What do you get when you combine Argentine, Venezuelan, and Mexican steel companies headquartered in Luxembourg?

A dividend-paying powerhouse with a leading position in a large swath of the developing world, it seems.

Ternium S.A. (NYSE: TX) manufactures and sells assorted steel products in Mexico, Argentina, Paraguay, Chile, Bolivia, Uruguay, and Colombia. It also does business across Central America and even in the good ol’ USA.

The company has two distinct business segments, Steel and Mining. The Steel segment sells finished steel products, such as hot-rolled steel, bars and building systems. The Mining segment sells iron ore and pellets.

Infrastructure Is a Global Business

Chief investment strategist Adam O’Dell and I are wildly bullish on infrastructure plays. That includes basic industries like steel. In fact, we’ve made multiple infrastructure-related recommendations over the past several months on Money & Markets and our premium Green Zone Fortunes service. Our readers have enjoyed market-crushing returns in them over the course of this year.

Ternium plays into this trend. While the company’s focus is Latin America, it’s important to remember that a rising tide lifts all boats.

Steel and steel products are global commodities. Demand in any part of the world boosts demand for the industry as a whole.

We’ve stuck to the U.S. in our infrastructure investing, but I expect much of the rest of the world to follow the same model. Infrastructure is politically popular and creates high-paying jobs.

All of this means that steel producers should have some nice tailwinds going into the next months and years.

Ternium Is a Steel Stock With a Competitive Dividend

Let’s talk dividends. At current prices, Ternium yields a solid 4%. That’s competitive in a world in which the 10-year Treasury yields less than 1.3%.

The only downside here is that, like many European companies that trade in the U.S., the dividend calendar is a little different. Ternium pays a single annual dividend in May of each year.

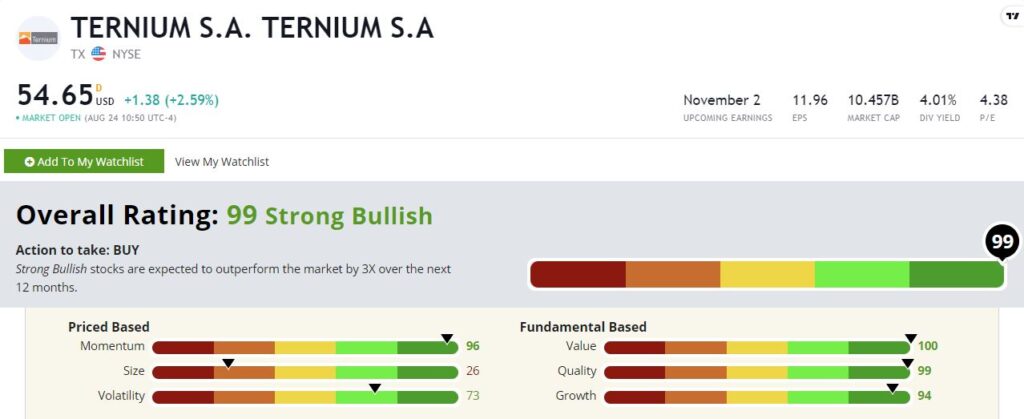

Ternium Stock Rates a “Strong Bullish”

Ternium rates a stellar 99 out of 100 on our Green Zone Ratings system. Digging into the details, it’s strong across the board.

Value — Ternium rates a perfect 100 out of 100 on value. Steel stocks are cheap today, and Ternium is cheap even by the standards of other steel stocks. We’re seeing a tug-o-war in today’s market between “COVID safe” tech stocks and more sensitive reopening plays. Investors can’t seem to decide which way this will go. Trading at just four times earnings and 0.9 times sales, Ternium is cheap enough to do well no matter which way that pendulum swings.

Quality — Ternium is also near-perfect on quality, with a rating of 99. That’s all the more remarkable when you consider that our rating system tends to reward “capital-lite” businesses like software and punish asset-heavy businesses like steel mills. Ternium picks up a lot of points here by having high returns on assets and equity.

