The ongoing federal government shutdown creates an especially tough situation for the Federal Reserve.

Because without the official government data on workers and the economy, it’s going to be challenging for members of the Fed’s Open Market Committee to decide whether it’s the right movie to cut interest rates.

We’ve got plenty of signs of a slowing economy, so next week’s rate cut seems all but locked in (see our last issue for the story there). But today, I want to show you some data that points to a strengthening economy that might prevent us from seeing more cuts in 2025.

Click the video below for the full story:

Video transcript:

It is time for Moneyball Economics. I’m your host, Andrew Zalin.

So we are four weeks into a government shutdown and quite frankly, Wall Street and the bond market seem to have shrugged it off.

Wall Street’s shrugged it off primarily because it’s earning season. They’ve got plenty of data and visibility to what individual companies are doing. They’re not worried.

The bond market? They are worried because this shutdown couldn’t have come at a worse time. A consequence of the shutdown is that there’s no economic data flowing. There’s no way to know where we are economically speaking and where we’re going.

And that matters because next week the Federal Reserve will be deciding if we’re going to see another rate cut. So why isn’t the bond market panicking if we’ve had a month of flying blind? Well, quite frankly, because they’re assuming a rate cut’s going to happen next week.

There’s a lot of other data out there that says economic softness. In fact, the Federal Reserve is recently been producing some of that data themselves. Philadelphia Federal Reserve Bank has reported a lot of softness and so on. So the Federal Reserve, everyone assumes they’re seeing a lot of data that says softness next week there’s going to be a rate cut. It’s okay if they make that decision based off of other data.

The real question isn’t next week. The real question is what comes next? When are the next rate cuts?

And to know that we’ve got to know what the economy’s doing and what the Fed perceives as what the economy’s doing.

Alright, so everyone is scrambling. They’re trying to figure out what data the Fed is going to be looking at and what data we should be looking at to second guess what the Fed’s looking at. What other parallel alternative data streams are there? And that’s where I come in.

I look at the supply chain. If I want to get a finger on the pulse of the economy, if I want to know economic activity, I’m going to look at the ebb and flow of stuff, how much stuff people are buying, how much stuff companies are buying compared to last year.

And to do that, I look at railroad shipments and I look at them for a variety of reasons.

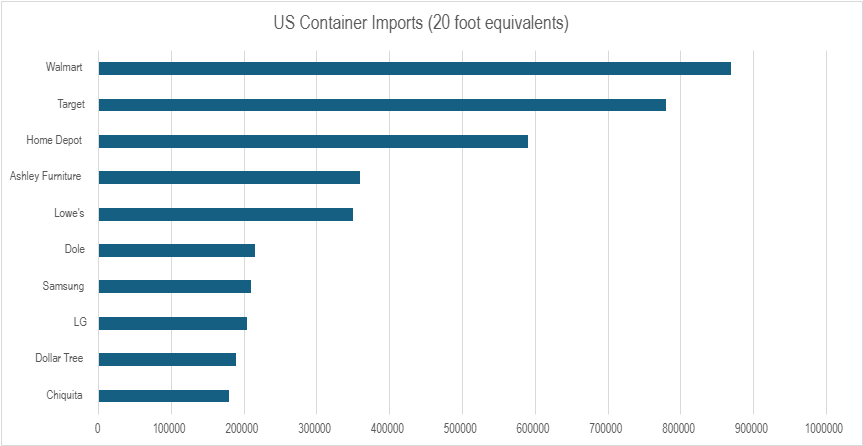

First of all, when we talk about consumer spending, the bulk of the consumer spending’s going through retailers, and guess what? The bulk of retailers are importing from China. And when they import those goods, they land at our shores at the ports and are then offloaded onto railroad cars.

So if I want to know if people are buying more or less, I look at whether we have more or less railroad cars shipping around versus last year.

And that’s what I want to share with you…

Within the world of rail car shipments, okay, we’ve got about 20 million containers that come onto our shore. And by the way, containers is very important to understand. A long time ago, shippers standardized how they were moving stuff back and forth across the ocean.

They created what’s called the 20 foot container. So what that means is if a boat comes to the port, everything is in the same shape. So a crane can come down, grab the same block, and then move it onto a truck and the truck knows how big it needs to be because it’s carrying the exact same shaped container. Same with rail cars. The crane reaches down, grabs this container and puts it on a rail car.

The standardization makes the flow of goods easier, but it also makes it easier to track. We can say a container, it’s always the same.

And so we can say this year’s containers, last year’s containers, it’s all about the volume. When we talk about containers coming in and moving around or containers going out and exported, they’re called intermodal containers. Intermodal means different modes of transportation. Comes in on a boat. That’s one mode. It then moves around on a rail car that’s a second mode. It moves across the country like coal, and then goes to the port of LA to go out to Vietnam. Boom, that’s a second mode.

