There’s a new top dog in listed companies, plus stocks to watch today in the Money and Markets Wall Street Wake-Up.

In its opening minutes on the stock market, Saudi Arabian oil company Saudi Aramco gained 10%, upping its value to $1.88 trillion, passing Apple as the largest listed company in the world by market cap.

During premarket auctioning, morning bids reached the 10% limit allowed by the Saudi Tadawul stock exchange, pushing the price to nearly $9.39 per share, where it held throughout the day.

The market win came just after the $25.6 billion initial public offering which set a record for the largest in history — surpassing the $25 billion from China’s Alibaba in 2014.

Stocks to Watch Today

Ollie’s Bargain Outlet (Nasdaq: OLLI) — The discount retailer reported quarterly earnings of $0.41 a share, beating analysts’ projections by $0.03 per share. It also announced interim CEO John Swygert is the permanent CEO.

Gamestop Corp. (NYSE: GME) — The game retailer reported a drop of 25.7% in global sales in Q3 and a quarterly loss of around $0.49 per share. For the rest of the year, the company revised its guidance to include a “decline in the high teens” of store sales.

Chevron Corp. (NYSE: CVX) — The energy giant plans to write down its assets by $10 billion as long-term prices for oil and natural gas continue to project lower. Chevron said more than 50% of the write-down is related to gas drilling operations in Appalachia.

In the News

Facebook and Google are no longer among the top 10 places to work, according to Glassdoor’s annual rankings released Tuesday night.

Cloud marketing company HubSpot Inc. (NYSE: HUBS) was the top-ranked company. Google won the top ranking in 2015 but was No. 11 in this year’s survey. Facebook won the honor three times in the last 10 years but came in at No. 23 this year.

Fed To Talk Interest Rates

Today will mark the end of the final two-day policy session for 2019 for the Federal Reserve. It’s widely expected the Fed will hold interest rates steady with no changes.

The Consumer Price Index also comes out today. The expectation is the index will be right in line with the Fed’s 2% inflation target. In October, the CPI was set at +0.4% as energy and health care indexes both saw increases.

Streaming Wars Take a Bite Out of Netflix

Needham & Company analysts cut their rating of Netflix Inc. (Nasdaq: NFLX), leading to a more than 3% drop in the stock in Tuesday trading, according to The Street.

Concerns included “intensifying competition in the online streaming space,” which could cost Netflix as many as 4 million subscribers in 2020. Analysts suggested that in order to compete, the streaming giant needs to offer a lower-priced subscription tier, likely with ads, to compete with the likes of Disney+ and Apple TV — both of which are far less expensive.

North American Trade Deal Close to Fruition

House Democrats and the White House came together and agreed on the United States-Mexico-Canada Agreement, paving the way for its approval in short order.

Both sides said the new USMCA was a marked improvement over the legislation it replaces — the North American Free Trade Agreement.

Other Morning Reads

Arrests for U.S.-Mexico Border Crossings Plummet a Record 75% Over 6 Months — Money & Markets

Peloton Shares Drop Following Short-Seller Note on Competition — CNBC

Massive Loan Trade Highlights Rift in Junk-Debt Markets — Bloomberg

Earnings Report

Here are the companies releasing earnings today:

American Eagle Outfitters (NYSE: AEO)

Blue Bird (Nasdaq: BLBD)

Lululemon Athletica (Nasdaq: LULU)

Mesa Air Group (Nasdaq: MESA)

Twist Bioscience (Nasdaq: TWST)

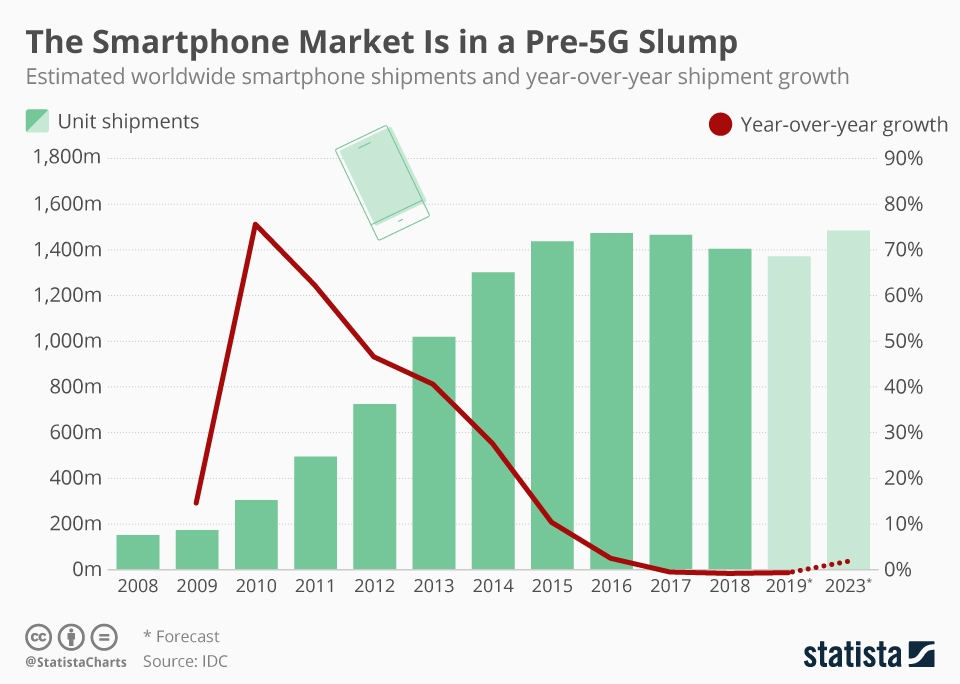

Chart of the Day

Since 2017, the global smartphone market has been flat in terms of sales. A lot of that is due to a slowdown in innovation across the industry.

Since 2017, the global smartphone market has been flat in terms of sales. A lot of that is due to a slowdown in innovation across the industry.

Global smartphone shipments dropped by 4% in 2018 and 2019 doesn’t appear to be going any better for the market, according to IDC.

However, IDC projects the advent of 5G will right the ship. The firm said 5G smartphones will account for 8.9% of global shipments in 2020 and just to 30% by 2023.

Check back each morning before the opening bell for stocks to watch today with the Wall Street Wake-Up, here on Money and Markets.