I lost a ton of money in crypto.

Let me rephrase that. On a percentage basis, I lost a lot of money in crypto. I’m down by well over half.

But in dollar terms, it wasn’t a lot of money. Who enjoys losing money? I hate losing a single nickel.

Some trades will be losers. It’s part of the game.

My losses in crypto were tolerable because my position size was small.

Let’s talk about that.

Risk + Position Size

Position sizing is one of the most important factors when managing risk. I’ve never met a successful investor who survived the test of time who didn’t account for position size.

You can choose the formula you want, but at its core is one basic principle: The more volatile a position is, the smaller it should be. The less volatile a position is, the larger it should be.

In my case, my total investment in cryptocurrencies amounted to less than 1% of my portfolio. My targeted range for the allocation was 1% to 3%.

At that level, a total loss — bitcoin and other major cryptos going to zero — would be little more than an annoyance.

It wouldn’t wreck my portfolio or set back my retirement plans by years. The largest chunks of my portfolio are in established dividend stocks and a handful of conservative options strategies with independent movement relative to the market.

Yes, I make speculative plays, and some of those put points on the board when they do well.

But they also don’t kill me when they don’t.

Risk Parity

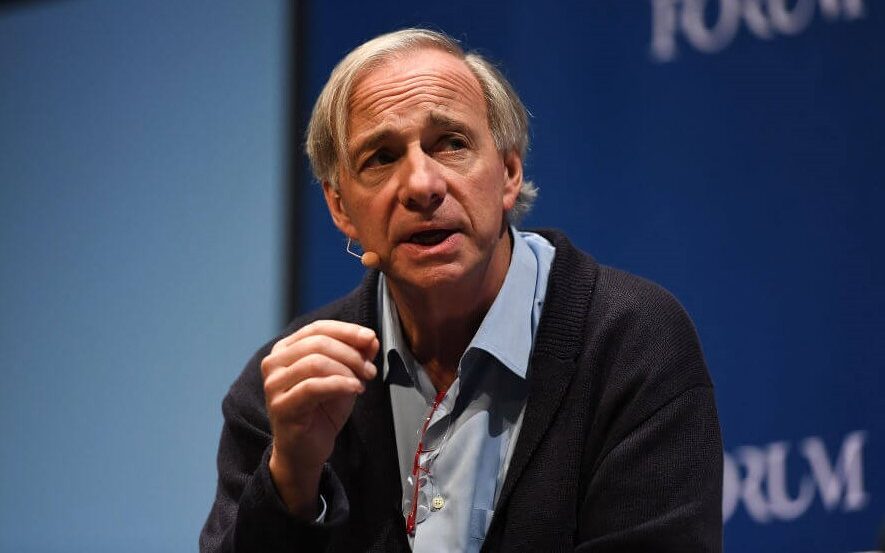

Ray Dalio, the billionaire founder of the hedge fund Bridgewater Associates, popularized risk parity.

The concept is simple: The pieces of your portfolio should be weighted so that each position contributes an equal amount of volatility.

In basic terms, if Stock A is twice as volatile as Stock B, its weighting would be exactly half of Stock B’s.

Dalio applies this to entire asset classes, which leads him to weight bonds much higher than stocks. (Dalio adds leverage to “juice” the portfolio.) But the same basic logic works well within a pure stock portfolio.

Apply It at Home

You can try it on your own in an Excel worksheet. Or use a third-party site like TradeStops to recommend position sizes based on volatility.

If you prefer not to get all that technical about it, use common sense to make your more volatile positions smaller and your less volatile positions larger.

You don’t have to be precise to three decimal points here. It’s the general principle that’s important.

Bottom line: Proper position sizing won’t eliminate your investment risk. General risk still comes with the broader market.

Most stocks follow the general market trend, so bear markets tend to sting even the most carefully constructed portfolio.

But getting position sizing right protects you from major, unforeseen errors. It will keep you from taking the kinds of losses you can’t recover from. It will let you live to trade and invest another day.

To safe profits,

Charles Sizemore, Co-Editor, Green Zone Fortunes

Charles Sizemore is the co-editor of Green Zone Fortunes and specializes in income and retirement topics. He is also a frequent guest on CNBC, Bloomberg and Fox Business.