Momentum —Investors are giving a lot of attention to Ternium these days. It rates a very solid 96 on momentum, and if we’re right about infrastructure stocks, that won’t slow down any time soon. A cheap, high-quality stock with momentum pushing it higher? Yes, please.

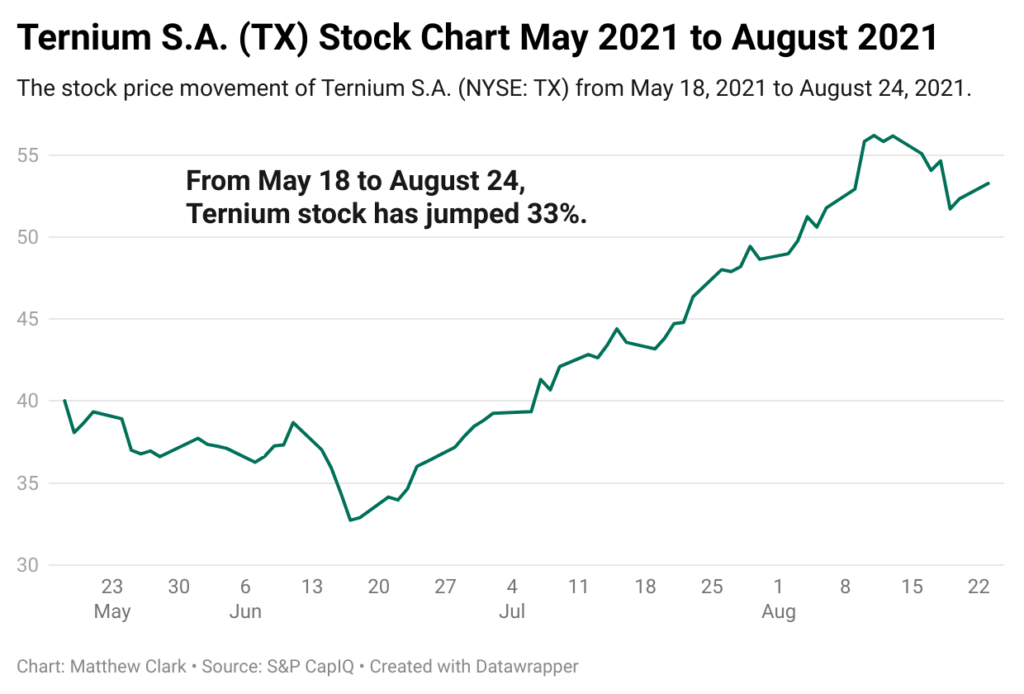

My colleague and research analyst Matt Clark wrote about Ternium stock on Money & Markets back in May. Since that analysis, its stock has gained more than 30%!

Growth — Ternium stock also rates a 94 on growth, and it’s not hard to see why. Year over year, revenues were up 105% last quarter. Now, some of that is pandemic-related, of course. But Ternium’s pre-pandemic earnings growth wasn’t too shabby either. Its compound annual growth rate in earnings puts it in the top 1% of all stocks in our universe.

Volatility — Steel stocks, like most basic materials, are known for being volatile. So, Ternium’s rating of 73 on this metric is interesting. The stock has a high beta at 1.36, but its risk-adjusted returns have been high enough to justify that higher volatility.

Size — Ternium is a $10 billion company by market cap (stock value times outstanding shares). That’s not huge by today’s standards, but it still qualifies as a large cap. Ternium rates a 26 on size, so we won’t get a small-cap bounce here.

Bottom line: Ternium isn’t the sexiest stock out there. It operates in a gritty business most people wouldn’t want in their backyard. But it’s a solid 4% yielder that should outperform the overall market by at least three times over the next 12 months. A U.S. infrastructure bill would only push this stock higher.

To safe profits,

Charles Sizemore

Co-Editor, Green Zone Fortunes

Charles Sizemore is the co-editor of Green Zone Fortunes and specializes in income and retirement topics. He is also a frequent guest on CNBC, Bloomberg and Fox Business.