Snacking is something we can all relate to.

My editorial assistant snacks pretty much every 15 minutes.

For me, the urge hits between lunch and dinner.

But I’m trying to watch my weight, so grabbing anything out of the pantry won’t do.

Instead, I reach for trail mix, peanuts or cashews.

They’re much healthier snacks than cookies or chips.

And companies are catching on to this trend.

Using Chief Investment Strategist Adam O’Dell’s proprietary six-factor Stock Power Ratings system, I found a “Strong Bullish” company that sells nuts around the world:

- It just reported a 24.7% increase in quarterly sales.

- Its gross profit jumped 20% year over year.

- We expect it to beat the market by 3X over the next 12 months.

The snack stock I share with you today will continue its strong performance throughout this shaky market — here’s why.

Snack Stock to Profit From Healthier Choices

I used to snack.

A lot.

Now, when I get the urge, I gravitate to trail mix or nuts, such as cashews or almonds.

And I’m not alone:

The chart above shows the rise in global revenue from selling nuts.

In 2020, the industry earned $51.4 billion.

Statista expects that number will expand by 44.2% to $74.1 billion by 2027.

Bottom line: This market is taking off.

To find maximum gains, let’s look at a top-rated snack stock.

Great-Quality and Low-Volatility Snack Stock: John B. Sanfilippo & Sons Inc.

The nut market is a niche with few players in the game.

John B. Sanfilippo & Son Inc. (Nasdaq: JBSS) is an Illinois-based company that sells nuts and nut products (think trail mix) worldwide.

It operates under several brand names:

- Fisher.

- Orchard Valley Harvest.

- Southern Style Nuts.

- Squirrel.

Let’s look at how this stock has performed.

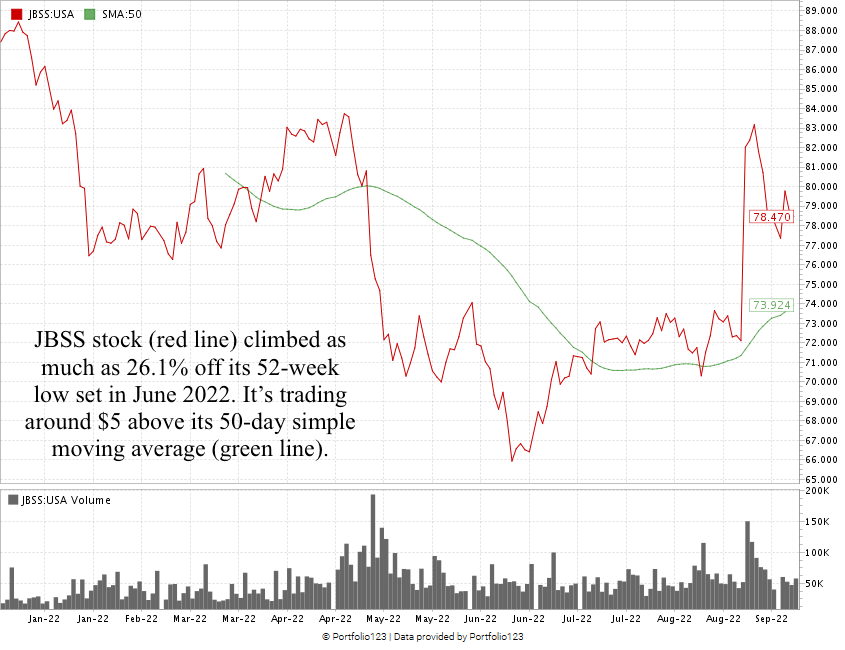

JBSS Tests Resistance at $77 per Share

JBSS hit a 52-week low in June 2022.

Two months later, the stock climbed 26.1%.

It’s pared some of those gains but is testing resistance at $77 per share.

I’m confident it will bounce up and hit a 52-week high in the near future.

John B. Sanfilippo & Son Inc. Stock Power Ratings

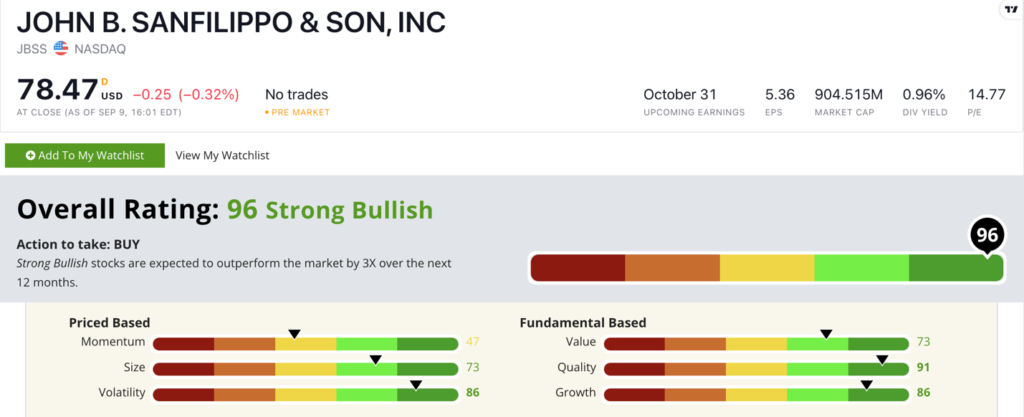

Using Adam’s six-factor Stock Power Ratings system, John B. Sanfilippo & Son Inc. stock scores a 96 overall.

That means we’re “Strong Bullish” on this snack stock and expect it to beat the broader market by at least three times over the next 12 months.

John B. Sanfilippo & Son Inc.’s Stock Power Ratings on September 12, 2022.

JBSS rates in the green on five of our six factors:

- Quality — The company’s return on equity is 23.7%, compared to the industry average of negative 3.1%. JBSS scores a 91 on quality.

- Growth — JBSS scores an 86 on growth, with a prior-year quarterly sales growth rate of 24.7% and an earnings-per-share growth rate of 40.7%

- Volatility — The stock has had just one significant downturn over the last 12 months. JBSS earns an 86 on volatility.

- Size — Its $904.5 million market cap makes it a good-sized stock for strong gains. JBSS scores a 73 on size.

- Value — JBSS’s price-to-sales ratio of 0.95 is half that of the food and beverage distribution industry’s 2. The stock earns a 73 on value.

The stock scores a 47 on momentum, but it jumped 26.1% off its 52-week low into late August.

Bottom line: Nuts are a great snack — and they’re healthy to boot!

As a global leader in the nut industry, JBSS is a strong snack stock for your portfolio.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He is a certified Capital Markets & Securities Analyst with the Corporate Finance Institute and a contributor to Seeking Alpha. Prior to joining Money & Markets, he was a journalist/editor for 25 years, covering college sports, business and politics.