I was driving around my town on the East Coast of Florida the other day and noticed something interesting.

There was a lot of construction going on in the downtown area.

That’s rare here because coastal Florida doesn’t have an abundance of land available for commercial development.

I was in Miami a few weeks ago, and it was the same thing … only on a much larger scale.

And this trend isn’t just in Florida … it’s everywhere.

Couple that with a squeeze on existing homes pushing new residential development and you have a good construction boom.

On top of all of that, material costs for things like lumber and steel continue to rise. When the cost of materials goes up, companies that sell those materials benefit.

Using Adam O’Dell’s six-factor Green Zone Ratings system, I found a company that is a global leader in producing steel for construction. It’s a steel stock to buy, and we are “Strong Bullish” on it. It’s situated to outperform the broader market by at least three times over the next 12 months.

Pro tip No. 1: This stock was one of the highest-rated stocks on our weekly hotlist. To find out more about our weekly hotlist, click here.

I’ll get to that in a bit.

First, let’s see why steel producers are going to boom this year and in the future.

A Steel Explosion in the Making

Steel is a key component in any construction project. It binds well to concrete and can be used for roofing, internal walls and even heating and cooling equipment.

It’s also used for underground pipelines for water and gas, constructing bridges and tunnels, automotive construction … you get the idea.

Steel Market Taking Off

Even amid the COVID-19 pandemic, the global steel market value rose from $290.7 billion in 2019 to $322.8 billion in 2020.

That market is expected to reach more than $500 billion by 2026 — a 73% increase in six years.

And that’s just for steel used in buildings.

This spells big gains for companies selling steel products like the global leader I have for you today.

Steel Stock to Buy: Ternium SA Fits the Global Bill

Ternium SA (NYSE: TX) is a company based in the tiny European country of Luxembourg. It manufactures and processes various steel products.

Its production is mainly in the U.S., Central America and South America.

Its products include reinforcing bars (rebar), roof tiles, steel decks, steel slabs and even pre-engineered metal building systems.

Ternium also sells iron ore and iron pellets which are used to produce other steel products.

Ternium Revenue Expected to Jump 37% By 2023

The company saw a significant drop in its total revenue from 2019 to 2020.

But its revenue is expected to climb from $8.7 billion in 2020 to between $12 billion and $12.9 billion in the next three years.

TX Stock Bounces 233% in 12 Months

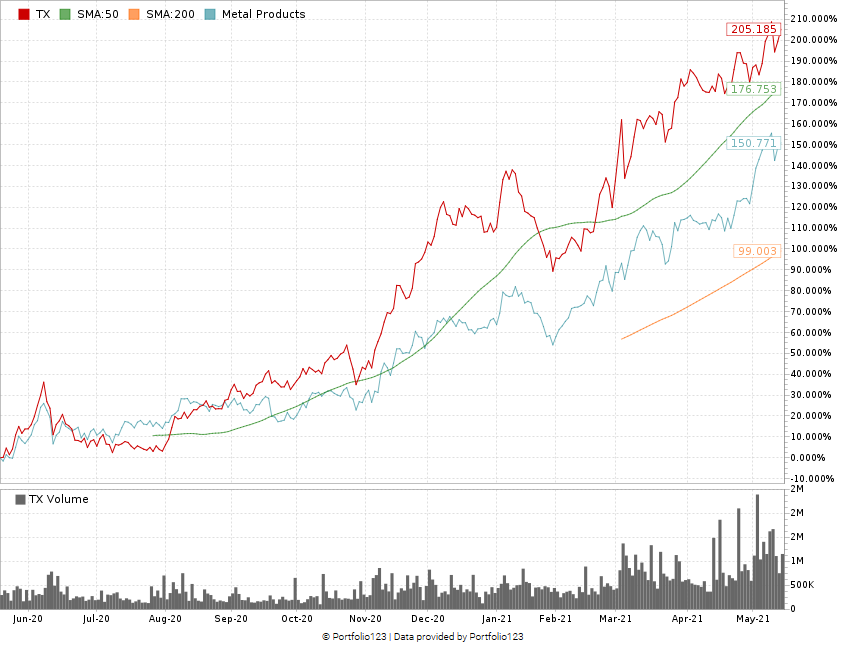

From May 14, 2020, to today, Ternium’s stock price (red line) has climbed 233% thanks to the global construction boom and the rise in steel prices.

Its gains have also outpaced the broader metal products industry over the last 12 months.

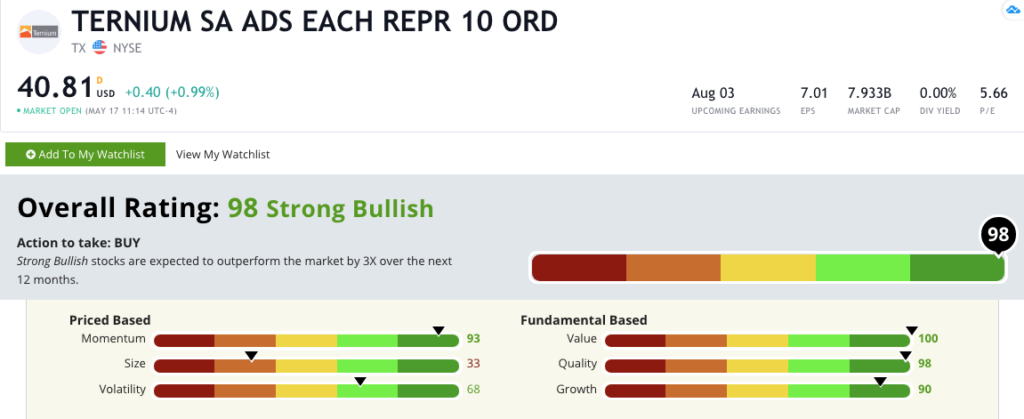

Using Adam’s six-factor Green Zone Ratings system, Ternium SA scores a 98 overall. That means we are “Strong Bullish” on the stock and expect it to outperform the broader market by three times in the next 12 months.

Ternium S.A.’s Green Zone Rating on May 17, 2021.

Ternium rates in the green on five of our six factors. This is what makes its a steel stock to buy:

- Value — The company’s price-to ratios (earnings, sales, cash flow and book) are all well below the metal products industry averages. It scores a perfect 100 on this metric.

- Quality — Ternium also has very strong returns on assets, equity and investment (all double digits) compared to the industry averages, which are all close to 0%. The company scores a 98 on quality.

- Momentum — As you can see from its stock chart, Ternium stock has been in a consistently strong uptrend over the last year. It earns a 93 on this metric.

- Growth — Its one-year annual earnings-per-share growth rate tops more than 315%, making it a solid growth stock. It scores a 90 on growth.

- Volatility — The strong uptrend in Ternium’s stock price pulled back at times, but that came when the overall market pulled back as well. Its stock volatility is still low as it scores a 68 on that metric.

Ternium does score a 33 on size because of its nearly $8 billion market cap. However, the other five factors still make this a strong stock.

Pro tip No. 2: Last week, I told you about biotech player SIGA Technologies Inc. (Nasdaq: SIGA). That stock just joined Ternium on our weekly hotlist … after I wrote about it. Learn more about SIGA here.

Bottom line: The steel industry is only going to get bigger.

Because it supplies steel around the world, Ternium is less susceptible to U.S. market changes.

That global diversification will keep Ternium’s stock momentum going in the right direction, even if construction in the U.S. doesn’t meet expectations. But construction trends within the U.S. are a great sign for Ternium’s future.

That’s why Ternium SA is a strong commodity stock worth looking at for your portfolio.

Safe trading,

Matt Clark

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.