Chinese markets take a big hit, Bitcoin surges in January plus stocks to watch today in the Money and Markets Wall Street Wake-Up.

The Morning Open

U.S. markets were up strongly at Monday’s open.

As of 10 a.m. Eastern time, the Dow Jones Industrial Average opened up 1%. The S&P 500 was up 1% and the Nasdaq Composite was up 1.3% as markets try to rebound from last week’s losses.

The Opening Bell

In response to the coronavirus outbreak, Saudi Arabia is considering a significant cut to oil production.

The Organization of Petroleum Exporting Countries will meet Tuesday and Wednesday to discuss the measure. The coronavirus has led to the largest drop-off in oil prices in 30 years.

Saudi Arabia could lead to a collective reduction of 500,000 barrels a day until the crisis has passed. The reduction could even be as high as 1 million barrels a day.

Stocks to Watch Today

Aimmune Therapeutics Inc. (Nasdaq: AIMT) — The pharmaceutical company received approval from the Food and Drug Administration for its treatment of peanut allergies. Shares of the company were up 15%.

Verizon Communications Inc. (NYSE: VZ) — Shares of the telecom giant were down 0.4% after the Credit Suisse Group downgraded the company to “neutral” from “outperform.”

Northrup Grumman Corp. (NYSE: NOC) — The Goldman Sachs Group dropped its rating of the defense contractor from “buy” to “sell” Monday and changed its price target to $337. As a result, shares of the company were down 1.75% in premarket trading.

In the News

The Chinese stock market suffered the biggest sell-off of stocks in years when it opened Monday.

On the first day of trading since closing for the Lunar New Year, the CSI 300 index dropped by as much as 9.1% in midday trading. Thousands of shares fell by the daily limit within minutes of the market opening, according to Bloomberg.

All but 162 of the nearly 4,000 stocks in Shanghai and Shenzhen recorded losses and 90% of stocks dropped the maximum amount allowed by Chinese exchanges.

Bitcoin Has Its Best January Performance

The value of Bitcoin jumped nearly 30% in January thanks to continued fears over the coronavirus.

The market capitalization, or value of all Bitcoin in circulation, rose by $39.7 billion — the biggest jump since January 2013 when the crypto rose 54% during the month.

“The ongoing upward trajectory of the price of bitcoin correlates to the spread of the coronavirus,” deVere Group CEO Nigel Green said in a note Monday. “The more individual cases that are identified, the more countries around the world that are affected, and the greater the impact on traditional financial markets, the higher the price of bitcoin has jumped.”

Forever 21 Reaches Deal to Sell to Mall Owners

On Sunday, retailer Forever 21 announced a deal to sell to a group of mall owners, including Simon Property Group Inc., Brookfield Property Owners LP and Authentic Brands Group LLC.

The reported deal is worth $81 million.

Now the company will seek approval for the deal from the U.S. Bankruptcy Court in Wilmington, Delaware, according to papers filed with the court.

Forever 21 filed for bankruptcy in September 2019. Any rival bidders would have to pay Forever 21 a breakup fee of $4.6 million, according to the court records.

Other Morning Reads

3 Ways to Protect Your Retirement Accounts From Sneaky Hackers (Money and Markets)

Huawei, Chinese Chip Makers Keep Factories Humming Despite Virus Outbreak (Reuters)

Clark: 5 Investment Trends to Watch Going Into February (Money and Markets)

Earnings Report

Here are the companies releasing earnings reports today:

Alphabet Inc. (Nasdaq: GOOG)

Hartford Financial Services Group Inc. (NYSE: HIG)

NXP Semiconductors NV (Nasdaq: NXPI)

Sysco Corp. (NYSE: SYY)

Vavoline Inc. (NYSE: VVV)

Chart of the Day

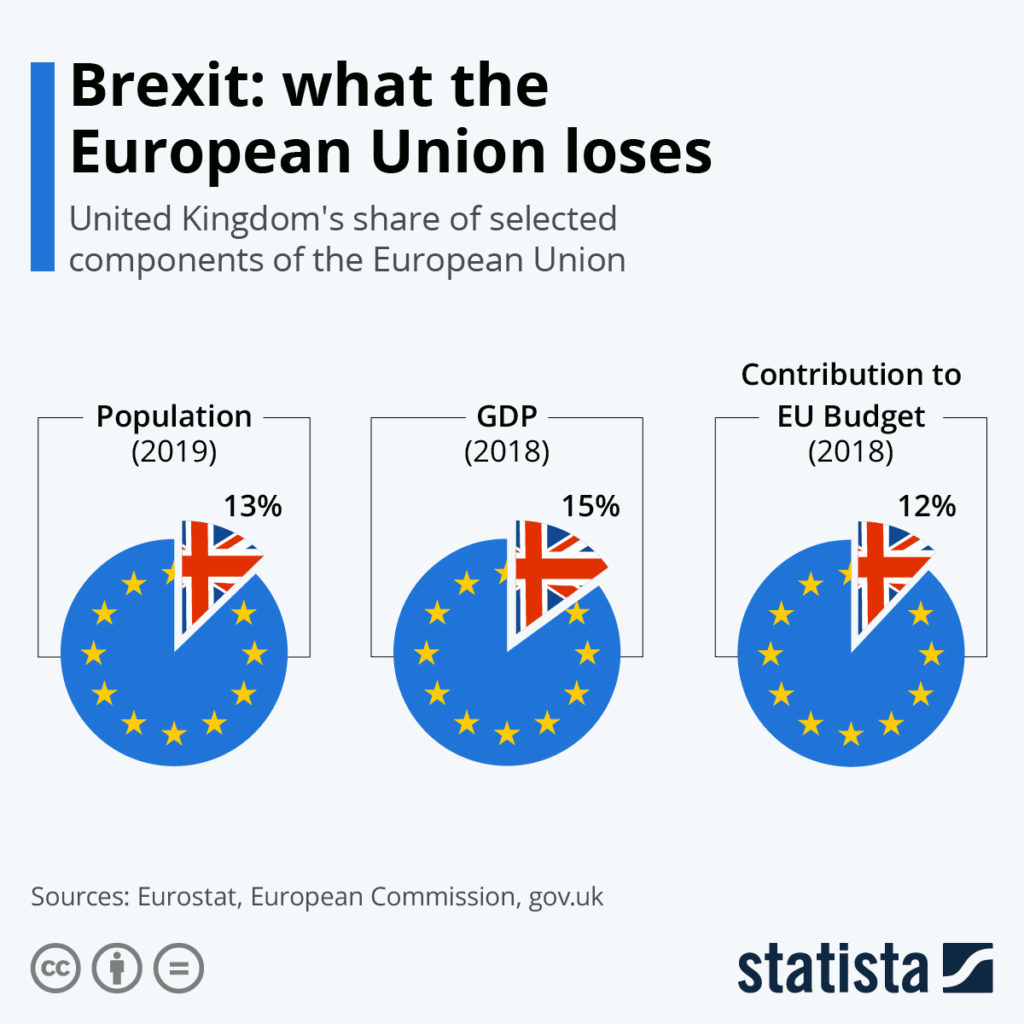

As of Friday, the separation period between the UK and the European Union officially began. The transition period will come to an end on Dec. 31, 2020.

At that point in time, the EU will lose 15% of its overall gross domestic product, 12% of its budget revenues and 13% of its population.

Check back each morning before the opening bell for stocks to watch today with the Wall Street Wake-Up, here on Money and Markets.