Can China actually deliver on trade deal promises, plus stocks to watch today in the Money and Markets Wall Street Wake-Up.

The Market Open

U.S. equities markets opened up Thursday.

As of 10 a.m. Eastern time, the Dow Jones Industrial Average was up 156 points, or 0.5% to 29,107. The S&P 500 opened up 0.5% while the Nasdaq was 0.8% higher.

The Opening Bell

Homebuilders are still confident that high demand and low costs will continue to make for a profitable business.

The National Association of Home Builders/ Wells Fargo Housing Market Index slipped one point but still remains much higher than January 2019. The index was at 75 for January 2020, compared to 58 the same time a year ago. Anything over 50 is considered positive.

Stocks to Watch Today

Morgan Stanley (NYSE: MS) — Shares of the investment bank were up 1.9% in Thursday premarket trading after it reported beating both revenue and earnings estimates.

Tesla Inc. (Nasdaq: TSLA) — Morgan Stanley downgraded Tesla shares to “underweight” Thursday. As a result, shares of the electric automaker dropped 3.3% in premarket trading Thursday.

Taiwan Semiconductor Mfg. Co. Ltd. (NYSE: TSM) — The world’s largest chipmaker is reporting a 9.5% year-over-year revenue increase in the fourth quarter. Shares jumped 0.6% in premarket trading.

In the News

Skeptics wonder if China can actually fulfill its end of a phase one trade deal signed with the U.S., according to The Wall Street Journal.

Part of the deal includes China buying an additional $200 billion of American farm products, manufactured goods, business services, oil and natural gas. And, they have two years to do it.

“This deal does not end retaliatory tariffs on American farm exports, makes American farmers increasingly reliant on Chinese state-controlled purchases and doesn’t address the big structural changes the trade war was predicated on achieving,” Michelle Erickson-Jones, a Montana wheat farmer, told The Journal.

WeWork Leasing Dropped 93% in Q4

A failed IPO, bailout funding and now news that WeWork leased just 184,022 square feet of space in the last quarter of 2019, according to CNBC.

It marked a 93% drop from its third quarter total of 2.5 million square feet. It also meant IWG-owned Spaces became the top flexible office leasing company as it leased 284,916 square feet in the fourth quarter.

Possible Ban of Nike Super Shoes Pushes Up Asics, Mizuno Shares

It is possible that new running shoes from Nike Inc. (NYSE: NKE) may be banned from competition by World Athletics, but competitors are already reaping benefits, according to Bloomberg.

In Japan, shares of both Asics Corp. jumped 8% Thursday before coming back to 4.7% gains. Fellow Japanese company, Mizuno Corp. shares rose nearly 2% after The Times of London reported World Athletics was considering banning the Nike Vaperfly shoe from professional competition.

Nike shares were down 0.4% in Thursday premarket trading.

Other Morning Reads

How 2020 Presidential Candidates Plan to Fix Social Security (Money and Markets)

Congress Investigates Lifting Some Cannabis Restrictions (CNN Business)

Steve Bannon Praises Trump’s Trade Deal That ‘Broke the Chinese Communist Party’ (Money and Markets)

Earnings Report

Here are the companies releasing earnings reports today:

CSX Corp. (Nasdaq: CSX)

Bank Ozk (Nasdaq: OZK)

Bryn Mawr Bank Corp. (Nasdaq: BMTC)

Insteel Industries Inc. (Nasdaq: IIIC)

Progress Software Corp. (Nasdaq: PRGS)

Chart of the Day

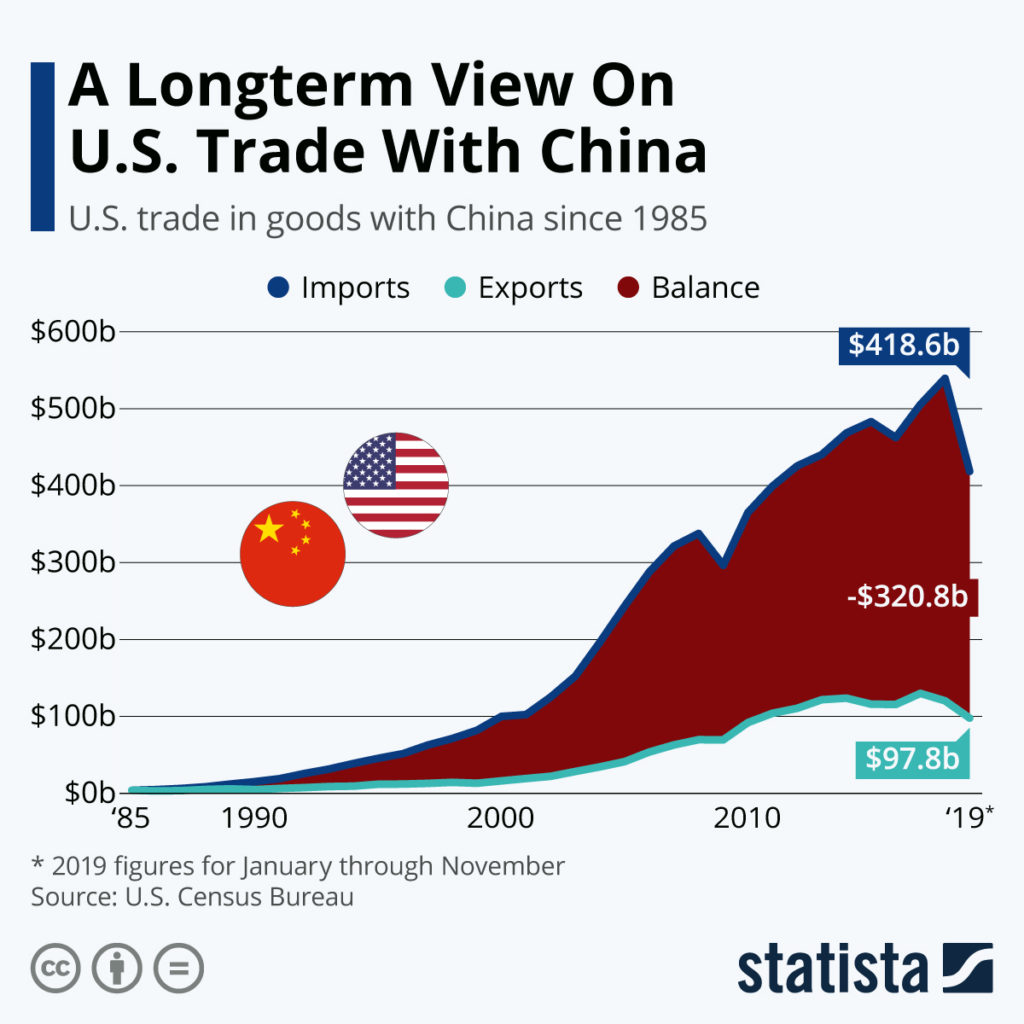

The phase one trade agreement between the U.S. and China was signed Wednesday. It comes at a time when the U.S. trade balance with China is starting to fall.

According to the U.S. Census Bureau, the trade deficit with China dropped to $320.8 billion from January to November 2019 from $382.7 billion in the same period a year prior.

Part of the phase one agreement includes China buying an additional $200 billion worth of American products over a two-year period.

Check back each morning before the opening bell for stocks to watch today with the Wall Street Wake-Up, here on Money and Markets.