It’s time to get on the fast track to stock profits — with the five things you need to make money this week … in just 5 minutes.

Let’s get started!

Tech Sell-Off? Thanks, DeepSeek!

It started in the wee hours of Monday morning.

News of a new AI platform from a Chinese company called DeepSeek started making the rounds.

The company released its current model, which works just as well as ChatGPT or Claude AI. The difference is that DeepSeek’s R1 model is free and open-source and took a fraction of the resources used for ChatGPT to develop.

Monday’s early result: A tech sell-off.

Shares of Nvidia Corp. (NVDA) were down more than 13% by 10:30 a.m. ET. The S&P 500 was also down almost 1.6%, while the Nasdaq fell almost 2.6%.

But you might be asking: Why would a Chinese AI platform have such an impact on U.S. markets? Why are we seeing a huge tech sell-off this morning?

Leading up to today’s tech sell-off, billions of dollars were planned for expanding AI in the U.S. — from new data centers to semiconductors and power grids.

Well, now that a company has developed a comparative AI model at a fraction of the price, Wall Street has initial fears that all those billions to expand AI may not be necessary.

Of course, the S&P 500 gains have still not fully diversified from the Magnificent Seven — namely, NVDA.

That concentration means when those stocks go down, so does the market.

According to Bloomberg, Monday’s drop in tech stocks could wipe as much as $1 trillion off the sector’s books.

While today’s sell-off shocked the system, it’s too early to know if this is a one-off event or signs of broader weakness.

We’ll have you covered there in Money & Markets Daily!

Netflix and Big Comms Earnings Beats

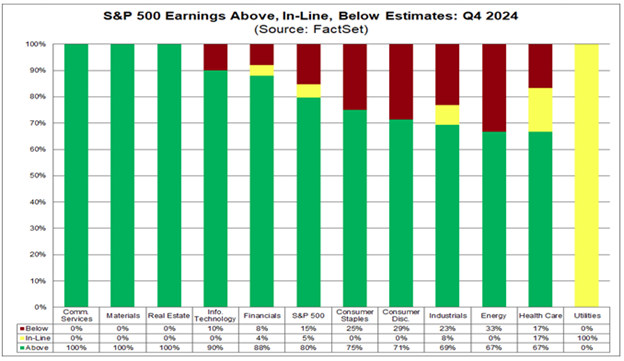

Speaking of tech, the first earnings season of 2025 has been particularly good for both the communication services and information technology sectors.

Thus far, 100% of communication services companies reporting earnings have reported above Wall Street estimates. Of the information technology companies reporting, 90% are coming in above estimates.

One example is Netflix Inc. (NFLX), which beat earnings estimates by 102.3% while its actual revenue came in 16% above estimates last week.

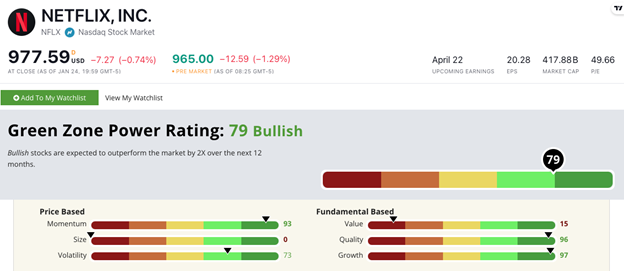

Its earnings and revenue beat earned NFLX solid ratings on Adam’s Green Zone Power Ratings system:

NFLX earns a “Bullish” 79 out of 100 overall, but its Momentum (93) and Growth (97) really stand out on the heels of its big earnings beat.

The Most Important Earnings Season?

This is already shaping up to be a critical earnings season for a few reasons…

- We want to know if the tech-driven bull market is going to continue.

- We want to know what executives are saying about President Trump’s second term.

- We want to know which stocks are set to outperform the most.

And Chief Investment Strategist Adam O’Dell has been laser-focused on these developments. He’s tracking what Wall Street’s elite are saying in the early days of this earnings season as they set the tone for an incredibly important year.

Stay tuned…

How Does $24 Billion Sound?

An investment banker and a lawyer walked away from their careers once…

Sounds like the start of a joke, but it’s actually the beginning of a journey that netted the two a $24 billion paycheck … each.

In 2013, Mike Sabel and Bob Pender decided to start Venture Global Inc., a company aimed at the liquified natural gas market.

They intended to build export plants faster and cheaper than their competitors.

The company debuted Friday in the largest energy-related initial public offering since 2021, according to Bloomberg.

While the IPO results were down 4%, the company went into the weekend with a market value of more than $64 billion when employee stock options were added in.

Because the co-founders owned a combined 81% stake in the company, their net worth jumped to $23.7 billion each, putting them among the world’s richest 100.

Of course, the timing helped, as President Donald Trump just lifted the ban on LNG exports and took control of domestic energy production.

Our TikTok Poll…

A couple of weeks ago, we asked about where you stood on banning TikTok. The Chinese social media app has gained an incredible following, with more than half of the U.S. population using the app!

It seems like TikTok doesn’t hold the same sway on our crowd going off of the 100+ poll responses we received:

- 75% of respondents were in favor of a TikTok ban.

- 11% were not in favor.

- 14% of you were not sure.

President Trump has since signed an executive order pausing the ban “to pursue a resolution that protects national security while saving a platform used by 170 million Americans.”

We’ll monitor this developing story closely and see how it affects other big names in the social media and tech space.

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets