Editor’s Note: The weekend is almost here, and a lot can happen to your portfolio in those two days. But Mike Carr’s Accelerated Income System is designed to make your weekends “worry-free.” He’ll have all the details for you on Thursday. Click here to make sure you’re one of the first to find out more.

We’ve officially hit the lull in South Florida.

Snowbirds and college students are heading north.

The summer vacation crowd is coming, but for now, I can enjoy less honking on the road and shorter waits at my favorite local spots.

Looking ahead, it’s shaping up to be a hectic (and expensive) summer travel season.

A NerdWallet survey found that 45% of Americans are already planning extended trips and will spend more than $3,500 on average on them. And 91% said they’re taking steps to save where they can, such as opting to drive instead of fly.

With inflation remaining elevated, travelers are planning accordingly.

We can do the same if we’re looking to invest in the seasonal summer travel trend.

All we’ve got to do is turn to our favorite system…

Green Zone Power Ratings and Seasonal Trends

Adam designed his proprietary Green Zone Power Ratings system to help us find the stocks that are best suited to beat the market over the next year. Stocks fall into five simple categories:

- Strong Bullish (81 to 100): Expected to outperform the market by 3X.

- Bullish (61 to 80): Expected to outperform the market by 2X.

- Neutral (41 to 60): Expected to perform in line with the market.

- Bearish (21 to 40): Expected to underperform the market.

- High-Risk (0 to 20): Expected to significantly underperform the market.

There are further breakdowns based on six individual factors, but that overall rating is a great starting point.

You can try it out for free here.

A lesser-known perk is that this all-weather system shows us how stocks stack up against strong seasonal trends. For example, we know the summer travel season is coming, so we can use that as a framework for related stocks.

(Chief Market Technician Mike Carr is a master of this approach in Apex Alert. He’s helped his subscribers lock in profits on seven out of eight trades so far. Click here to see how he does it.)

Let’s try that out with a couple of summer travel stocks…

How Summer Travel Stocks Stack Up

I want to kick things off with a stock that has been soaring higher this week.

United Airlines Holdings Inc. (Nasdaq: UAL) revised its earnings forecast for the current quarter to the upside on Tuesday. The airline expects to post earnings per share between $3.75 and $4.25 for the second quarter, well above Wall Street analysts’ expectations at around $3.76 per share.

Of course, the airline also cut its forecast for new aircraft due to the laundry list of issues at Boeing, but investors are ignoring that part of the report.

Shares have been on a tear following the news. UAL stock gained more than 20% between Tuesday’s close and intraday trading on Thursday.

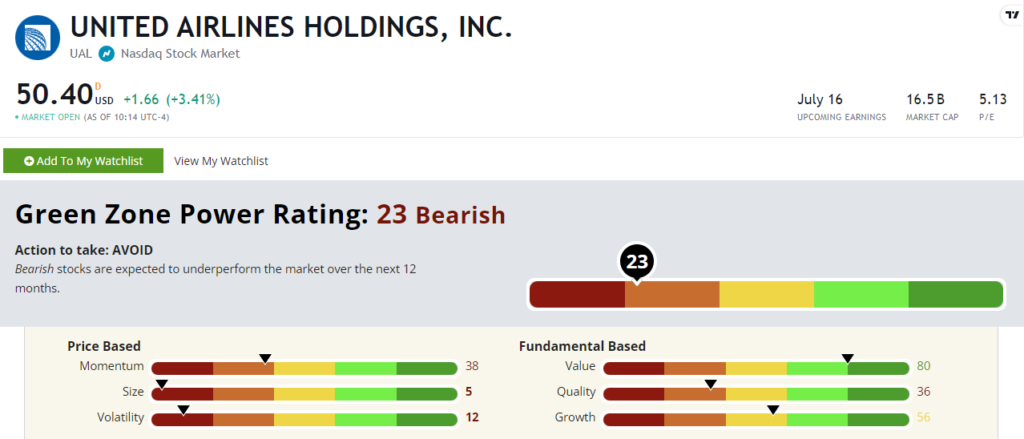

But I’m not diving in quite yet after a quick look at the stock’s Green Zone Power Ratings:

With a “Bearish” 23 out of 100, our system projects that United Airlines stock will underperform the broader market from here.

While the stock’s near-term momentum has been strong, zooming out tells a different story. UAL stock is up almost 17% over the last year but is still well below its 52-week high from last July. This is also not enough to beat the S&P 500’s 21% gain over the last 12 months.

UAL’s 12 rating on Volatility means it’s more volatile than 88% of stocks that Adam’s system rates.

This stock’s overall rating could improve, especially if this momentum carries into the summer months. But I’m happy to sit on the sidelines and look for a stock with less baggage dragging it down.

Here’s what I found…

A “Bullish” Travel Stock

We all know that when traveling, it’s not about how you get there but where you stay.

I kid, of course. There have been plenty of times when I wish I’d sprung for roomier seats on a cross-country flight.

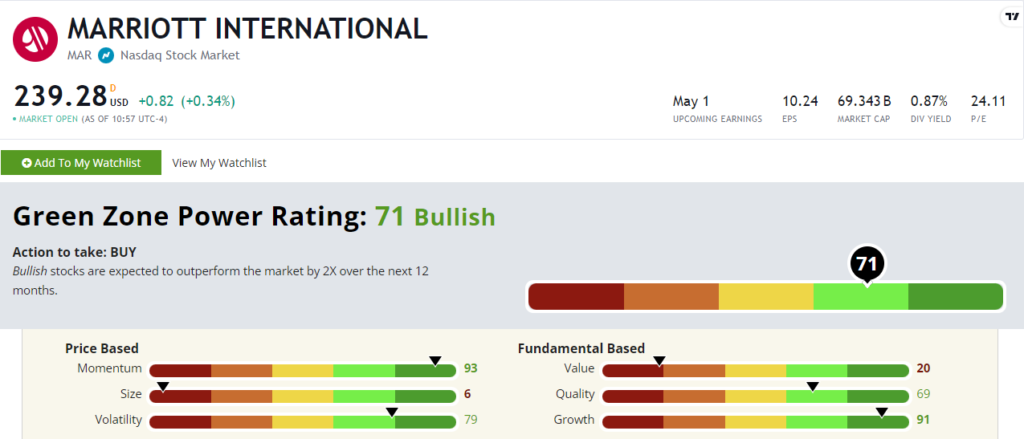

But it’s hard to beat that feeling of walking into a clean hotel room after a long travel day. If you’re trying to bank off that feeling, Marriott International Inc. (Nasdaq: MAR) stock looks solid in our system.

Marriott stock rates a “Bullish” 71 out of 100 in Green Zone Power Ratings. That means it’s expected to beat the broader market by 2X over the next 12 months.

MAR has gained more than 38% in the last 12 months, almost doubling the S&P 500’s performance. Its steady climb shows why it rates a 93 on Momentum and a 79 on Volatility.

It’s also a solid growth stock, with a 91 rating on that factor. For the fourth quarter of 2023, it reported revenue of $1.68 billion, an 11.5% year-over-year increase. Net income was also up 26% for the quarter.

With a busy travel season ahead, MAR is well-positioned for continued outperformance, according to Green Zone Power Ratings.

Back to packing for my camping trip in North Miami. Yup, you read that right… I’ll have some pics to share next week.

Until next time,

Chad Stone

Managing Editor, Money & Markets