While we anticipated the Federal Reserve’s actions last week, it came after the central bank watched inflation climb for almost two years.

The initial rate hike of 0.25% is a tentative step toward fighting the battle the central bank had hoped to avoid.

It seems the Fed has been concerned about changing policy because of the impact higher interest rates could have on the stock market. Since 1987, it has explicitly supported higher stock prices. Economists believe the wealth effect associated with higher prices drives consumer spending.

The Fed’s concerns about the stock market are well-founded. Rate hikes can hurt stock gains at times.

But that’s not the case now.

Real Interest Rates and the Stock Market

By keeping rates low, the Fed allowed the rate of inflation to move above its benchmark interest rate.

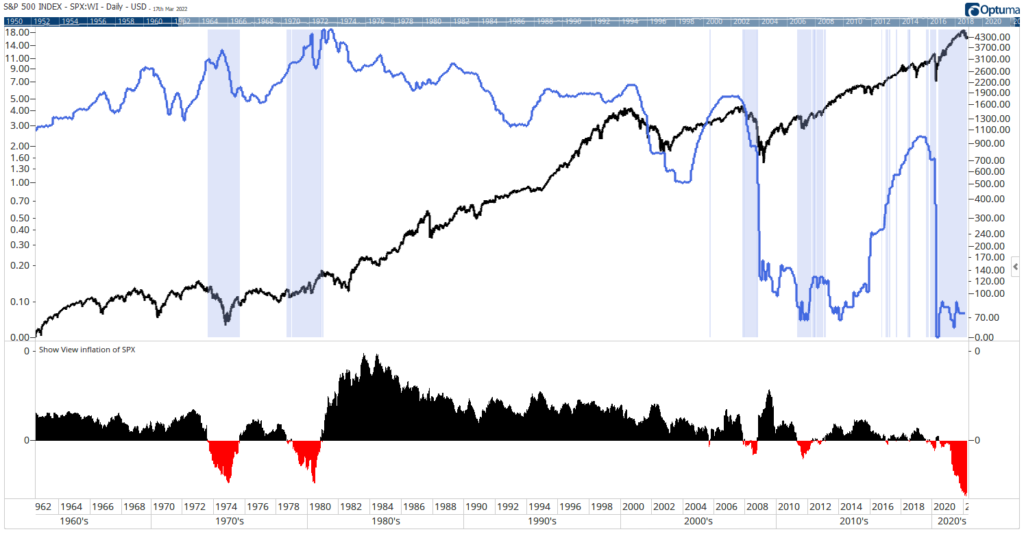

The chart below shows the difference between rates on 10-year Treasury notes and inflation, an indicator known as “real interest rates.”

Normally interest rates are above inflation. This results in a positive real interest rate, shown in black at the bottom of the chart.

In the last two years, rates have failed to keep up with inflation. Negative real interest rates are shown in red.

Deep in Negative Territory

At the top of the chart, the black line is the S&P 500. The blue line is the fed funds rate, the benchmark interest rate that the Fed controls. Blue bars highlight the times when they were negative.

The chart shows that stocks rally when the Fed raises rates while real interest rates are negative. Stocks tend to decline when the Fed cuts rates in the same scenario.

Now, rising rates are bullish. But the Fed needs to stick with its policy decision for now.

If the central bank doesn’t start reducing its balance sheet or holds off on future hikes, stocks will sell off as traders doubt the Fed’s commitment to fight inflation.

Michael Carr is the editor of True Options Masters, One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.