The fears surrounding the coronavirus outbreak pushed markets down, plus stocks to watch today in the Money and Markets Wall Street Wake-Up.

The Morning Open

U.S. markets opened with a big drop Monday.

As of 10 a.m. Eastern time, the Dow Jones Industrial Average was down 405 points, or 1.4% to 28,584. The S&P 500 was also down 1.4% and the Nasdaq Composite opened down more than 1.8%.

The Opening Bell

Global markets continued their downward trend early Monday as coronavirus fears spread.

Most Asian markets were closed due to the Lunar New Year holiday, but Japan’s Nikkei 225 was down by more than 2% in afternoon trading, according to The Wall Street Journal.

The European Stoxx 600 was down 1.7% in early trading while international bond yields also took a hit. The yield on the German 10-year Bund dropped to -0.35W% and the U.K. 10-year Gilt was down to its lowest mark since October 2019 — 0.543%

Stocks to Watch Today

Starbucks Corp. (Nasdaq: SBUX) — The coffee company recently closed its shops in China’s Hubei province as fears of the coronavirus spread. Shares of the company were down 1.6% in premarket trading.

Arconic Inc. (NYSE: ARNC) — Following the news that the metals engineering company missed Q4 profit and sales estimates, shares were down 3% in premarket trading Monday.

Abbvie Inc. (NYSE: ABBV) — Shares of the pharmaceutical company were up 1.1% in premarket trading Monday amid news it’s selling off positions in AstraZeneca Plc. (NYSE: AZN) and Nestle to gain the approval of its $63 billion acquisition of drugmaker Allergan Plc. (NYSE: AGN)

In the News

The yield for the 10-year Treasury note dipped to 1.64% Monday morning amid coronavirus fears.

Yield on the 30-year bond dropped to around 2.1% as Chinese officials confirmed more than 2,700 cases of the virus. The death toll rose to 80, according to CNBC.

A Possible Early Return for 737 Max

The Federal Aviation Administration said the Boeing Co. (NYSE: BA) 737 Max airliner that its grounding could be lifted sooner than expected.

Speaking to senior officials of the three U.S. airlines who fly the jet — Southwest, United and American — FAA Administrator Steve Dickson said the agency did not have a timeline and that “the agency is pleased with Boeing’s progress in recent weeks toward achieving key milestones,” according to CNN Business.

Oil Traders Made Billions in 2019 as Conflict Shook the Market

Energy traders had a big 2019, capitalizing on global geopolitical issues, ship fuel regulations and pipeline outages, according to Bloomberg.

Big groups like Vitol Group, Tarafigura Group Ltd., Royal Dutch Shell Plc and BP Plc made billions of dollars in profits, according to the report.

“By all accounts, 2019 was among the best years ever for the energy trading industry,” Marco Dunand, the chief executive of Mercuria Energy Group Ltd., one of the five largest independent oil traders, told Bloomberg.

Other Morning Reads

Top 6 IPOs to Watch in 2020 (Money and Markets)

Online Mattress Retailer Casper IPO to Raise $182.4 Million (CNBC)

Trump Vows to ‘Save’ Social Security 1 Day After Suggesting Cuts (Money and Markets)

Earnings Report

Here are the companies releasing earnings reports today:

Flexsteel Industries Inc. (Nasdaq: FLXS)

Heartland Financial USA Inc. (Nasdaq: HTLF)

South State Corp. (Nasdaq: SSB)

Sprint Corp. (NYSE: S)

Whirlpool Corp. (NYSE: WHR)

Chart of the Day

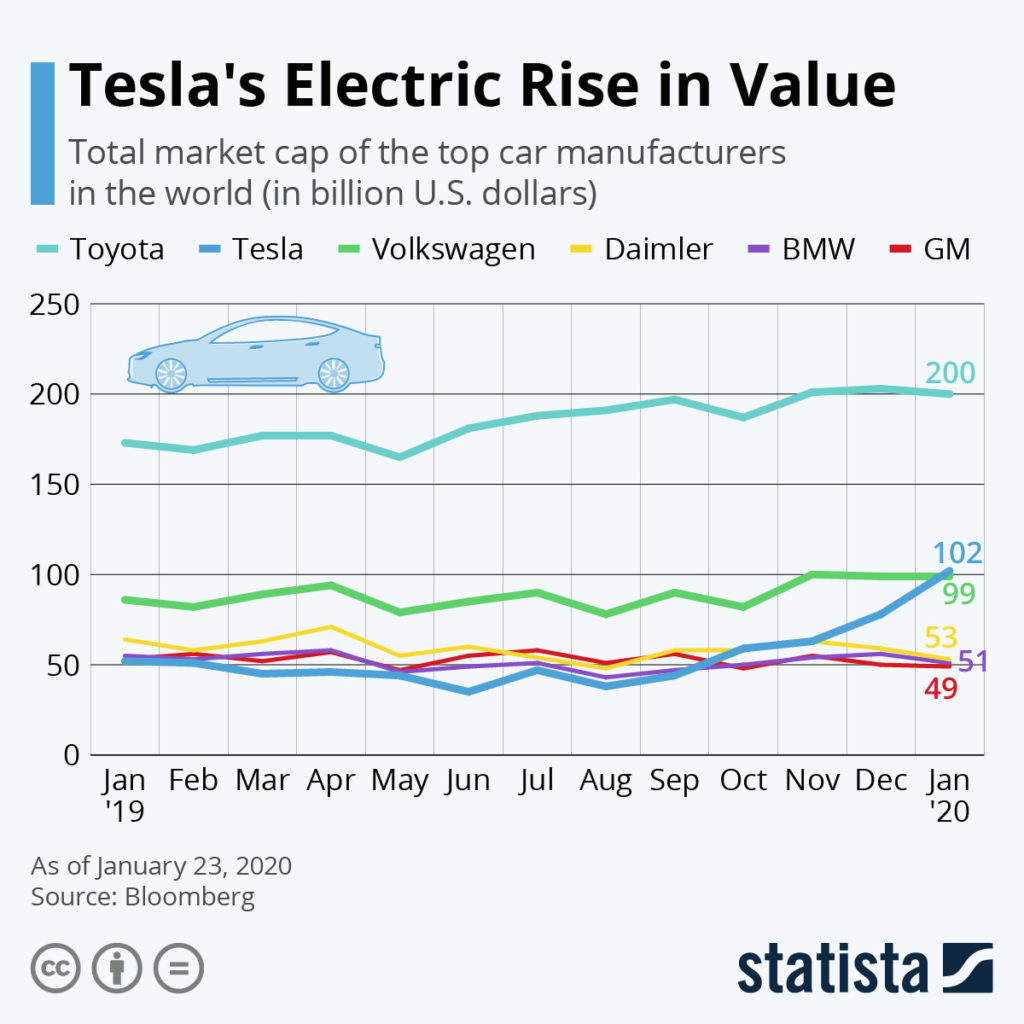

Tesla Inc. (Nasdaq: TSLA) now trails Toyota for the title of most valuable car maker in the world.

The electric auto manufacturer recently reached a market cap of $102 billion, making it the first U.S. car maker to eclipse the $100 billion mark.

Check back each morning before the opening bell for stocks to watch today with the Wall Street Wake-Up, here on Money and Markets.