Energy companies highlight earnings plus stocks to watch today in the Money and Markets Wall Street Wake-Up.

The Morning Open

U.S. markets were down Friday morning.

As of 10:15 a.m. Eastern time, the Dow Jones Industrial Average was down 311 points, or 1%. The S&P 500 dropped 0.7% and the Nasdaq Composite was down 0.5%.

The Opening Bell

Oil prices could sink into bear market territory as prices of West Texas Crude and Brent Crude are at their lowest levels since October 2019.

Since the outbreak of the coronavirus, oil prices have dropped more than 10%, according to OilPrice.com. As of 8 a.m. EST, West Texas Crude was at $52.49 and Brent Crude was priced a $57.57 a barrel — slight increases from Thursday dips.

Thursday’s report by the Energy Information Administration said oil inventories were at 3.5 billion barrels for the week of Jan. 24. Bloomberg reported the flow of oil from Latin America to China has stopped due to the coronavirus outbreak.

“The Wuhan virus outbreak and its economic fall-out on Asia, the engine room of the world, remains the most crucial issue facing oil markets, with any rally likely to have short half-lives,” Jeffrey Halley, senior market analyst at OANDA, told Reuters.

Stocks to Watch Today

Amazon.com Inc. (Nasdaq: AMZN) — Shares of the e-commerce giant were up 10% in premarket trading Friday. The jump was sparked by Amazon blowing out analysts’ estimates for earnings and revenue. The company beat earnings per share estimates by more than $2 a share.

Visa Inc. (NYSE: V) — The payment company came in line with analysts’ EPS forecasts, but its revenue was down due to a 14% increase in expenses. Its shares were down 2.8% in premarket trading.

Navistar International Corp. (NYSE: NAV) — The Chicago-based truck company saw its shares move up 55% in premarket trading after news Volkswagen’s truck division, Traton, submitted an unsolicited $2.9 billion bid for the company. Traton already owns 16.8% of Navistar. The bid was for the remaining stake.

In the News

IBM Corp. (NYSE: IBM) jumped as much as 4% early Friday morning. The jump came a day after the company announced Virginia “Ginni” Rometty would be stepping down as CEO and president of the company, effective April 6.

In a company statement, the head of IBM’s cloud software division, Arvind Krishna will become the company’s 10th CEO. Former Red Hat CEO Jim Whitehurst will be IBM’s new president.

Rometty became IBMs president and CEO in 2012. She will remain executive chairman of the company until the end of 2020.

Coronavirus Could Cost Chinese Economy $60B

Because of its already fragile state, the Chinese economy may have to take drastic measures for the coronavirus to not have a massive negative impact.

According to CNN Business, because the outbreak has already brought large areas to a standstill, the economic growth rate could drop two percentage points. That slowdown would cost the Chinese economy approximately $50 billion.

It would take big tax cuts, a spending increase and a massive cut to interest rates for the country to avoid taking an even bigger economic hit.

Eurozone Economy Records Worst Year Since 2013

The eurozone economy, which consists of the 19 countries that use the euro currency, turned in the worst year of growth in 2019 since the debt crisis of 2013.

Statistics agency Eurostat reported the eurozone grew just 0.1% from the previous quarter. It’s the lowest quarterly growth since 2013 when the zone was battling a debt crisis that nearly sank the euro.

In 2019, as a whole, the eurozone grew by just 1.2% — the lowest since 2013 when the economy dropped 0.2%.

