I’ve been tracking the retail trend after I noticed a flood of customers at all my local spots.

Everywhere I went … from the drug store to the grocery store … had full parking lots. Once inside, they were all packed with fellow customers.

It’s almost like the COVID-19 pandemic never happened.

So, I looked for a way to invest in this trend using Adam O’Dell’s six-factor Green Zone Ratings system. Back in June, I found a company that remained a strong retail leader despite the COVID-19 pandemic. It’s one we are still “Strong Bullish” on.

The underlying stock is situated to outperform the broader market by at least three times over the next 12 months.

Since I recommended it in June, the stock has jumped more than 10%! The S&P 500 only gained 4.2% within the same timeframe.

Pro tip: This stock was one of the highest-rated stocks in our weekly hotlist. To find out more about our weekly hotlist, click here.

Before we get into the stock, let’s see how retail sales have rebounded after the COVID-19 pandemic.

Retail Sales Better Now Than In 2019

There’s no question that COVID-19 battered the retail sector.

Retailers were forced to close physical locations to prevent the spread of the virus.

That meant consumers like you and me were pushed to e-commerce sites to order products, hoping there were delivery options that could get our essential goods to us in a timely fashion.

In March, April and May 2020, sales in the U.S. retail sector were the worst in the last three years.

The retail sector generated just $409 billion in sales in April — the lowest sales recorded in a month since November 2012.

But retailers have roared back in 2021 with record-breaking revenues in the first six months of the year.

This trend means huge gains on the horizon for retail companies who weathered the low points of 2020.

Target Corp. Survives and Advances

If you are in the U.S., you are familiar with Target Corp. (NYSE: TGT), the major retail outlet based in Minneapolis, Minnesota.

It operates more than 1,900 stores across the country. Target also operates offices in Bangladesh, Cambodia, China, Guatemala, Hong Kong, India, Indonesia, Pakistan, Thailand and Vietnam.

Despite COVID-19's impact to the retail sector, Target’s total revenue went up by $15 billion from February 2020 to January 2021. After the pandemic hit, the retailer focused on pickup options and online shopping, which likely offset potential losses.

Total revenue projections for the company show it reaching $101 billion by 2022 — a 29.5% increase from 2019 revenue.

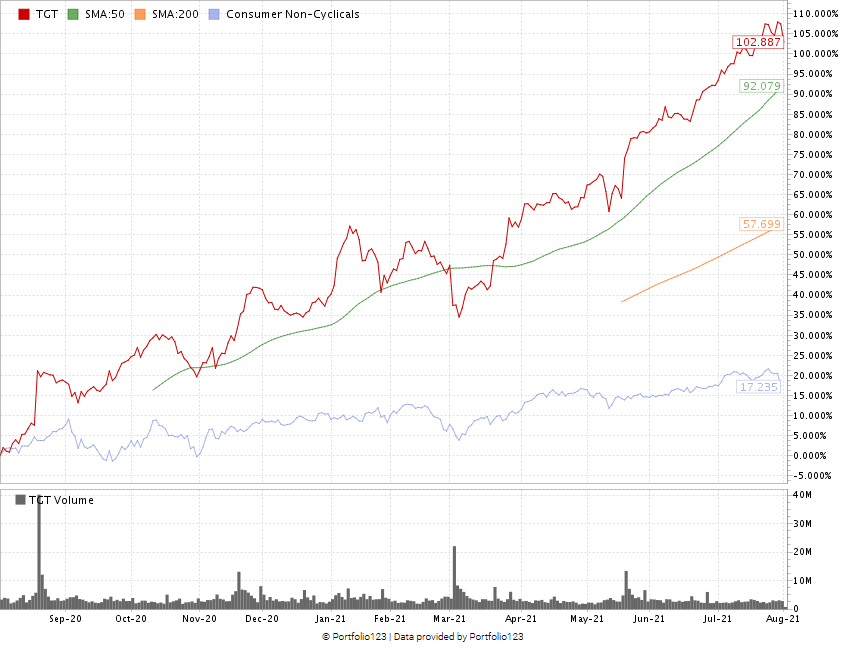

Target Stock Jumps 100% in Last 12 Months

In the last 12 months, Target’s stock price has risen from $125 per share to more than $255 per share today.