Intermodal references, imports and exports. And for the benefit of what we’re trying to track, we’re going to look at intermodal. Here’s a chart showing you this year’s intermodal container shipments every week versus last year:

And what I want to share with you is a couple of things. First of all, the amount of rail car shipments, whether it’s domestic just staying on shore or whether it’s intermodal coming in or going out this year compared to last year, the number of containers moving around on railroads is up.

It’s up 2%. And that’s not earth shattering, but two percent’s pretty good. If you want to talk in terms of GDP, it means today’s economy is a little bit stronger than yesterday’s economy and that’s a positive point. But let’s drill in a little bit because it’s kind of interesting to see what is and isn’t happening when we basically pull back the curtain.

When you look at intermodal, one thing that should strike you is this year compared to last year in the first half of the year, container shipments. Wow … off the charts! And that’s for two reasons. One, the tariffs. All these companies were front running tariffs, and so they were importing a lot more. And that’s showing up in the first half of the year.

At the same time. You see how starting at around May, June timeframe, the amount of containers is about the same as last year.

Why? Well, because we have everything we need.

We’ve got all the stockpiling of inventory, we don’t need a lot more. Hold onto that thought for a second. That implies that the first half of the year we pulled in stuff that we would need from the second half of the year. Well, here we are, we’re at the end of the year, which means we’re probably running out of this excess inventory as we go into next year, which means we’re probably going to have to start turning on things again.

We’re going to start to see more activity, both bringing in manufacturing, whatever it means. But stay with me on that first half of the year. I mentioned that are two reasons why it went up. One is just general front running, which means we’re just borrowing from the future, but the other is coal. Now this is one we got to completely strip out.

There was a bad accident last year that affected our ability to export coal. And so the growth in the first half, a lot of that is just basically a rebound in our ability to ship coal when we strip it out though it’s 2% growth year over year.

So where does that bring us? What we’ve got with intermodal shipments is a reference point. See, in the first half of the year, we’ve got to ignore that. It’s distorted by coal, it’s distorted by the front running. And so when we focus on the second half of the year, it’s very similar to last year. And remember, again, as I mentioned, we’re basically pulling in from the second half in the first half, which means we are lean right now. And even as lean as we are, we’re still running at about the same level as last year.

We cannot maintain this leanness very much longer. What I believe is happening in payrolls and everywhere we look in this economy is we went through a soft patch. We are escaping a soft patch. Let me expand on that a little bit…

Trump comes in, creates nothing but uncertainty for everybody. As a result, companies panic. They shut down hiring, they cut a lot of jobs, a lot of uncertainty. You don’t invest during uncertainty. They go on vacation, the summertime, very soft patch.

But people come back in August and they realize corporate America looks around and says, “the economy’s just fine.”

All this bluff and bluster from Trump is really just bluff and bluster. It’s not really truly hitting us that hard. The economy’s doing just fine. Worse, we actually need some people. We got to backfill some positions. So I believe that what’s been happening the past couple of months is in fact corporate America is reinvesting a little bit.

They’re hiring a little bit more, spending a little bit more. Inventories have run down, they’re going to start replenishing. And in fact, new orders have been going up. When we look at things like ISM bottom line, I can’t tell yet whether we are just kind of zigging to the zag.

We overreacted and now we’re kind of just recovering a little bit or whether we are actually tilting up. And that’s the question that hedge funds need answered right now. Are we firming up after a soft patch or is there more on the table?

And quite frankly, I think there’s more on the table. I believe that as we get into the new year, budgets are relieved. You get companies looking around saying It’s time to start hiring. It’s time to start replenishing stockpiles of inventory. It’s time to start investing in this growing economy that’s a deal killer for future rate cuts.

So right now the markets are expecting at least two rate cuts.

This year I’m raising my hand and saying, I don’t know. I think there is actually a possibility of only one, and I certainly don’t think there will be any more next year. Well, for the foreseeable future.

Having said that, one other thing up in the air when we talk about rate cuts is Donald Trump and the way he’s trying to stack the Federal Reserve board, he wants doves on the board. He wants people more prone to cut rates. If we can cut rates, it weakens the dollar.

That helps with exports and on and on and on. So there are other layers here when we talk about rate cuts. But if we’re only looking at the economy, I see a strong vibrant economy next year. And that’s a deal killer for rate cuts. A lot of moving parts, a lot of moving pieces. And I’m on it. I’m watching it for you.

We’re in it to win it folks. Zatlin out.

Andrew Zatlin

Editor, Moneyball Economics