The President’s economic approval numbers reach their highest level of the year, plus stocks to watch today in the Money and Markets Wall Street Wake-Up.

The Market Open

As of 10 a.m., markets are up across the three major indexes, though down a bit from premarket highs.

The Dow Jones Industrial Average opened at 28,291 while the S&P 500 opened at 3,195 and the the Nasdaq opened at 8,834.

The Opening Bell

According to a new CNBC All-America Economic Survey, President Donald Trump has his highest economic approval rating of the year.

The poll showed 49% of Americans approve of Trump’s handling of the economy, up from 42% in September. Disapproval dropped from 50% to 40%.

Stocks to Watch Today

Cintas Corp. (Nasdaq: CTAS) — The Cincinnati-based specialized business services company beat consensus quarterly profit estimates by $0.24, according to its quarterly report.

Cigna Corp. (NYSE: CI) — New York Life Insurance is paying more than $6 billion to purchase non-medical insurance products from Cigna, according to the Financial Times.

General Mills Inc. (NYSE: GIS) — The Minnesota-based food producer reported quarterly earnings of $0.95 per share, beating estimates by $0.07.

In the News

Shares of FedEx Corp. (NYSE: FDX) were down more than 7% in premarket trading after the company’s second-quarter net income was down 40% from the same period a year ago, according to CNN Business.

That’s on top of the news that Amazon is banning third-party sellers from using the shipping company for Prime deliveries.

In a call with Wall Street analysts, FedEx Chief Financial Officer Alan Graff Jr. said the company is “at the bottom,” which is never something you want to hear — unless you’re looking to buy its stock at a discount.

Dish Network On Verge of Wireless Network

In testimony in support of the T-Mobile-Sprint merger, Dish Network CEO Charlie Ergen said he has three letters from banks offering $10 billion to fund a new wireless network.

Spring Corp. (NYSE: S) and T-Mobile US Inc. (Nasdaq: TMUS) are battling with state attorneys general from 13 states who sued to block the merger, according to the Wall Street Journal.

The letters shown by Ergen indicated each of the three banks were “highly confident” of loaning Dish Network $10 billion to start its own wireless network.

Fiat Chrysler and PSA Peugeot Ink Merger

Fiat Chrysler Automobiles (NYSE: FCAU) and PSA Peugeot signed a binding merger agreement Wednesday, creating the fourth-largest automaker in the world.

The deal is a 50-50 merger that will end with a group having revenues of nearly $190 billion while producing 8.7 million cars each year, according to the Associated Press.

Fiat Chrysler shares were up 2% in Milan and Peugeot jumped 4.2% in Paris.

Other Morning Reads

Wealth Tax Gets More Support Than Border Wall: Fox News Poll (Money & Markets)

Bed, Bath & Beyond CEO Clears Decks, 6 Execs Out (CNBC)

Is A No-Deal Brexit Back On the Table (BBC)

Earnings Report

Here are the companies releasing earnings reports today:

Beyondspring Inc. (Nasdaq: BYSI)

General Mills (NYSE: GIS)

Micron Technology (Nasdaq: MU)

Paychex Inc. (Nasdaq: PAYX)

Toro Co. (NYSE: TTC)

Chart of the Day

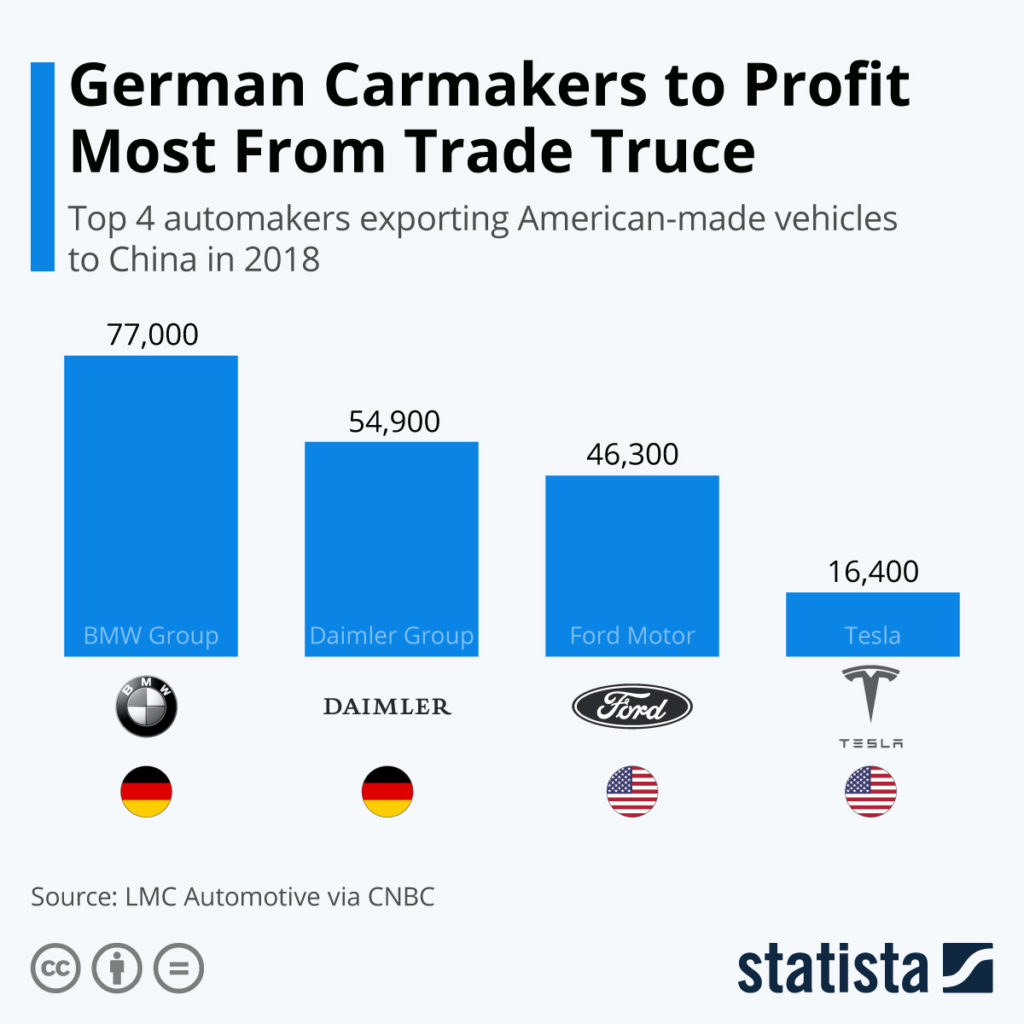

Among the big winners in the recent ease of U.S.-China trade tensions are German-based automakers exporting to China from the United States, according to data from LMC Automotive.

BMW’s X5 SUV was the best-selling U.S. car in China in 2018. It is produced at BMW’s manufacturing facility in Greer, South Carolina. BMW exported 77,000 automobiles to China last year.

Daimler and Ford also stand to benefit from China rolling back tariffs on passenger cars imported from the U.S.

Check back each morning before the opening bell for stocks to watch today and more news with the Wall Street Wake-Up, here on Money and Markets.