That’s a 104% increase in share price.

The stock price has grown more than 10% since I recommended it in June.

It’s risen further and faster than the 17% jump in the broader consumer non-cyclical sector.

How Target Stock Rates

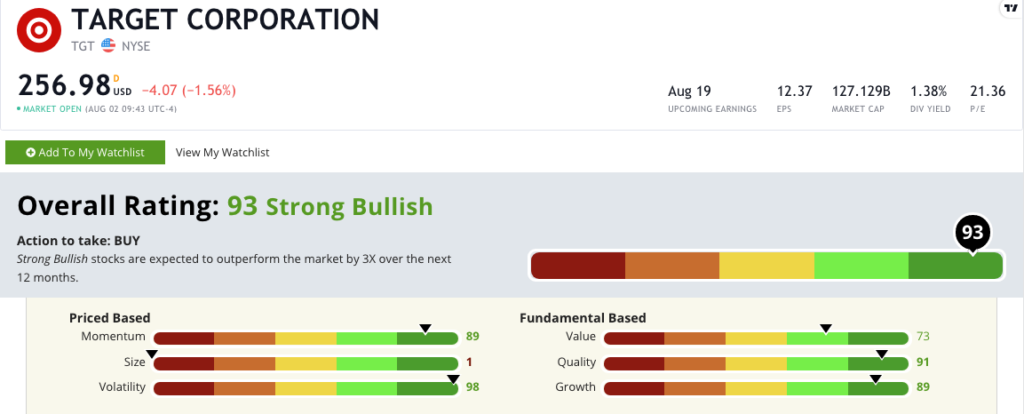

Using Adam’s six-factor Green Zone Ratings system, Target stock still scores a 93 overall. That means we are “Strong Bullish” on the stock and expect it to outperform the broader market by three times in the next 12 months.

Target stock's Green Zone Rating on August 2, 2021.

Target stock still rates in the green in five of our six factors:

- Volatility — Target’s uptrend in stock price has met little resistance in the last 12 months. Its slight pullbacks have occurred at the same time the broader market experienced a pullback. Target scores a 98 on volatility.

- Quality — The company’s returns on assets, equity and investments are all double or more the general merchandise industry. Target earns a 91 on this metric.

- Growth — Target has a trailing 12-month earnings-per-share growth rate of 127%. Its trailing 12-month annual sales growth rate is nearly 23%. The company scores an 89 on growth.

- Momentum — As seen by its stock chart above, Target stock has been in a consistent, strong uptrend over the last 12 months. Target earns an 89 (up from 81 when I first recommended it) on momentum.

- Value — The company’s price-to ratios (earnings, sales, book and cash flow) are all either in line or slightly below the industry average … making it a good value stock. It scores a 73 on this metric.

Target stock does score a 1 on size with a massive $127 billion market cap. But its performance over the last 12 months suggests its size is not a big factor on its stock price.

Bottom line: The retail sector has recovered nicely after the COVID-19 pandemic forced stores to close and shift efforts to e-commerce platforms.

Now that stores are open, customers are flocking to find deals and … well … get out of the house.

Target showed a lot of strength during the pandemic, and it’s only gotten better now that we are returning to some normalcy.

The strong uptrend in its stock price uptrend has continued after I recommended it in June.

I think I’ll keep seeing more and more cars in my local Target parking lot for years to come.

I would give Target stock a close look for your portfolio.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He is a certified Capital Markets & Securities Analyst with the Corporate Finance Institute and a contributor to Seeking Alpha. Prior to joining Money & Markets, he was a journalist and editor for 25 years, covering college sports, business and politics.

Story updated on August 2, 2021.