It wasn’t meant to be…

After two consecutive weeks as the strongest sector in the S&P 500, tech’s reign came to an end.

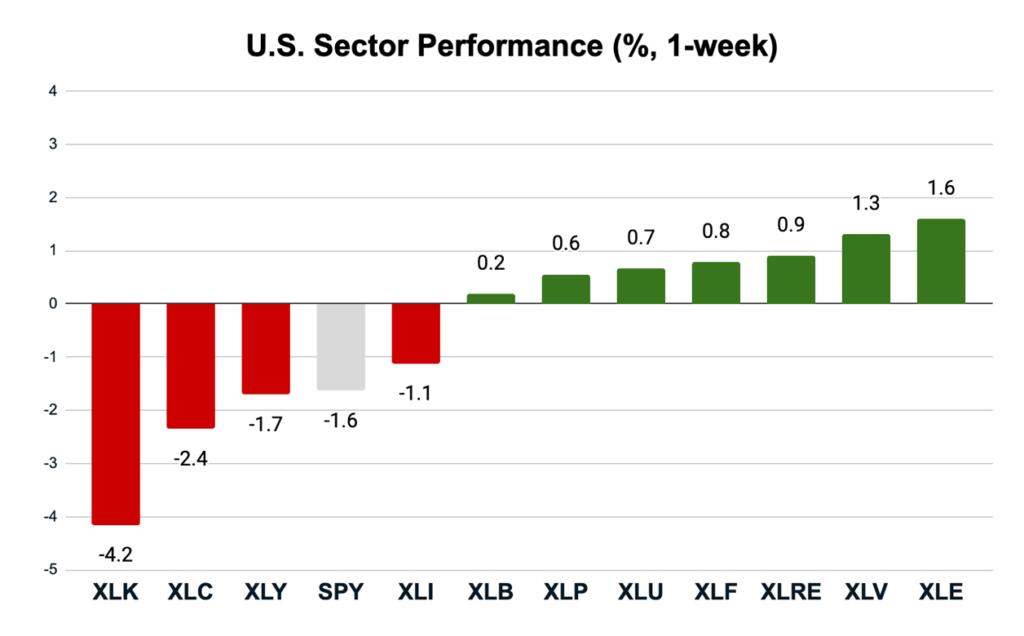

And not only did technology stocks not lead the pack… they actually finished the week in last place as the weakest of all sectors, down 4.2%. It was quite a 180!

Meanwhile, the stodgy old energy sector came out on top last week, posting modest gains of 1.6%.

Now, before we dig into the details, I want to make a few quick observations about what is actually under the hood of the sector ETFs we cover …

Two of the most critically important “technology stocks” to the AI revolution aren’t technically classified as belonging to the technology sector. Meta Platforms (META) and Alphabet (GOOGL) – both AI hyperscalers and members of the popular Mag 7 – are included in the communications services sector.

This matters because both stocks are large by market cap and influence the overall performance of the sector. Alphabet’s shares were flattish last week, and Meta’s have been trending lower for about two weeks now on concerns that the company is spending too much money on its AI ambitions without much in the way of tangible returns.

As such, Meta’s poor performance contributed to XLC finishing the week down 2.4% as the second-worst performing sector.

Why the Sudden Bearishness Towards Tech?

One week doesn’t make a trend, and it would be a mistake to read too deeply into it, particularly given that tech stocks are up sharply this morning on the news that the government shutdown might finally be over.

But the whispers on Wall Street are telling.

The weakness in tech stocks seemed to come from two primary worries:

- Concerns over tech stock valuations that really do look frothy by all traditional value metrics.

- Legitimate questions about where the cash to bankroll the AI revolution will come from.

Remember, the AI bull market is circular. All the major players simultaneously invest in each other and buy each other’s products and services …

Microsoft invested billions in OpenAI and runs OpenAI models on Microsoft Azure cloud. To power this, Microsoft buys Nvidia GPUs, while Nvidia relies on Azure, AWS, and Google Cloud to train and benchmark its chips. Amazon invested in Anthropic, and Anthropic uses AWS cloud and Amazon-built chips. Meanwhile, Google both competes with and buys Nvidia GPUs for its own AI models.

A chain is only as strong as its weakest link. And that weakest link might be the privately held OpenAI… which also happens to be the center of the entire AI economy.

The company’s CFO, Sarah Friar, didn’t exactly instill a lot of confidence last week when she suggested that the U.S. government should backstop the massive spending commitments made by OpenAI and its peers.

OpenAI quickly walked back the comments, and it’s probably a mistake to take them too seriously. But in a market in which tech stocks are priced for perfection, anything that chips away at investor confidence is of utmost importance, as it could prove to be the finger flick that brings down this house of cards.

Key Insights:

- Technology shares were the worst-performing sector last week, followed by communications.

- Bearishness in tech pulled the S&P 500 into negative territory.

- Investors are starting to question tech valuations.

