This Friday, August 1, is the big day.

That’s when President Trump’s tariffs are finally set to take effect after being delayed twice.

Tariffs — taxes on goods imported into the U.S. — will go up anywhere from 10% to 50%, depending on how much a country sells to the U.S.

Countries like the United Kingdom, Japan, Vietnam, Indonesia and the Philippines, as well as the European Union, have already struck deals with the Trump administration.

Other countries are reportedly continuing discussions.

I bring this up not only because the tariff deadline is less than 48 hours away but also because, as an investor, there’s something you need to understand about these impending levies.

Let me explain…

How Much Do We Really Collect In Tariffs?

As I mentioned before, tariffs are simply taxes collected on goods imported into the U.S.

Tariffs were a huge income generator for the U.S. during the Great Depression, when as many as 25% of working Americans were out of a job and not paying income taxes.

The idea is essentially to protect local industries by making imports more expensive, thus driving consumers to domestic companies.

In April, following Trump’s first announcement of Liberation Day reciprocal tariffs, he floated the idea that revenue from tariffs could offset or even eliminate the federal income tax…

The big question being … is that even feasible?

Here’s what I found:

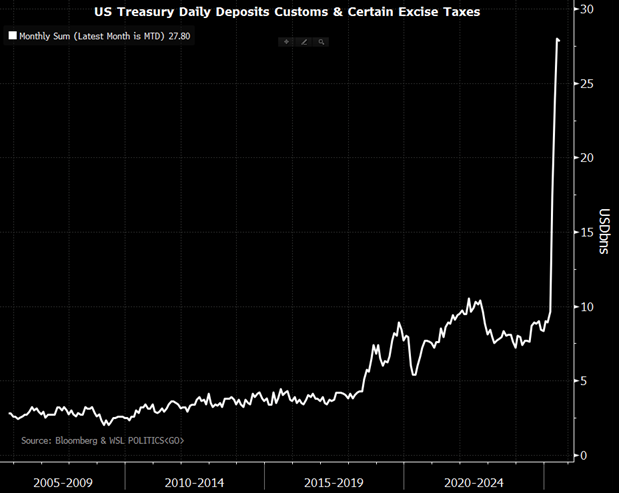

This Bloomberg chart shows the amount of money the U.S. has collected from customs and excise taxes since July 2005.

Through 2018, the U.S. garnered no more than $5 billion monthly from tariffs or roughly $60 billion per year.

Since April’s “Liberation Day,” the U.S. has collected between $17.4 billion and $28 billion each month.

If that pace continues, the Trump Administration could bring in between $208 billion and $336 billion per year from tariffs.

That’s still well below the $4 trillion in federal income taxes the government has collected so far in 2025, but this increase in tariff revenue is significant, especially when compared to previous years.

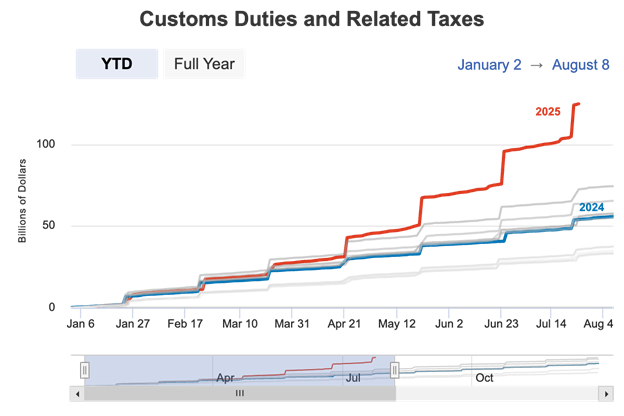

Here’s another compelling chart from the University of Pennsylvania Wharton School of Business (President Trump’s alma mater):

This chart compares tariffs collected in 2024 and 2025 from January to July.

The U.S. has already collected $124.7 billion in tariffs in 2025, compared to just $53.9 billion collected in 2024.

Again, not enough to supplant federal income taxes, but Trump’s tariff plan is working to a degree.

What Will Deals Mean For Tariff Income?

This question is a little more complicated because trade deals are not all-inclusive.

There are different tariff rates for different types of products from different countries.

For example, Trump announced a 25% reciprocal tariff rate on goods coming to the U.S. from Japan before the two countries worked out a deal earlier this month to cut that rate down to 15%.

In the deal, Japan secured favored nation status for tariffs on semiconductors and pharmaceuticals, but not steel and aluminum.

So, the tariffs apply differently to each country and to whatever is being imported.

That said, if the administration secures deals with every country by August 1 — which isn’t very likely, considering there are still huge players that are playing hardball — the result would still be an increase in tariff revenue for the U.S., just not enough to eliminate federal income taxes.

The other lingering question is what happens to the market if deals aren’t cut by the deadline?

In a piece I wrote back in January (before Trump announced his reciprocal tariffs), I outlined how the market reacted to tariffs … specifically against goods from China during Trump’s first administration.

I said that we could expect a market pullback, but that the negative reaction would be short-lived.

S&P 500 Dips On Reciprocal Tariffs… Then Rises

Well, that’s precisely what happened. The S&P 500 reached its 2025 low the day of the tariff announcement, fumbled below 5,400 points for a few weeks, then rallied to nearly 6,400 points in the months that followed.

I see the same thing happening this time around, but with less of a drop at the deadline since markets have had much more time to process Trump’s plans.

I believe the bigger drops will come in stocks based in countries that did not close a deal at the deadline. Companies within these countries will face as much as a 50% levy on any goods they import into the U.S.

This puts those companies in precarious positions as the cost of those increased tariffs will have to be passed on to consumers, raising prices and trimming sales.

Investors will not look kindly on some of these countries and companies.

My Money & Markets colleague and Top Bloomberg Forecaster Andrew Zatlin has been tracking these tariff developments like a hawk.

He’s hosting an urgent emergency meeting tomorrow at 1 p.m. ET… just hours before the president’s August 1 deadline.

During this Trump Tariff Shockwave summit, Andrew is going to show you exactly what’s going to go down on Friday, and how you can position your portfolio before things really hit the fan.

Watch your inbox for a special invite to this free presentation tomorrow.

Until then…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets