A “Phase One” trade deal between the U.S. and China appears to be ready; British Prime Minister Boris Johnson’s big win plus stocks to watch today in the Money and Markets Wall Street Wake-Up.

The Opening Bell

Stocks started off low on mixed trading news Friday but, as of 10 a.m., the Dow Jones Industrial Average jumped more than 100 points while the S&P 500 was up nearly 11 points and the Nasdaq shot up around 44 points.

Markets opened mixed after Trump tweeted Friday morning that a report in the Wall Street Journal regarding a tentative deal and China’s silence on the deal was wrong.

The Wall Street Journal story on the China Deal is completely wrong, especially their statement on Tariffs. Fake News. They should find a better leaker!

— Donald J. Trump (@realDonaldTrump) December 13, 2019

But in a Friday morning news conference Chinese officials said they had agreed to trade deal language and “will now move toward signing a deal as quickly as possible,” according to CNBC.

We have agreed to a very large Phase One Deal with China. They have agreed to many structural changes and massive purchases of Agricultural Product, Energy, and Manufactured Goods, plus much more. The 25% Tariffs will remain as is, with 7 1/2% put on much of the remainder….

— Donald J. Trump (@realDonaldTrump) December 13, 2019

The deal includes the United States rolling back some tariffs already in place on Chinese goods, but doing so in phases. Trump did tweet that 25% tariffs on $250 billion in imports will stay while cutting existing duties on another $120 billion in products to 7.5%.

Stocks to Watch Today

Oracle Corp. (NYSE: ORCL) — The software giant was lower in premarket trading Friday after it posted adjusted earnings of $0.90 a share — beating analysts’ expectations by $0.01. But what hurt the stock was the announcement it would not seek a co-CEO after the death of Mark Hurd earlier this year. Oracle’s revenue was reported at $9.61 billion, lower than analysts’ estimates of $9.65 billion.

Costco Wholesale (Nasdaq: COST) — The bulk discount retailer also dropped in premarket trading despite beating fiscal first-quarter earnings per share by $0.17 a share. Net sales grew to $36.24 billion in the quarter, but lower e-commerce sales hit total and comparable sales by 0.5%, the company reported.

Sarepta Therapeutics (Nasdaq: SRPT) — The Food and Drug Administration gave early approval to Sarepta for its second treatment for Duchenne muscular dystrophy. The company still needs to conduct drug trials, which it expects to conclude in 2024. It’s up 30% on premarket trading.

In the News

British Prime Minister Boris Johnson took a gamble and it paid off.

His Conservative Party won its largest majority in the House of Commons on Thursday night since 1987 when Margaret Thatcher was prime minister. Conservatives picked up 66 seats while Jeremy Corbyn’s Labour Party lost 42 seats.

As a result, Corbyn said he would stand down as Labour’s leader. Conversely, Johnson now has the majority he needs to push a deal with the European Union through Parliament to remove the United Kingdom from the EU by his Jan. 31, 2020 deadline.

Third Tesla General Counsel out in a Year

Tesla Inc. has lost its third general counsel in a year, according to Bloomberg.

Jonathan Chang left the company on Dec. 6 to take a similar post for artificial intelligence startup SambaNova.

Despite the news, Tesla Inc. (Nasdaq: TSLA) had a solid day Thursday, climbing as high as $362.74 a share — up from its open of $354.92.

Retail Sales Report Could Mean Good Economic News

The Commerce Department is releasing its retail sales report Friday, which gives insight into consumer spending.

Investors will be able to gauge the health of the economy as trade talks continue to keep markets on edge.

Economists are expecting a jump in retail sales in November.

Other Morning Reads

ETF Assets to Surge Tenfold in 10 Years (CNBC)

Fintech Company Bill.com Jumps 60% on First Day of Trading (CNBC)

U.S. Business Debt Exceeds Households’ For The First Time Since 1991 (Bloomberg)

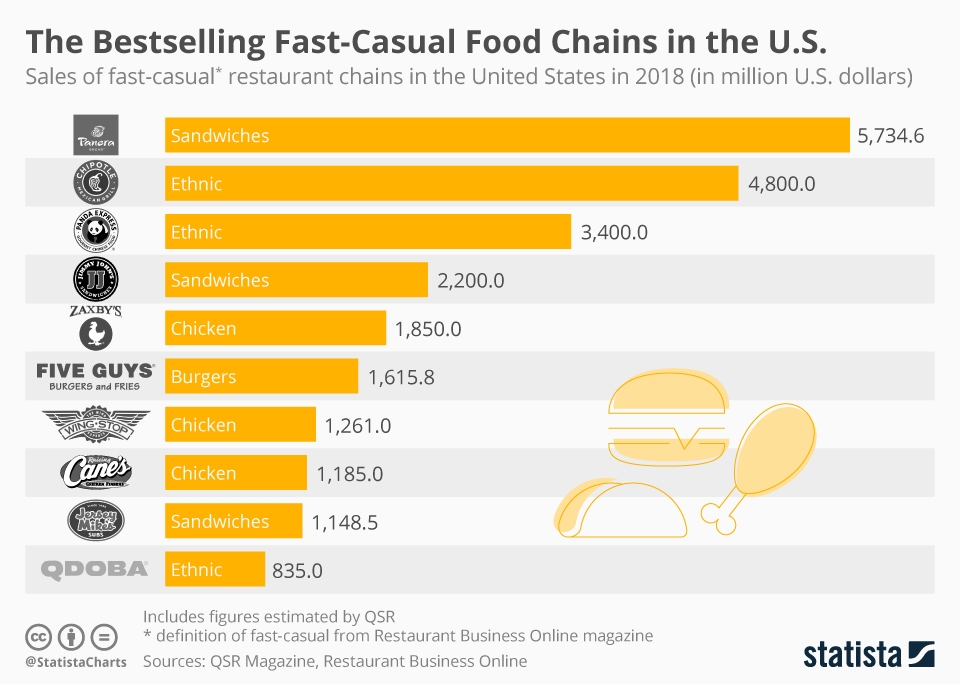

Chart of the Day

Fast-casual dining chains have grown at nearly three times the rate of typical fast-food chains, according to Restaurant Business Online and Technomic.

Fast-casual dining chains have grown at nearly three times the rate of typical fast-food chains, according to Restaurant Business Online and Technomic.

Panera, a sandwich and bakery chain, grew its sales from $4.8 billion in 2015 to $5.7 billion in 2018. Chipotle’s sales have grown two years in a row to $4.8 billion in 2018.

Check back each morning before the opening bell for stocks to watch today with the Wall Street Wake-Up, here on Money and Markets.