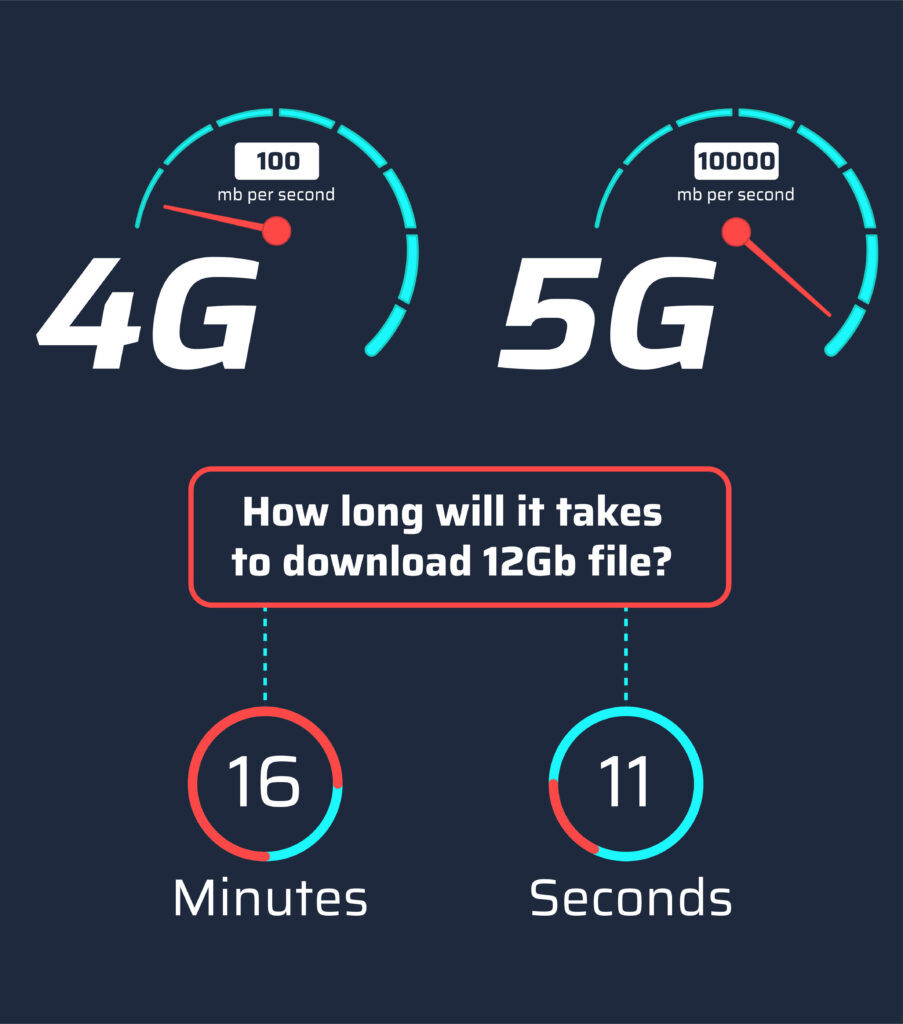

When I used to travel back and forth from South Carolina to Florida, I would download a movie to my tablet to entertain myself.

The biggest problem is I would download the movie at the airport, which took at least 20 minutes for a two-hour movie.

But we’re on the cusp of a revolution in tech — the shift to 5G.

With 5G, I’ll be able to download 10 movies to my tablet in the 15 minutes it takes to board a plane.

Check out the graphic below and you’ll get the idea.

And the 5G tech revolution won’t just impact phones and tablets. It will also speed up the development of things like autonomous driving.

One industry in particular will benefit hugely from this change. And we can profit by buying the leading company in said industry.

But first, let’s dive deeper into the 5G tech revolution.

The 5G Tech Revolution Means Lightning Fast

According to Entegris Chief Technology Officer Jim O’Neill, 5G networks will be able to transfer large amounts of data up to 200 times faster than today’s 4G LTE networks.

As the chart below indicates, the number of mobile devices with 5G connectivity is expected to increase tenfold in the next five years.

But devices first need to be able to process data at those speeds. Our cellphones today simply cannot do that.

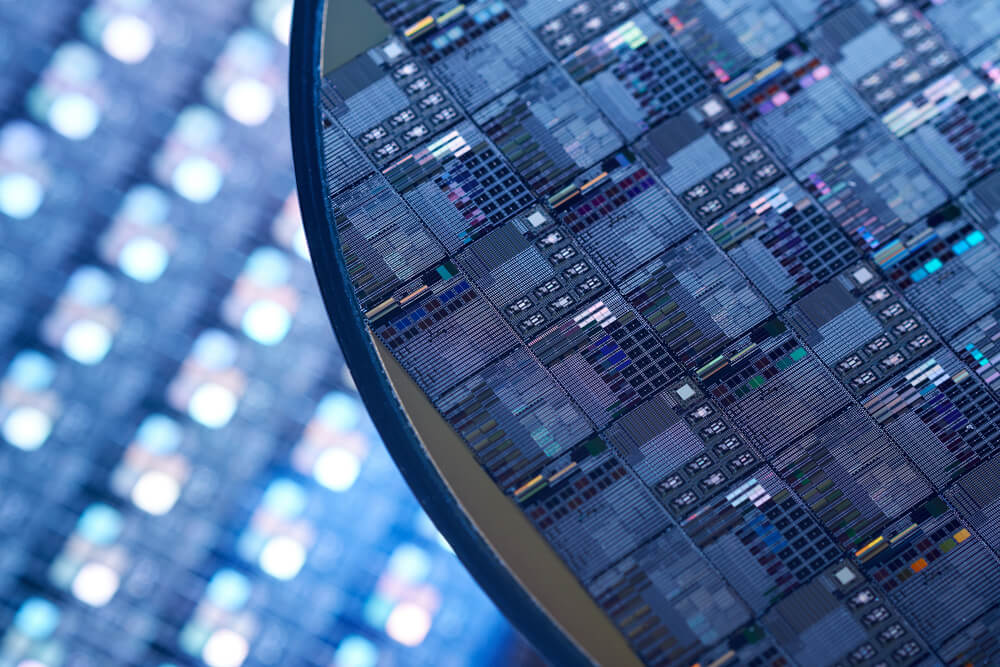

They require one crucial component to be able to take in and process data that fast: semiconductors

Demand for Semiconductors Is on the Rise

To be able to process data at 5G speeds, devices need semiconductors.

These are the microchips that allow smartphones, tablets, computers and even cars to take data and store, analyze and process it.

With the 5G tech revolution on the horizon, semiconductor companies are working full-speed ahead to develop and manufacture the chips necessary to handle 5G technology.

Revenues for the semiconductor industry are set to grow by more than $200 billion globally as we head toward 2025. That’s more than 30% growth in just five years.

And one tech company is at the forefront of this development.

Money & Markets Chief Investment Strategist Adam O’Dell’s proprietary stock rating system scores this company high in both value and quality.

That makes it a strong investment opportunity for you.

The Precision of a Swiss Watch

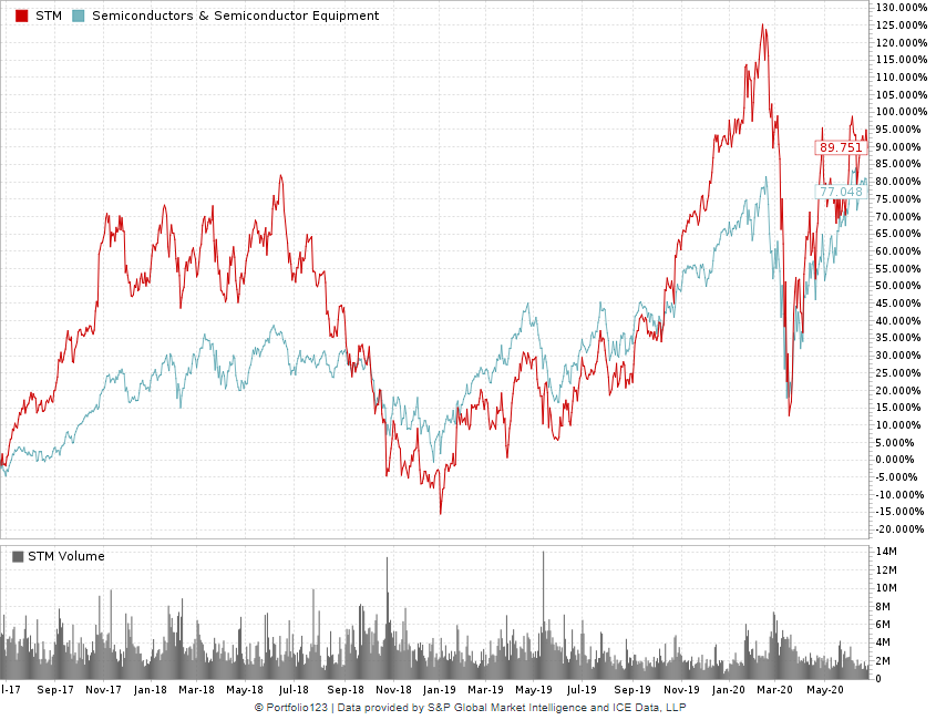

STMicroelectronics NV (NYSE: STM) is a Swiss-based developer and manufacturer of semiconductors that operates in Europe, North and South America, and Asia.

STM Gains Beat the Semiconductor Sector

M&M Chief Investment Strategist Adam O’Dell

According to Adam’s proprietary rating system, STM is a high-quality, high-value company with a ton of upside potential.

Let’s dive deeper into these factors:

- Value — STM is beating the semiconductor industry in different categories, telling us it has strong value. Its price-to-book ratio is 3.42 compared to the industry average of 3.99 (the lower the number, the better). STM has a price-to-sales ratio of 2.52 compared to 3.94 for the rest of the industry. Where its value shines is in its price to cash flow. STM’s ratio is 12.84, which is considerably less than the industry average of 26.01.

- Quality — The returns for STM are unmatched by the rest of the industry. Its return on assets is 9% compared to just 0.68% for other semiconductor companies. The company’s return on equity is 15.3% — much higher than the 2.87% industry average. STM’s return on investment is 11.8%, which also beats the rest of the industry (3.03%). The company also has a strong operating margin of 12.5% — the industry average is half that.

What You Should Do Now to Capitalize on the 5G Tech Revolution

As you can see, Adam’s system says STM is a strong value and quality company.

These factors signal that STM is a great buy.

As the 5G tech revolution ramps up, providers will need new semiconductors for a wide range of products to handle this massive increase in data transference.

This revolution is going to be big for the semiconductor industry.

We think STMicroelectronics NV is going to take off with this technological change.

Investors who get into the semiconductor industry now will make big gains. STM is a great way to do just that.