This past Friday, I shared a video update with my Infinite Momentum Alert subscribers, in which I talked about how systematic investment strategies give us the unique ability to navigate confidently through a myriad of “unprecedented” market events.

Ironically, I quoted the 2011 downgrade of U.S. Treasury bonds as one such event.

I say ironically because the biggest news out over the weekend is none other than Moody’s downgrade on the U.S. credit rating.

While U.S. stocks and bonds opened sharply lower this morning, stocks have so far traded higher in this morning’s session — a move that suggests investors aren’t too worried about the news.

As you’ll see below, bullish investors showed up across the board last week.

Let’s get right to it by looking at how each of the major U.S. stock sectors fared:

Key Insights:

- The S&P 500 (SPY) closed the week 5.3% higher.

- Every major sector showed a positive gain for the week.

- Eight sectors underperformed the broader S&P 500.

- The tech sector (XLK) rallied the strongest (again!), with an 8% gain.

- Health Care (XLV) was the only sector to post a gain below 1%.

Having Big Tech stocks in your portfolio (which you likely do through index funds, if not individual holdings) is paying off right now… but there are also plenty of opportunities within other sectors if you dig below the surface. That is precisely my strategy for running the Green Zone Fortunes model portfolio – we have some “Big Tech” plays, but are most certainly diversified in a couple dozen stocks outside the Magnificent 7.

Now, let’s take a closer look at the tech sector’s top-performing stocks through the lens of a simple momentum screen…

The Best-Performing Sector: Tech, Again!

Investors seem to default to buying the so-called “Magnificent Seven” stocks, and Big Tech more generally, as long as sentiment is relatively positive.

But that doesn’t mean these stocks will always appear on our momentum screens or that they’re the best place for your money today…

After screening for all S&P 500 tech sector stocks that closed last week within 10% of their 52-week highs, you can see the top performers from last week in the table below:

Overall, there are some Big Tech names in here… but there’s a distinct lack of “Mag 7” in my Top 10 momentum screen. That was also the case a few weeks ago, as well … leading me to explain that those stocks remained in deeper drawdowns and, thus, didn’t meet the criteria of being close to their 52-week highs.

That was still largely the case at this morning’s open:

- Microsoft (MSFT) is the only Mag-7 stock within 10% of its 52-week highs.

- Nvidia (NVDA) is now slightly more than 10% off its highs.

- Meta (META) and Amazon (AMZN) are off between 13% and 15%, respectively.

- Alphabet (GOOGL) and Apple (AAPL) remain 20% off their highs.

- Taking up the rear, Tesla (TSLA) shares are 29% below their highs.

This just goes to show that these beloved stocks have recovered ground since the early-April lows … but they still have a way to go before fully recovering the price peaks these stocks made in February.

Now let’s see which stocks pulled the health care sector lower last week…

Last Week’s Laggard: The Health Care Sector

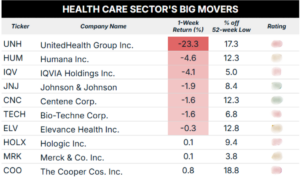

Here’s what my screen of the weakest health care sector stocks revealed:

This screen shows the worst-performing health care stocks that ended the week within 20% of their 52-week lows.

One stock’s performance sticks out like a sore thumb: UnitedHealth Group (UNH), which fell more than 20% last week alone!

Here’s a snippet of a few of the negative news items UNH investors were forced to stomach last week:

- CEO Andrew Witty unexpectedly stepped down on Tuesday

- The company suspended its 2025 financial forecast, citing rising medical costs

- The U.S. Department of Justice has a criminal investigation underway for alleged Medicare fraud.

Ouch! That’s a lot of negative news for UNH shareholders to overcome.

I’ll note that my Green Zone Power Rating system currently has UNH rated in the “Bearish” category…

Suffice it to say, this is a stock you’ll want to steer clear of for the foreseeable future.

There are far better health care stocks out there, including one that Matt Clark and I just recommended — click here to learn more!

To good profits,

Editor, What My System Says Today