The action this morning suggests that the bull market may still have gas left in the tank. So, let’s take a look at the tech sector to see if there might be some bargains to be found.

Looking for Bargains in Tech

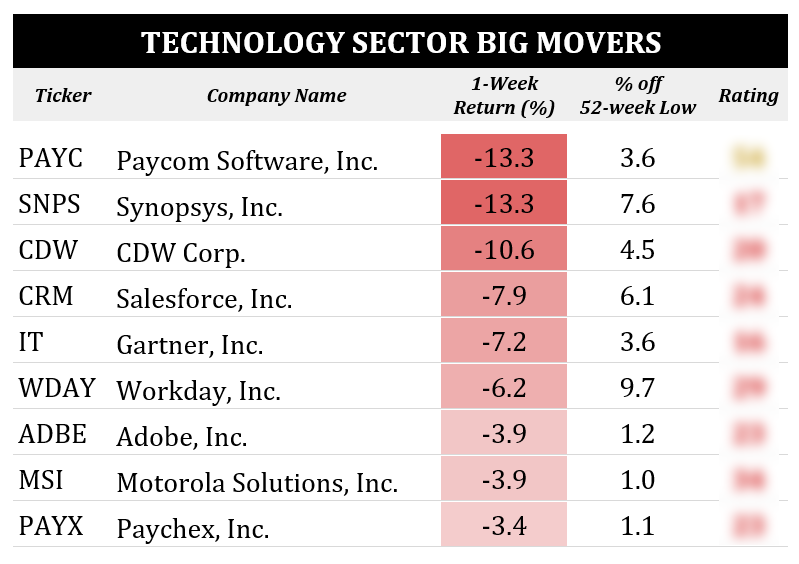

Here are the sector laggards from last week, all of which closed within 10% of their 52-week lows.

Unfortunately, the pickings are slim. Of all the worst performers, only one – Paycom Software (PAYC) – rates as high as “Neutral” with a Green Zone Power Rating of 54. All the rest rate as distinctly “Bearish.”

There are still tech and communications stocks that rate well, of course. Alphabet still rates as “Bullish,” as does Microsoft (MSFT). But the remaining Mag 7 all rate as “Neutral” at best.

Overall, my system suggests that caution is still warranted for tech stocks.

Energy Sector’s Big Movers

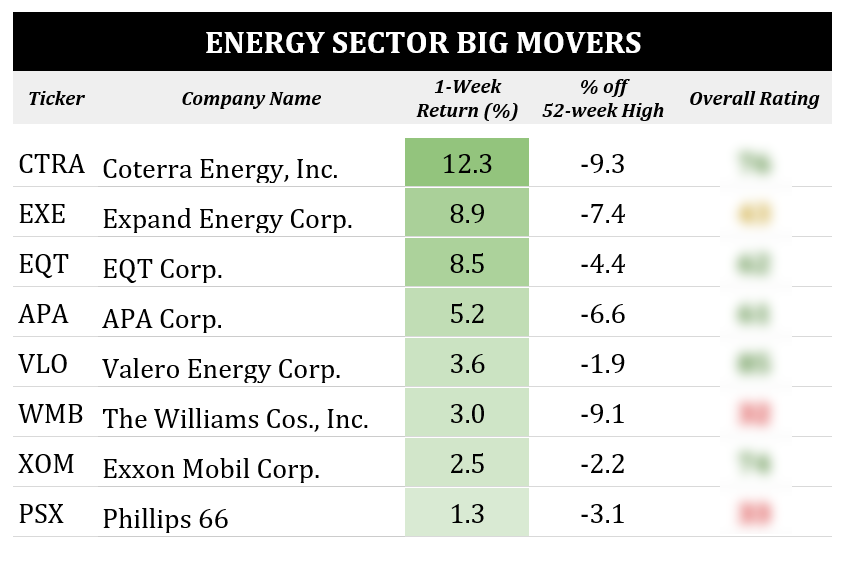

It might not be as sexy as tech, but energy was the winner last week. Below are the best-performing energy stocks that finished the week positive and closed within 10% of a 52-week high.

There are quite a few stocks that immediately pop off the page. Oil refiner Valero Energy (VLO) rates a “Strong Bullish” 85 and closed last week less than 2% below its 52-week high.

Coterra Energy (CTRA), an exploration and production stock, blasted 12% higher last week and rates a solidly “Bullish” 76 on its Green Zone Power rating.

Of course, both refiners and exploration companies can be wildly volatile. If you’re looking for something a little more conservative, Exxon Mobil (XOM) sports a “Bullish” score of 74 and offers the comfort of being one of the largest and most diversified energy majors in the world.

To see how any of these stocks rate overall, as well as on the six factors that drive my system, click here to join me in Green Zone Fortunes today. One of many benefits of joining is the freedom to look up any of these stocks (or thousands of others) with just a few clicks of your mouse.

To good profits,

Editor, What My System Says Today