Other Morning Reads

Schiff: Market ‘Is an Inflation-Driven Bubble’ Ready to Pop (Money and Markets)

Crop Prices Dip Despite Trade Deals (The Wall Street Journal)

Tesla Lifts Off Again on Monster Q4 Earnings (Money and Markets)

Earnings Report

Here are the companies releasing earnings reports today:

Caterpillar Inc. (NYSE: CAT)

Colgate-Palmolive Co. (NYSE: CL)

Exxon Mobil Corp. (NYSE: XOM)

Honeywell International Inc. (NYSE: HON)

Phillips 66 (NYSE: PSX)

Chart of the Day

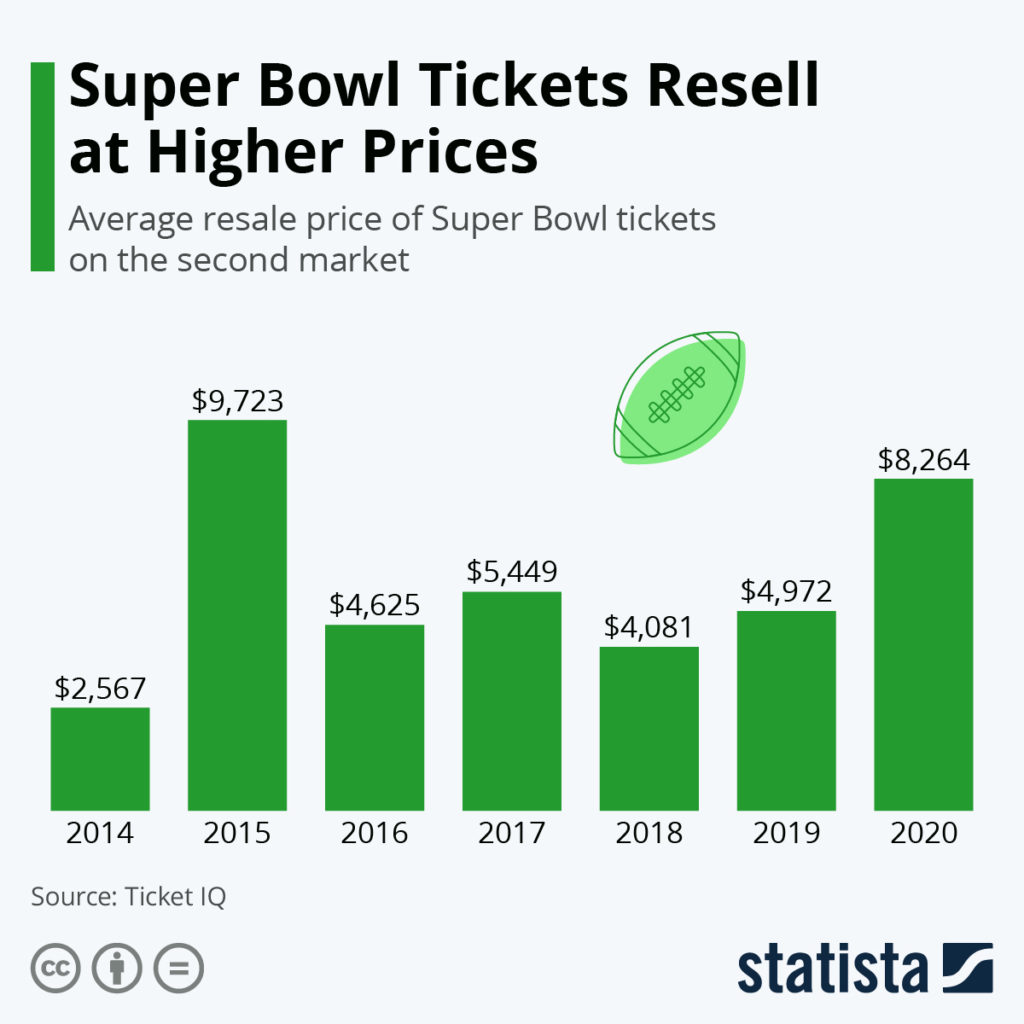

Sunday will mark one of the biggest sporting days of the year when the Kansas City Chiefs and San Francisco 49ers meet in Super Bowl LIV in Miami.

This Super Bowl will be second-most expensive to secure a ticket, according to TicketIQ. Research shows a ticket to Sunday’s game will cost an average of $8,264 — only behind the 2015 game where tickets were around $9,723.

The report suggested ticket prices will be on the rise until game day.

Check back each morning before the opening bell for stocks to watch today with the Wall Street Wake-Up, here on Money and Markets.