Money & Markets Week Ahead for the week of November 22, 2020: Here are a few things to look forward to during the run-up to Thanksgiving.

Remember, the stock market will be closed on Thursday in observance of the holiday. The New York Stock Exchange and Nasdaq will also close early at 1 p.m. Eastern on Friday.

But we’re in the midst of earnings season.

One brick-and-mortar retailer decided to close its doors to in-person shopping. When it pivoted to its website and allowed consumers to pick up orders curbside, it set itself up for success.

My prediction: Best Buy will have a good third quarter … but the fourth quarter will be massive.

On the IPO Front

There are no new initial public offerings (IPOs) scheduled for this week.

That means it’s a good time to look at how IPOs have performed so far this year.

Let’s take a look at the number of IPOs released to the market over the last decade.

Number of IPOs Up From 2019

So far this year, there have been 186 IPOs compared to 160 in all of 2019.

I suspect we will reach, and possibly surpass, 2018’s figure of 192 IPOs, by the end of the year.

However, I don’t see us reaching 2014 levels when 275 IPOs were launched.

Next, let’s look at the proceeds (or value) of the IPOs launched over the last decade.

Value of IPOs Increases Since 2016

This chart tells me that while the number of IPOs hasn’t increased much, the value of those companies has jumped higher.

Since 2016, when the total value of IPOs was $18.8 billion, the value has soared more than 240% to 2020’s figures.

One thing to note is that special purpose acquisition company (SPAC) activity has been very high this year, thus driving the number of IPOs and their value up.

We aren’t done with 2020, and there are some big IPOs that could still launch this year:

- Airbnb — Pricing terms have not been set as of publication.

- Churchill Capital Corp V (a SPAC) — Selling 40 million shares for $10 per share.

- Far Peak Acquisition (a SPAC) — Selling 55 million shares for $10 per share.

- Spartan Acquisition II (a SPAC) — Selling 40 million shares for $10 per share.

I talked about SPACs in depth during a recent episode of The Bull & The Bear podcast. You can listen to that podcast here.

This is going to be a strong year for IPOs, despite the economic difficulties the country has faced with COVID-19 … and SPACs are a large reason why.

Slowdown in Earnings

It’s a slow week of quarterly earnings reports for investors.

One to keep an eye on is Best Buy Co. (NYSE: BBY).

The large electronics retailer is planning to release its earnings for the quarter ending Oct. 31, 2020 on Tuesday.

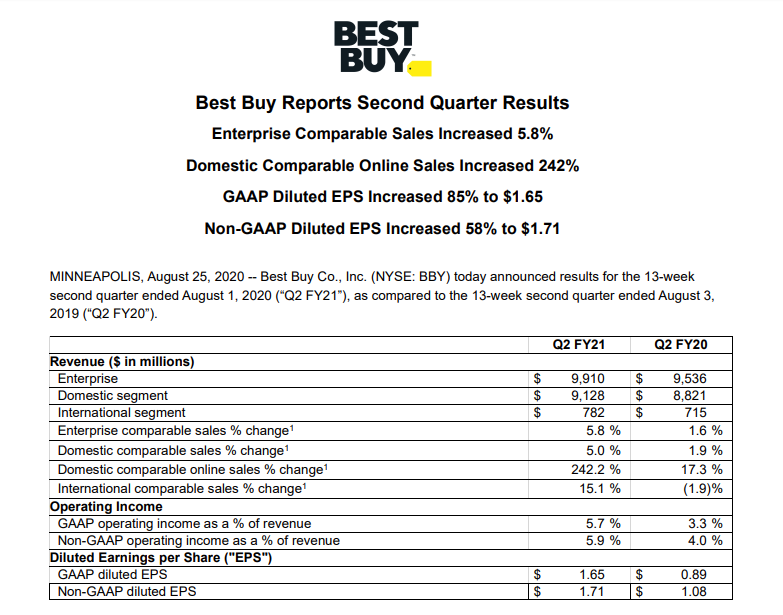

Best Buy wasn’t too adversely impacted by COVID-19 lockdowns.

After the company closed its doors to in-person shopping, it pivoted online and even allowed curbside pickup of products.

Over the last four quarters, Best Buy has beaten analysts’ expectations.

Its biggest beat was in the quarter ending in April, where analysts forecast earnings per share for the company to be $0.41. Best Buy’s actual earnings were in the neighborhood of $0.67 per share — beating the consensus forecast by 63%.

In the last quarter, the company reported a 3.5% increase in domestic sales and a 9.4% jump in international sales.

Its earnings per share jumped from $0.89 per share in the same quarter a year ago to $1.65 per share.

The consensus quarterly earnings forecast for Best Buy is around $1.69 per share, and I think that is a realistic mark.

I can see sales ticking up slightly, but not too much from the previous quarter.

Looking ahead, Best Buy should have a strong fourth quarter, despite the potential for even more COVID-19 lockdowns in the coming weeks.

I’ll talk about other company’s reporting quarterly earnings this week in a bit.

Money & Markets Week Ahead: Data Dump

It’s a light week for data as well due to the Thanksgiving holiday.

The Federal Reserve Bank of Chicago will release its National Activity Index for the month of October on Monday.

The index gauges overall economic activity and related inflationary pressure.

In September, the index was at 0.27 for the month, which was down from the 1.11 reading in August.

That points to slower growth, but still above average. Any positive reading of the index indicates growth, while a negative reading indicates contraction.

On Tuesday, the Federal Reserve Bank of Richmond will unveil its Survey of Manufacturing Activity for the month of November.

Last month, the report showed a composite score reading of 29, up from 21 in September.

The increase was due to a jump in shipments and new orders. The employment component of the index was unchanged.

The Labor Department will provide weekly jobless claims data on Wednesday this week as the typical release date falls on Thanksgiving.

Last week, the total number of jobless claims was 742,000 for the week of Nov. 14. This was well above Wall Street estimates of 710,000.

The total of those receiving benefits — which is two weeks behind the jobless claims data — fell by more than 840,000 to 20.32 million.

This indicates a slow-down in the job market. It was the first week-over-week increase in jobless claims in a month.

Earnings Reports

To finish off the Money & Markets Week Ahead, here’s a look at some of the key earnings reports due out next week:

Monday

Niu Technologies ADR (Nasdaq: NIU)

Urban Outfitters Inc. (Nasdaq: URBN)

Tuesday

Autodesk Inc. (Nasdaq: ADSK)

Best Buy Co. Inc. (NYSE: BBY)

Hormel Foods Corp. (NYSE: HRL)

Dollar Tree Inc. (Nasdaq: DLTR)

J.M. Smucker Co. (NYSE: SJM)

Wednesday

Deere & Co. (NYSE: DE)

GameStop Corp. (NYSE: GME)

Flower One Holdings Inc. (OTC: FLOOF)

Thursday

MER Telemanagement Solutions Ltd. (Nasdaq: MTSL)

Friday

No major announcements scheduled

That’s all for this week.

Until next time…

Safe trading,

Matt Clark

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.