It was all champagne and rainbows last week when Tesla Inc. reported rare quarterly earnings in the black.

But many on the Elon Musk bandwagon seemed to missed some of the fine print.

The glaring piece of Tesla’s third-quarter earnings report was the fact that Tesla experienced a staggering 39% drop in U.S. market sales.

Remember, the U.S. is the company’s largest market.

Overall sales in the United States went from $5.13 billion in the third quarter of 2018 to $3.13 billion in 2019.

Where Tesla made things up … kind of … was with its global deliveries, which hit a record of 97,000. The biggest problem is most of those sales were on the car with the lowest profit margin — the Model 3.

By pressing ahead with the Gigafactory Shanghai plant in China, Musk is attempting to offset continued losses in the U.S. market by opening the doors to the world’s largest auto market — China.

Tesla did see a jump in sales in China — from $409 million to $699 million over the course of a year — but it is still nowhere close to overcoming the deficit Tesla sees from sagging U.S. sales.

After hitting huge gains in its stock price Monday into Tuesday, Tesla shares have dropped from Monday’s high of $339.41 to $315.90 at 11 a.m. EDT on Thursday.

The Chinese government recently gave Tesla the go-ahead to start producing vehicles at its Shanghai facility.

Overall, electric car sales in China dipped for the first time by 14% in July to around 128,000 electric cars sold by all manufacturers. One of the big reasons for the drop is Beijing has cut subsidies for electric cars.

Tesla is hoping to compete in a Chinese market already saturated with companies making electric vehicles. One of the chief competitors for Musk is BYD Co., a Warren Buffett-backed Chinese company. In July, BYD sold 16,000 electric vehicles compared to Tesla’s market-leading 20,000.

BMW also made gains in China along with Chinese state-owned BAIC Group.

It’s an indicator that while electric vehicle sales may not have reached their zenith in China, it could be a long road before they do.

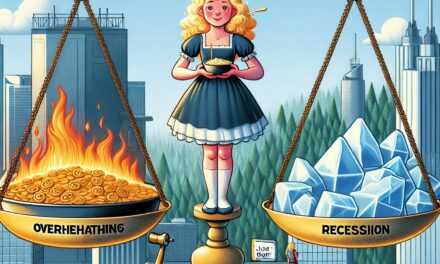

It is a $2 billion to $5 billion bet that Tesla can see strong tailwinds backed by increased deliveries in China. If they don’t see it, the gamble will be one that will cost Tesla for years to come.