After running the numbers, one sector absolutely dominated during an otherwise lukewarm trading period last week. And it’s a sector that did a lot of the work in the early months (even years) of this bull market we’ve enjoyed since late 2022.

I’m talking about tech, of course!

Just look at the chart below…

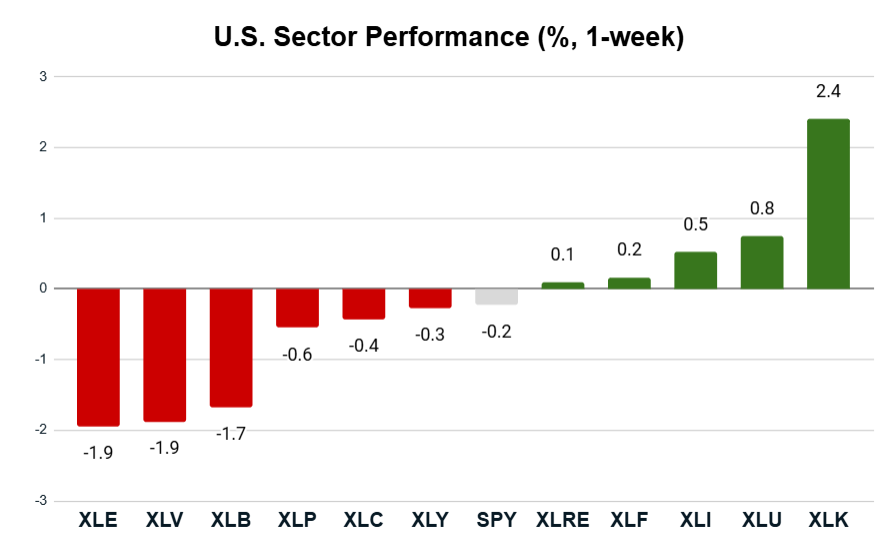

Key Insights:

- The S&P 500 (SPY) closed the week -0.2% lower.

- The tech sector (XLK) crushed the broader market with a 2.4% gain.

- The energy sector (XLE) slightly edged out health care (XLV), with both losing 1.9%.

- Five sectors beat the S&P, while six sectors underperformed.

Zooming out, tech bullishness has returned in a big way, with the sector trading 7.4% higher over the last month, beating the S&P 500’s gain of 4.5% over the same time frame.

That’s not quite the 2X to 3X outperformance we like to see when looking for “Bullish” or “Strong Bullish” individual stocks using my Green Zone Power Rating system, but it tells me this is a sector worth taking a closer look at.

Let’s do exactly that now by seeing which S&P 500 tech stocks are closing in on their 52-week highs…

Tech Sector’s Top Performers

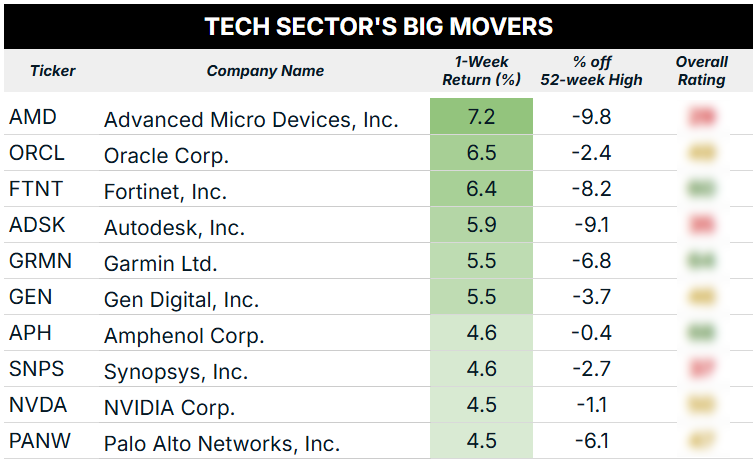

As always, you’ll see below the Top 10 tech sector stocks that closed within 10% of their 52-week highs:

(If you want to see the full Green Zone Power Rating breakdown for each of these stocks, go here to see how you can join my flagship investing service now.)

One thing I will note here is that only three of the stocks above rate “Bullish” in my system, and none of these stocks are currently “Strong Bullish,” meaning they are set to beat the market by 3X over the next 12 months.

