Tech stocks have been the driving force behind the market’s rise out the COVID-19 crash back in March 2020.

And, as a smart investor, watching top market trends presents profitable opportunities.

Chief Investment Strategist Adam O’Dell preaches the momentum principle regularly to the Money & Markets team and his dedicated readers. Simply put, we want to “buy high, sell higher.”

Stocks or sectors in a confirmed uptrend fit this bill. And tech stocks led the momentum pack since March.

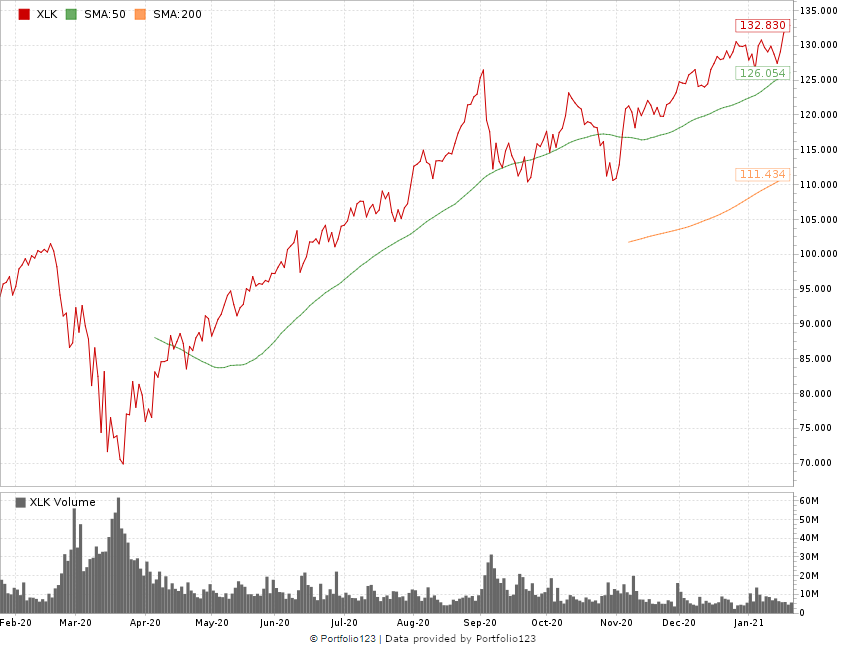

If you look at the Technology Select Sector SPDR Fund (NYSE: XLK) — an exchange-traded fund (ETF) that holds some of the biggest tech stocks in the market — you can see tech’s momentum since March.

Tech Sector ETF Grows 92% Off March Lows

The growth of XLK is 36.3% over the last 12 months. Compare that to other sectors like real estate (down 8%) and communications (up 23%).

But you don’t want to buy junk stocks that carry a lot of risk.

That’s why I’m on a mission to find tech stocks that have good quality and value. Companies that will continue to beat the market in 2021.

Using Adam’s six-factor Green Zone Ratings system, I’ve found two tech stocks you need to buy right now.

GNSS: An Emergency Management Tech Stock to Buy

Living in Kansas as a kid, I got used to hearing tornado sirens.

But technology has evolved considerably since then, and people can access emergency information in many ways now.

That’s where my first tech stock pick comes in.

Genasys Inc. (Nasdaq: GNSS) specializes in delivering emergency management alerts and notifications to targeted areas.

Its Genasys Emergency Management, National Emergency Warning and LRAD long-range voice broadcast systems are used across the country by national, state and local entities.

Entities from the national, state and local level use its services, including:

- Genasys Emergency Management.

- National Emergency Warning.

- LRAD long-range voice broadcast systems.

Genasys’ revenues have grown over the last three years. In 2018, the company reported revenue of $26.3 million, but in 2020 its revenue was $43 million — nearly double in just two years.

Its gross profit margin has grown from $12.7 million in 2018 to $22.6 million in 2020.

GNSS Stock Rises 278% Since March 2020

Over the last 12 months, GNSS stock has jumped 116.6% compared to the average tech sector increase of 50%.

