Last week, Oracle Corp.’s (ORCL) market cap ballooned by roughly 25% to $892 billion — a massive move for an already very large company. The jump was spurred when Oracle painted a rosy picture of its AI-fueled future during its earnings report.

Broadly, Oracle’s commentary cemented the market’s belief that this tech-driven bull market is most certainly not over … and that the AI mega trend is still in its “early innings.”

That said, it also left investors with a conundrum to ponder.

Should you buy (more) shares of ORCL and position yourself for its future growth? Or, has the stock become too expensive, seeing as its valuation just jumped 25% overnight?

Really, that’s the question you’re facing when you consider any of the market’s largest tech stocks, as we’ll see in today’s tech sector x-ray…

Why is the Tech Sector So “Bearish?”

It’s been almost two months since the tech sector was the top performer for the week, so I haven’t run an X-ray in what feels like forever.

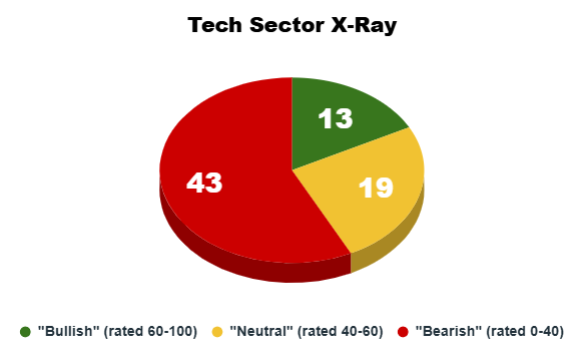

What I can say this time around is that the breakdown of “Bullish,” “Neutral,” and “Bearish” stocks based on my Green Zone Power Rating system still suggests caution in the space.

In fact, the sector looks slightly more bearish than it did when I ran the same “x-ray” back in July:

Now, 43 stocks rate “Bearish” compared to 39, and only 13 stocks rate “Bullish,” one fewer than the previous screen.

This is certainly not a rosy picture.

But there’s more to the story, here.

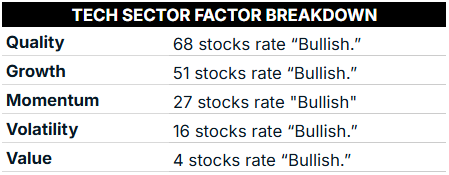

To understand why the sector’s average rating is so poor, we have to dig into the system’s individual factor ratings…

Paying a Premium for Tech Growth

The tech sector can be characterized by two notable “extremes” right now:

On one hand, 68 of 77 stocks rate “Bullish on my Quality factor.

This means that 88% of companies in the tech sector have strong balance sheets, manage debt well and produce strong sales and profits.

On the other hand, only four stocks (5%!) rate “Bullish” on my Value factor.

This means that the vast majority of stocks in the sector are now trading at elevated valuations — investors are paying a mighty premium to own tech’s top players.

Paying that premium may feel OK so long as the sector maintains healthy price momentum, as many of its individual stocks are currently (note: 27 S&P 500 tech stocks rate bullish on my momentum factor).

But paying high multiples for a tech stock only works … until it doesn’t. When this “buy at any price” sentiment changes, as it always does eventually, risk-insensitive latecomers will be left holding the bag.

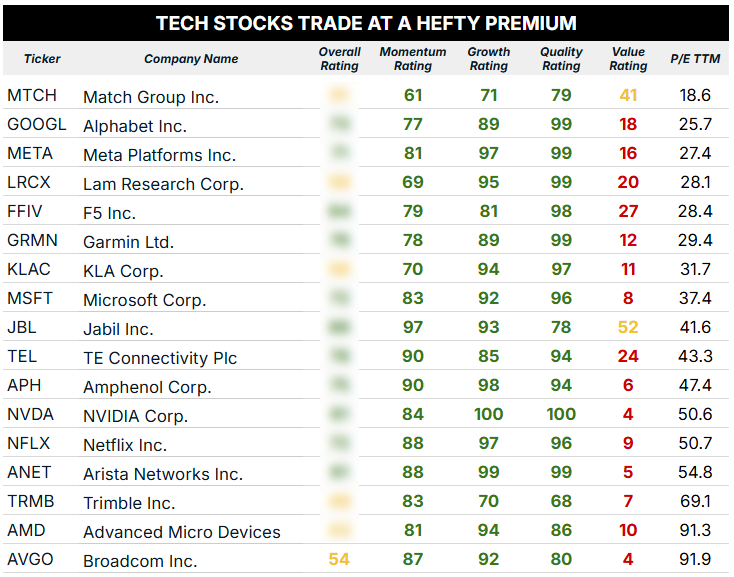

The screen below shows just how expensive America’s top tech stocks have become.

It shows every S&P 500 tech stock that rates “Bullish” on Quality, Growth and Momentum — a coveted “trio” and the sector’s three strongest factors right now.

Pay attention to the two right-most columns, which show each stock’s Value rating and price-to-earnings (P/E) ratio.

As I said, these 17 companies give investors the enticing mix of high-quality businesses, strong growth rates and strong share price momentum … but their low Value ratings and high P/Es show well how the sector has become quite expensive.

For reference, the S&P 500 is currently trading at a P/E ratio of 30.7, which is the highest we’ve seen since December 2020, when the index peaked at 35.3 before plummeting during the COVID-driven bear market.

So we’ve got 11 stocks in the table above the S&P 500’s P/E, with some stocks trading three times higher!

Of course, we have to play with the hand the market is dealing us, and many of these stocks still rate “Bullish” overall … pointing to even more outperformance ahead.

But understanding the premium that’s required to own these mega-cap tech stocks is critical to keeping a level head and having realistic expectations for future returns.

To good profits,

Editor, What My System Says Today

P.S. You can run any of these tickers through my Green Zone Power Rating system by joining Green Zone Fortunes today. Along with unlimited access to my system, you’ll gain other benefits such as my monthly stock recommendations and hotlists showing the best-rated stocks every week! Click here to see how you can join now.