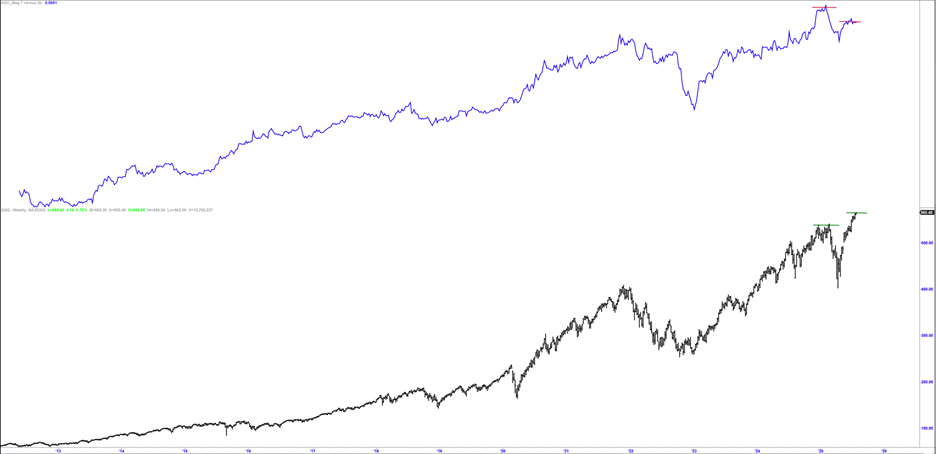

Remember that tech outperformance was concentrated in the so-called “Magnificent Seven” for much of the bull market we’ve been in since November 2022. For a while there, it felt like those seven stocks were the only game in town … but that may be changing. Have a look at this chart:

The blue line above is a ratio chart, plotting the average price of the seven “Magnificent Seven” stocks against the Nasdaq 100 index, while the black plot at the bottom is the Nasdaq 100. Notice how the Nasdaq (black) is making new highs, but the Magnificent Seven ratio chart is not.

We’ll see how that “bearish divergence” in the strength of the Mag-7 plays out, but for now it’s indicative of investors looking elsewhere.

Of note, Nvidia Corp. (NVDA) is the only Mag-7 stock that passed this week’s screen. Investors can’t seem to get enough of NVDA, but it’s “Neutral” standing in my system points to performance that may merely track the broader S&P 500 over the next 12 months.

But now that we’re seeing market breadth expand as investors look for other opportunities and drive a wider selection of stocks higher, we’re seeing new tickers climb toward their recent highs. This is a great thing and also points to a strength of my Green Zone Power Rating system.

By using the system and looking for stocks that boast “Bullish” or better overall ratings, we have a stronger chance of investing in stocks that are “built to last” and shouldn’t have the bottom fall out should things reverse again.

Let’s move on to last week’s laggards…

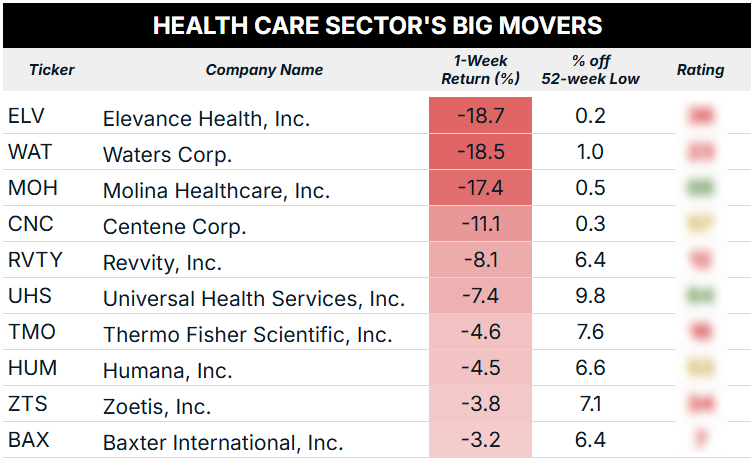

Health Care Sector’s Laggards

As we saw previously, two sectors showed similar underperformance last week: energy (XLE) and health care (XLV).

I want to focus on health care since we haven’t had a chance to talk about this sector as much recently. Here’s a look at the stocks that closed the week within 10% of their 52-week lows:

Of note, health care funding cuts as part of the Trump Administration’s “Big Beautiful Bill” are putting added pressure on insurers. That’s partly why we’re seeing a significant sell-off across the sector as a whole.

To single one company out here, news also just broke of a class action lawsuit against Centene Corp. (CNC), citing securities fraud violations for “fudging the numbers” by posting misleading financial statements and/or failing to disclose important information to CNC investors.

I’ve always gravitated toward the health care sector. As you might know, I was studying to enter the medical field before making the change and pursuing finance. And I think there are some incredible opportunities to invest in breakthrough technologies or services.

But it’s clear that this is a sector to tread carefully in right now.

With the exception of a tech-oriented health care platform that’s more than doubled since I recommended it last November, my Green Zone Fortunes portfolio is definitely “underweight” health care names right now.

To good profits,

Editor, What My System Says Today