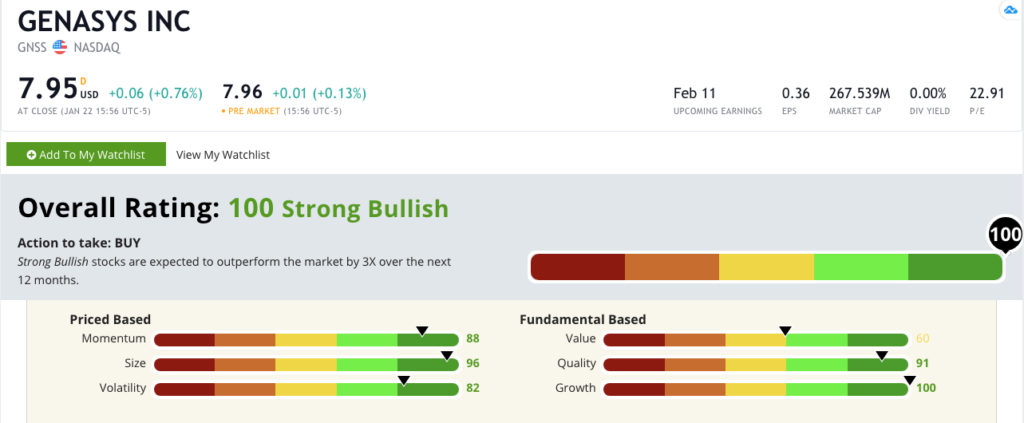

A big reason why Genasys is one of the tech stocks to buy right now is how it ranks on Adam’s six-factor Green Zone Ranking system.

The company ranks a 100 overall, meaning it is in the top percentile of all stocks ranked in our metrics.

Genasys Inc.’s Green Zone Rating on January 25, 2021.

GNSS ranks in or near the top 10 percentile in five of the six factors:

- Growth (100) — The company has nearly doubled its sales in the last two years. High-growth stocks tend to outperform lower-growth ones.

- Size (96) — Its market capitalization is just $267.5 million. We know that small-company stocks tend to outperform large-company stocks.

- Quality (91) — Genasys’ $10 million increase in gross profits makes it a high-quality stock.

- Momentum (88) — The company’s stock price has been in a strong uptrend since dipping in August 2020.

- Volatility (82) — The company has a beta of 0.73. Any beta at 1 or below is considered a low volatility stock. Beta measures a stock’s volatility against the overall market.

Genasys is a solid company with essential emergency management products. It’s 100 rank on our Green Zone Ratings system means we are “strong bullish” and expect it to outperform the broader market by three times in the next 12 months.

HEAR: A Video Game Tech Stock for 2021

Gaming market insider Newzoo recently said that the console and PC gaming market (Sony PlayStation, Microsoft Xbox, World of Warcraft, etc.) was worth $159.3 billion in 2020.

They project that will grow to $200 billion by 2023.

Video Game Market On the Upswing

Additionally, video game sales will rise by 32% by 2025, according to Statista.

But you don’t have to focus on the companies that sell the games.

Online gaming has become a predominant way to play, and communication is key. Players need to be able to talk to each other.

That’s where Turtle Beach Corp. (Nasdaq: HEAR) comes in.

This California-based company develops and markets gaming headsets for various platforms. It also offers keyboards, mice and other accessories.

Its sales for the last 12 months were $329 million, and its trailing 12-month income is $43 million.

