Welcome back to Money & Markets’ Success of the Week, a place where we celebrate the success of others. With so much happening in the world today, it’s worth taking a breath and recognizing the little victories.

Late last week, the market saw a sharp sell-off spurred on by the Japanese conglomerate SoftBank Group (OTC: SFTBY).

Its CEO, Masayoshi Son, is capable of moving markets himself, earning him the designation as a “whale.” He spent billions on call options (bullish bets) of mega-cap tech stocks, which include Microsoft (Nasdaq: MSFT), Facebook (Nasdaq: FB), Amazon (Nasdaq: AMZN) and Tesla (Nasdaq: TSLA).

This likely contributed to the recent run-up in the Nasdaq Index and caused both the Volatility Index (VIX) and the Nasdaq to move higher together over the past 10 days or so — a rare occurrence since they typically move in opposite directions.

When I asked about the sell-off and if there was cause for concern, Money & Markets Chief Investment Strategist Adam O’Dell told me:

I think short-term issues are driving the sell-off. Long-term, I still think that Federal Reserve support, ultra-low interest rates and a likely continued economic recovery will keep the longer-term bullish trend intact.

This market rout could very well be a buying opportunity.

And while the aftermath of this sell-off has left the markets in shaky territory, there are some stocks that are still “strongly bullish” — scoring at least an 81 in Adam’s Green Zone Ratings system.

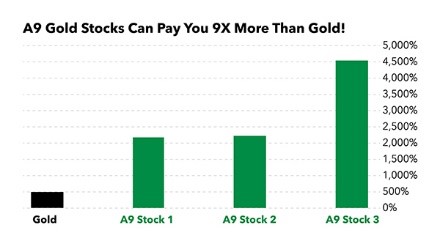

As I mentioned last week, Adam and his readers are privy to a small group of stocks that he’s termed “A9 Gold Stocks.” One of these stocks scores an overall rating of 93 in his system.

And over the past 12 months, gold has tripled the return of the S&P 500, the Dow Jones and even the outperforming Nasdaq.

But you haven’t seen anything yet.

Take Mike G., another member of Adam’s option-trading Cycle 9 Alert service, who wrote us to share his success with a particular A9 gold miner:

I bought 9 contracts on February 18, 2020, $7000 into the buy. On April 9, 2020, I sold 5 contracts for $7770 (100% profit). And then on July 27, 2020, I sold 4 contracts for $13,210 (425% profit).

No complaints!

I’ll keep it in my brokerage account but it is money in the bank. I’ll keep my standard investment per option the same and let the profits add up for now.

It’s shaping up to be a good year for Cycle 9 Alert.

Thanks for your services Adam. I also use Green Zone Fortunes and 10X Profits. Both doing well right now.

Thank you for sharing, Mike! We’re glad to hear about your success with one of Adam’s A9 Gold Stocks, and that you’re also having success with his Green Zone Fortunes and 10X Profits services.

How about you? Do you have a success story you’d like to share?

Did you follow advice from Adam or one of our other experts in Money & Markets that paid off? Have you recently achieved a goal that you set?

Send us an email at feedback@moneyandmarkets.com. We’d love to hear from you!

To your success,

Coty Poynter

Managing Editor, Green Zone Fortunes