There’s an episode of the classic Batman Animated Series (the good one from the early nineties) starring the Riddler called, “If You’re So Smart, Why Aren’t You Rich?”

The Riddler, aka Edward Nigma, is a powerless loser with big dreams based on nothing but his ego and his intellect. Nigma’s fatal flaw is that he thinks he’s the smartest guy in the room.

And his hubris leads him to leaving Batman ridiculous clues to his current crime. Batman, of course, actually being the smartest guy in the room, always catches the Riddler.

And in Batman’s Rogue’s Gallery circa 2019 The Riddler is a joke.

It’s the Road Runner/Coyote story with more puns.

The reason the Riddler and the Coyote are tragic figures is because they never learn humility. They never learn the important lesson that while you may be smart, that doesn’t make you wise or that your intellect guarantees success.

Elon Musk is certainly rich. And there’s no doubt he’s perceived as very smart. But he’ll soon be neither. Why?

Because as I’ve said before, Tesla is a literal dumpster fire of a company. And last weeks’ earnings report proved that in spades.

With the stock on a crash course to oblivion it’s obvious there is real desperation finally emerging in the story behind Tesla. The Coyote has run off the cliff but hasn’t dared to look down yet.

And that’s why the announcement of a $2.3 billion stock and bond capital raise right now seems like just another desperate attempt to keep the dream alive after both the disastrous earnings report and equally laughable Autonomy Day Tesla organized.

When I watch interviews like this…

… I can only shake my head at the 1) desperation and 2) bubble-headedness of these so-called analysts.

Honestly, how anyone invests money with them I have zero idea.

And since neither of these stammering perma-bulls can even talk about the cars themselves, I know the old Wall St. Shuck and Jive is happening. They are jiving and retail investors are about to get shucked.

Moreover, this major capital raise isn’t going to the big investment houses so they can add to their positions at these sale prices. No, Fidelity is soliciting (Guess Who?) retail investors to take the plunge into the lake of Elon’s bottomless ego.

Musk is so convinced he’s smarter than everyone else he’s got himself in real trouble having loaned Tesla a lot of his wealth using his stock in the company as collateral.

I’ve read reports from multiple sources, but Mark Spiegel of Stanphyl Capital Management has done most of the heavy lifting on this, who believe that with Tesla’s stock breaking down below $250 Musk is getting very close to, if not already subject to, a margin call on those loans.

And $232 is the breakpoint.

For that means he would have to post more shares as collateral. As Mr. Speigel points out, Musk has plenty of shares to throw at the problem, but he wouldn’t be downsizing his expensive lifestyle — selling mansions, issuing a sale/leaseback on his private jet, etc. — if the cash crunch wasn’t already here.

Hence this capital raise.

They are burning $700 million a quarter, right now. They have a demand problem. The car industry is shrinking. The Trump administration is laser-focused on pumping more oil and lowering gas prices.

Most of the Model 3 revenue was pre-booked. The cars are 1) uninsurable, 2) irreparable and 3) depreciating monstrosities.

If you’re a Tesla owner seriously consider the fact that your car may be unsalable at the five-year mark because of the batteries. Like the internal combustion engine or not, you don’t have to replace one after 60,000 miles.

But you do with an electric car.

And trying to sell the idea that Tesla is so far ahead in autonomous driving that people who buy one will make money as a robo-cab is straight out of the Acme catalog Wily E. Coyote used to order from.

It’s not the genius of a mad futurist no one understands, it’s the psychotic ravings of a bi-polar adrenaline junkie who’s in way over his head.

If these cars have this much income potential, if they are worth so much to the owners as cabs that it will more than offset the cost of the car, why would Tesla ever sell one in the first place?

It makes no sense. As CEO he’s guilty of not acting in the company’s best fiduciary interest if this is remotely true. I’m half-tempted to buy one share of this fake car company just so I can file a shareholder lawsuit for breach of fiduciary responsibility on the part of Tesla’s board for selling one Model 3.

Of course, Elon could just be lying, like he did last year about his $420 per share mystery buyer.

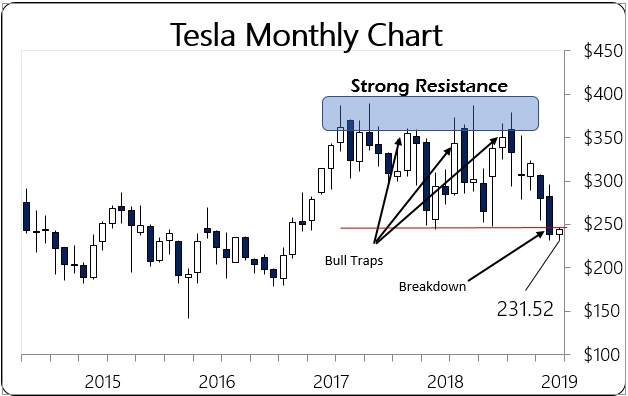

Here’s the technical situation for Tesla’s stock. I told my Patrons in a private market report back in August, after Musk’s criminal tweet, that Tesla’s medium and long-term technical position was bearish. You can review my comments in this video here.

Fast forward to today and everything I said in that video has come to pass. Volatility at the monthly level has been unprecedented. Tesla has been in a massive distribution pattern since 2017 which no technical analyst worth his salt would argue with.

This monthly chart is pretty clear. There is strong resistance above $360. And for the past two years every time Tesla has rallied to this point the resultant selling has been Biblical. The $245 region emerged as support, conveniently around 5% above Musk’s margin call level.

But this earnings report and subsequent amateur hour of an earnings call that had Wall St. pros shaking their heads in disbelief, finally got the stock to break down below that Maginot Line and close April at $238.69.

Color me shocked that Tesla comes out with a massive stock and bond offer to retail muppets two days later as the stock drops right to Musk’s max pain level.

There is real worry here that the institutions are finally bailing on this company. A breakdown like this signals there aren’t buyers anymore looking to support the price. Don’t be fooled by any bounce here that doesn’t take the stock back above $300 on a monthly closing basis. Tesla’s chart now confirms the company’s fiscal and political realities.

Musk may have finally run out of riddles to bamboozle the rubes with. And he’s going to find out really quick that he liked being rich a whole lot more than he does being smart.

• Money & Markets contributor Tom Luongo is the publisher of the Gold Goats ‘n Guns Newsletter. His work also is published at Strategic Culture Foundation, LewRockwell.com, Zerohedge and Russia Insider. A Libertarian adherent to Austrian economics, he applies those lessons to geopolitics, gold and central bank policy.