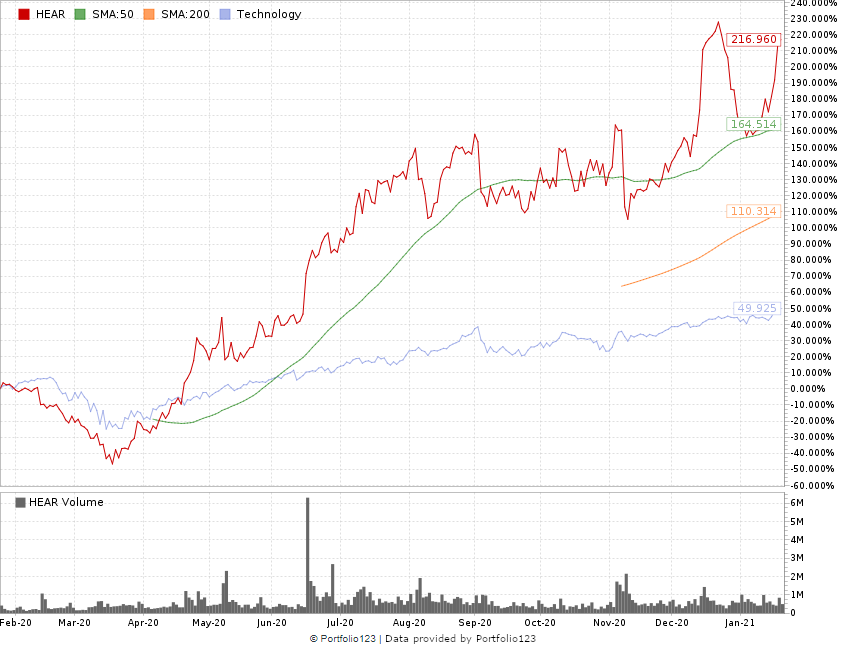

Turtle Beach Stock Jumped 514% Off March Lows

The company’s stock jumped to a high of more than $25 in December 2020 and pared back into the first of the year.

However, it seems to be testing that resistance and is poised to break through it.

Pro tip: I recommended Turtle Beach Corp. as a buy on December 1, 2020. It’s up more than 35% since that recommendation. You can read more in-depth insight into the company here.

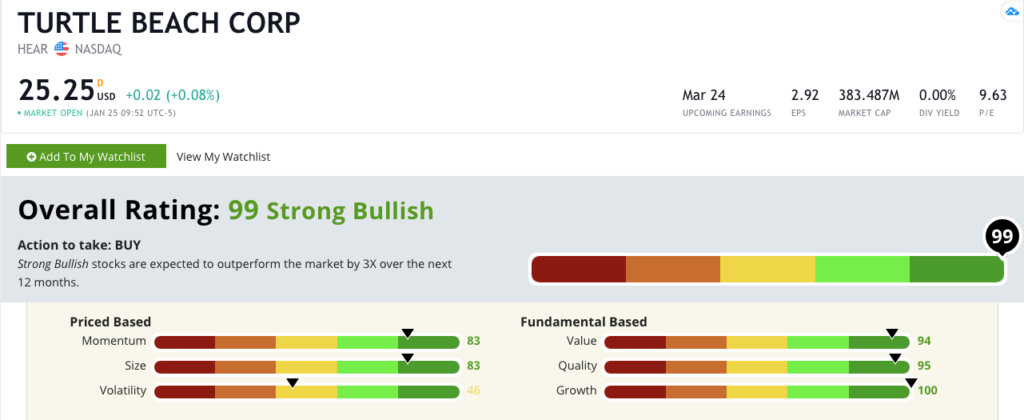

Another reason HEAR is a tech stock to buy right now is how it ranks in Adam’s Green Zone Ratings system. It rates 99 overall — putting it near the top of all stocks we consider.

Turtle Beach Corp.’s Green Zone Rating on January 25, 2021.

The stock ranks high in Growth (100), Quality (95), Value (94), Size (83) and Momentum (83).

With a price-to-earnings ratio of 9.63, Turtle Beach remains a great value.

Quarterly sales have increased from $35 million in Q1 2020 to $112 million in Q3 2020 … making HEAR a great growth stock.

Its value is strong as well, with just $5 million in debt and $43 million in trailing 12-month income.

The video game industry is only going to get stronger in the coming years. With that comes the need for accessories like Turtle Beach headphones.

That’s what makes HEAR a tech stock to buy now.

The Bottom Line With These Tech Stocks to Buy

The tech sector has been on fire since the COVID-19 crash of March 2020.

I think that growth is only going to get stronger in 2021.

The two tech stocks I’ve recommended here provide essential software or hardware.

Both closed out 2020 strong and look to continue that upward trend this year.

That’s why Genasys Inc. (GNSS) and Turtle Beach Corp. (HEAR) or two tech stocks to buy now.

Until next time…

Safe trading,

Matt Clark

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.