, know that there’s a trend here.

I work with some incredible people. Thank you again, Matt!

As Matt said above, this is a very reactionary stock. When news is good, investors will give the stock a jolt akin to the strongest espresso shot around.

But when news is bad, it’s like the caffeine crash that hits me every day right around 2 p.m. Just look at the 15% loss that occurred back in April after the company reported lackluster earnings.

That high volatility, paired with a 46 rating on Momentum in Green Zone Power Ratings (the stock is flat year to date), tells me to look elsewhere for now.

Niccol may revive America’s coffee king like he has with other American fast food giants, but I’m happy to wait this one out.

Until next time,

Chad Stone

Managing Editor, Money & Markets