The Federal Open Market Committee (FOMC) sets interest rate policy. The group of the top-ranking Fed officials meets every six weeks to set Fed policy.

There are other approaches to managing monetary policy.

The Fed could follow rules. This would take emotional and political concerns out of the process. One reason the Fed wouldn’t like the idea of rules is because it prevents decisions based on political rather than economic factors.

One example of a political decision from the Fed interest rate policy over the last couple of years: The central bank held short-term rates near zero as inflation rose.

This policy wasn’t driven by economic data. It was a choice the Fed made for reasons that still aren’t clear.

But the implications of the Fed’s recent decisions are clear.

Inflation is roaring. This may have been avoided if the Fed had adopted a rules-based approach.

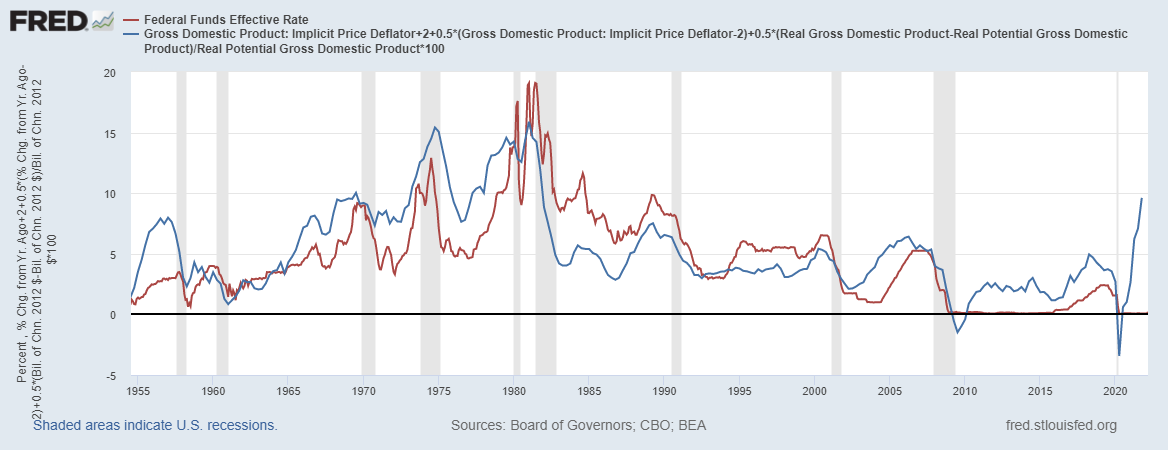

One rule is shown in the chart below. The blue line, based on the Taylor rule, shows that short-term rates should be 9.6% instead of 0.25%.

Short-Term Rates Are Way Off the Mark

Source: Federal Reserve.

Taylor Rule = Where Rates Should Be

The Taylor rule compares what the economy is doing to what the economy is capable of doing. Economists call this the output gap. The rule is a simple formula that tells us what the interest rate should be based on three things:

- The output gap.

- The current rate of inflation.

- And the Fed’s target rate of inflation.

As the chart shows, for almost 60 years, the rule closely matched the actual interest rate (the red line in the chart). That changed when the Fed ignored economic data and held rates too low for too long.

The last time inflation was this high, in the 1970s and ’80s, the Fed needed to raise rates higher than the Taylor rule predicted. That’s likely to be the case this time.

At least that’s good news on inflation. The Fed knows what needs to be done.

The bad news is the Fed lacks the political will to raise rates quickly. That means inflation may last for years.

Michael Carr is the editor of True Options Masters, One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.