By definition, momentum is the amount of motion an object has.

In investing, we look at momentum in terms of the direction of stock prices.

A stock price that is consistently moving up has upward momentum. A stock has downward momentum when its price continues to fall.

We like to focus on upward stock momentum here at Money & Markets. It’s part of our philosophy to “buy high … sell higher.”

It’s why momentum plays such an important role in chief investment strategist Adam O’Dell’s six-factor Green Zone Ratings system.

I’ll tell you why.

Pro tip No. 1: If you are curious about how to use Green Zone Ratings to find out how 8,000+ stocks rate in our system, we’ve got you covered. Click here to watch my brand-new tutorial, and look up some of your favorite stocks today!

Stock Momentum in Practice

When you look at a stock performance chart, it’s easy to see if a stock is moving up, down or sideways.

We can take any stock and judge its momentum.

Take Celsius Holdings Inc. (Nasdaq: CELH) for example:

CELH’s Stock Momentum Shift

As you can see in its chart, Celsius Holdings had very strong upward momentum from April 2020 to January 2021.

It was sustained over a long period of time.

Green Zone Fortunes co-editor Charles Sizemore wrote about Celsius Holdings in December 2020.

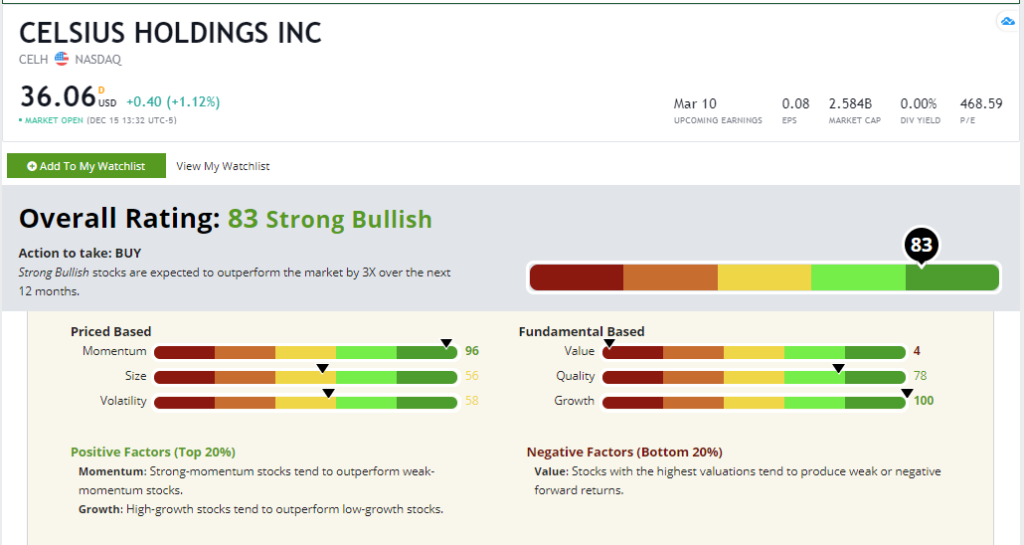

Celsius Holdings’ Green Zone Rating on December 15, 2020.

Looking back at the time Charles wrote the story, Adam’s Green Zone Rating system rated Celsius a 96 on momentum.

Going back to the stock chart above, you can see that CELH’s stock momentum trended downward after the price reached a high of around $69 per share.

It dropped to around $43 per share in late March 2021.

The stock regained some momentum, and the price moved back up to around $60 per share in early April. It has pared back slightly since then.

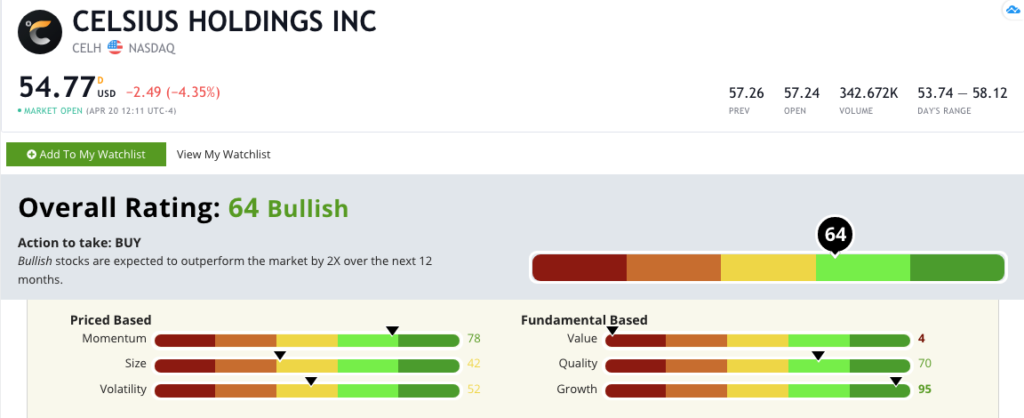

Celsius Holdings’ Green Zone Rating on April 20, 2021.

That downward stock momentum dragged Celsius’ momentum rating down a bit. But it’s still in the green at 78.

And the stock still gained 50% since Charles wrote about it in December.

Why an Uptrend Is So Important

Some investors don’t want to buy a stock in an uptrend because they think they’ve already missed out on a chance for big gains.

But that’s not true. Stocks that are already in a strong upward trend tend to keep moving up.

In July 2020, Celsius Holdings was one of our 10 hotlist stocks.

Pro tip No. 2: To find out more about our weekly hotlist, click here.

It rated a 96 on momentum as the stock price moved from $4.26 in January to more than $13 in July.

Many investors probably thought the steam ran out of Celsius and passed on this opportunity.

They were wrong. Celsius kept going.

The fitness beverage maker hit $69 per share — a 415% jump from when it made our watch list.

Even with the recent pullback, Celsius is still up 315% from the time it was on our hotlist.

It proves that the idea of buying high and selling higher works.

The bottom line: Stock momentum paints a pretty strong picture, but it doesn’t work by itself.

That’s why there are six factors to our Green Zone Rating system.

All of them play a role in making up the total rating of a stock.

I’m going to tell you more about those soon.

Until then …

Safe trading,

Matt Clark

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.