One of the wisest investment maxims is “know what you own.”

That can mean … don’t buy a complex derivative if you’re uncertain how it works.

It also means you should look beyond how a fund markets its stated objective.

For instance, the Global X SuperDividend U.S. ETF (NYSE: DIV) includes a one-sentence fund summary on its website:

“[The fund] … invests in 50 of the highest dividend-yielding equity securities in the United States.”

Sounds simple enough.

But as a prudent investor, you should dig deeper and ask questions.

Questions like …

- Does buying the top 50 dividend-payers expose me to outsized risk in any particular sector?

- How can I be confident these 50 companies can afford to pay these fat dividends?

To answer those questions, you have to “look under the hood” at the fund’s individual stock holdings.

Did You Know the SuperDividend (DIV) is an Energy Play?

On that first question, all you need to do is look at the sectors to which each of DIV’s 42 stock holdings belongs.

I did that … and found that 30% of DIV holdings are energy-sector stocks. There isn’t another sector in the fund that holds a higher weight.

Simply put, buying shares of the Global X SuperDividend U.S. ETF (NYSE: DIV) means you’re “overweight energy” — you’re placing an above-average sized bet on the hopeful outperformance of the energy sector.

Is that good or bad?

I can’t answer that for you … it all depends on whether you’re particularly bullish on energy stocks or willing to take the extra risk and volatility they may bring to your portfolio.

The point is, regardless of whether you view this overweighting to energy as “good” or “bad,” you should “know what you own.”

If you thought you were buying a “dividend fund” and wound up with an outsized play on the energy sector … you might be sorely disappointed if the sector stumbled and dragged the fund’s performance down with it.

Looking to my second question, “Can I be confident these 50 companies can afford to pay these fat dividends?”

For that, we turn to my six-factor Green Zone stock rating model. Let’s run an ETF X-ray on the 42 holdings in DIV …

ETF X-Ray Reveals a Better Buy

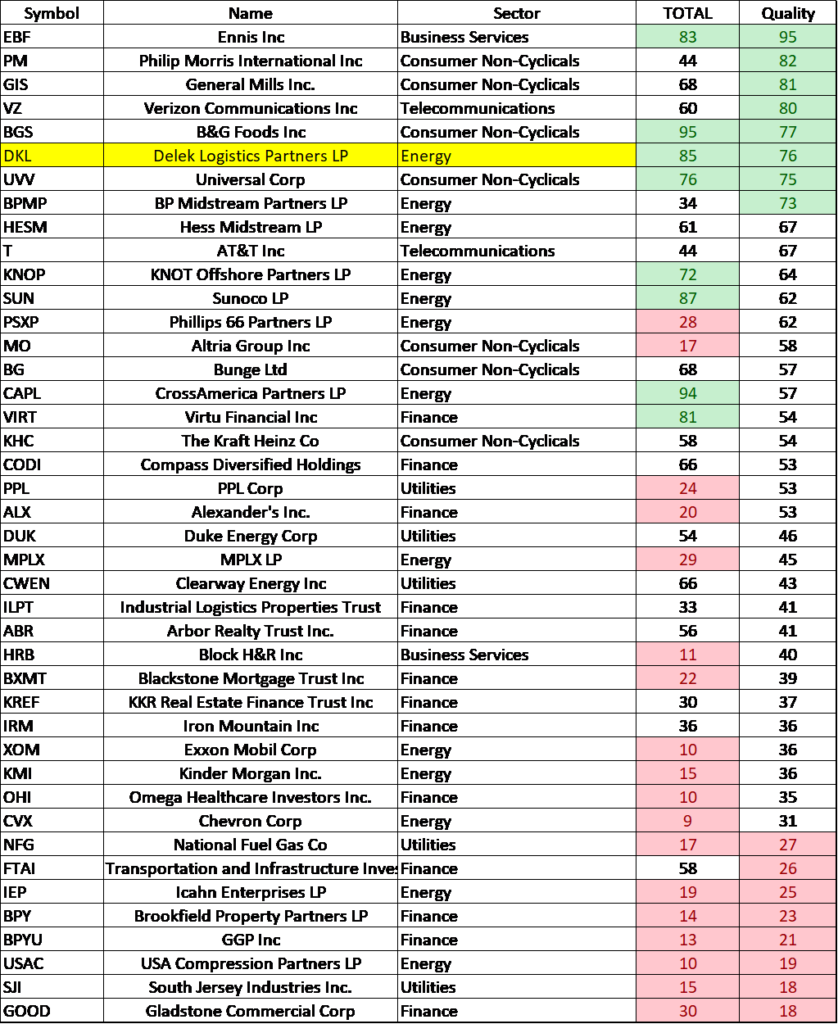

Here’s a table showing all 42 individual stocks held in DIV, along with their Overall and Quality Green Zone ratings:

My model’s “Quality” factor rates stocks based on things like … profit margins, debt-to-cash ratios, and free cash flow.

In short, it highlights high-quality companies that make money and are prudent stewards of investors’ equity. What’s more, it’s these companies that “can afford” to pay the large dividend payments that earn them a spot in this “SuperDividend” ETF.

Scrolling down this list, you’ll find that Delek Logistics Partners LP (NYSE: DKL) is the first energy-sector stock you’ll come to. This means it rates higher on “Quality” than any other energy-sector stock in the fund.

What’s more, Delek rates highly overall on my Green Zone model … earning a “Super Bullish” rating of 85.

Delek Logistics Partners is a “midstream” oil and gas partnership. It doesn’t poke holes in the ground, as oil and gas exploration companies do. And it doesn’t sell those drillers rigs or other ancillary equipment.

Instead, Delek acts as something of a “middle man,” by gathering crude oil from where it’s pumped … moving it through pipelines to terminal locations … and then marketing it for sale.

And for years now, even despite the headwinds suffered by a majority of the energy sector, Delek has proven itself as a highly-profitable player in this field.

Get this … the dividend that earned Delek the #2 spot in Global X’s DIV fund … it’s paying investors a forward yield of more than 9%!

And Delek can totally afford to pay it.

In fact, Delek has not only consistently paid a quarterly dividend … it has raised its dividend for 31 consecutive quarters!

That’s why I just pitched Delek Logistics Partners LP (DKL) as a smart energy-sector “buy” on this weekend’s The Bull and the Bear podcast, with my colleagues, research analyst, Matt Clark, and Green Zone Fortunes editor, Charles Sizemore.

Delek is a high-quality energy company and a fat-dividend payer at that.

I spoke on the podcast about why I’m expecting the oil and gas industry to have something of a “phoenix-style” comeback in the months ahead. And why I think Delek is a great way to play it.

Of course, if you’re comfortable making an overweight investment in the broader energy sector and also called yourself a “dividend investor,” then buying shares of the Global X SuperDividend U.S. ETF (NYSE: DIV) is an easy, one-click way to gain exposure to both of those bents.

But I think you can do one better by digging into DIV’s holding and, with the help of my Green Zone stock rating model, finding one or more top-rated stocks within the fund.

To good profits,

Adam O’Dell

Chief Investment Strategist