We’re still in a “data drought” as far as official government data is concerned, but there’s still a unique anomaly in healthcare data that’s as bullish as any payroll report could be.

I’m talking about the 100,000 healthcare workers who are conspicuously absent from this year’s hiring numbers.

On a chart, their absence looks like any other data anomaly. But once we dig a little deeper. You’ll see there’s an especially fascinating dynamic at play here.

Hit the video below to dive in:

Video transcript:

Welcome to Moneyball Economics.

I’m Andrew Zatlin, and hey, before we jump into things, can I take a moment as a proud parent to share with you a picture of my son?

He just started his college career. I had a chance this week to go see him. He’s at West Point, he’s loving it, and I couldn’t be more proud, so thank you for sharing this moment with me and I guess building on that positivity, I’m going to tell you right now that I am seeing some positive economic growth out there.

I think the end of the year and the beginning of next year are going to be surprisingly strong in the economy, and that’s going to boost the stock market accordingly.

To understand why I see that strength, I’m going to talk about what’s going on with healthcare payrolls…

When you take a step back, conceptually, there should be a strong correlation between the population growth and healthcare labor growth.

So everyone gets sick, everyone has to see a dentist, and so as the population grows, it’s going to pull along more doctors and nurses and so forth. Except that correlation has simply not been there for the past, say, five years since the end of COVID.

And so a lot of people are dismissing healthcare data. They’re saying, “Hey, the hiring in the healthcare space, it doesn’t correspond to what we’re seeing in the broader signals coming out of payroll, so we’re going to dismiss it.”

In fact, I want to invert that.

I want to say that the bigger non farm payroll data that’s telling us what’s going on in the working population is the wrong signal, and the right signal is the healthcare industry signal.

That’s very meaningful because if healthcare labor data is the correct signal, then we can extrapolate from what’s going on now in that space to understand what’s going on in the broader economy.

It all begins with understanding that healthcare does indeed reflect population growth, but the payrolls don’t because the payrolls are ignoring what 12, 14 million undocumented workers. However, those workers are seeing dentists, they are getting medical care, and so whatever demand they’ve created is being reflected in healthcare.

To understand this, we have to go back in time to the glory days of the start of Obamacare.

Obamacare essentially created tax on everybody. We were going to contribute as a country to a bucket of money that was going to pay for everybody’s medical needs. So right off the bat, that opened up the door to more medical spending and therefore more medical services and more payrolls.

When you look at the data, what you see is suddenly there is an acceleration in healthcare payrolls that is not the same as overall payroll growth in the United States.

Then we get to the Trump era.

If you recall, Trump sent troops down. He tried to block the border with Mexico. Remember all those people coming up walking from Guatemala, northwards, and they were stopped, and guess what? Healthcare payroll growth suddenly re-converged with the same pace of growth as the broader economy in terms of payroll.

That was our first clue that in fact, healthcare is reflecting what’s going on with the growth in the worker base, which happens to include immigrants who are not documented. And guess what? Official data doesn’t include those workers directly.

So when we get to the COVID era under Biden and we’ve got millions of people gang rushing every year coming in up for the southern border, what happens? Well, number one, they’re not included in the total payroll count, so cyclically as the economy starts to slow, it looks like the working population’s slowing.

But when you look at the healthcare payrolls, they’re continuing to boom because healthcare payrolls are reflecting the reality of more people here, a bigger population and a bigger working population, and then suddenly last year again, Trump comes back to town and guess what? The pace of healthcare payrolls slows again.

Okay, so what we’ve got is in fact, healthcare payrolls are slowing down and we are going to look at them as a proxy for what’s going on in the economy.

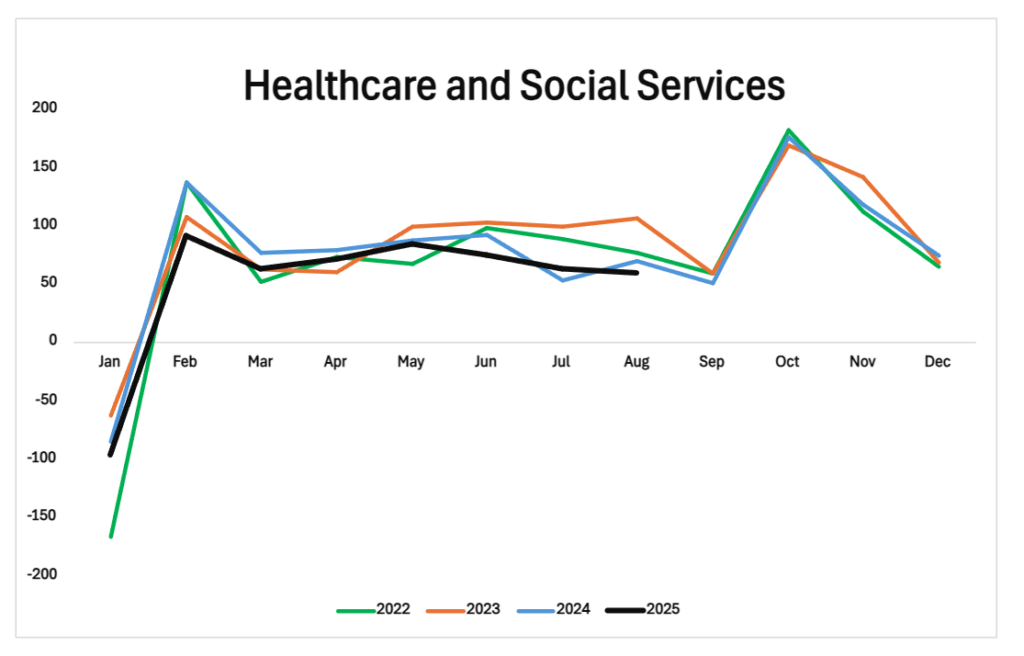

Guess what … my read of what’s going on with healthcare payrolls is they’re starting to re-tick up. When you look at what’s going on this year, you compare healthcare payrolls to last year’s healthcare payrolls. What you’re going to note is that we’re about a hundred thousand workers shy of where we were last year.

Let me re-say that. Last year we hired about a hundred thousand more healthcare workers than we have this year. So if we, again, use this as a proxy for slowing economic growth, slowing population growth, that would indicate that we are on the down slope that the healthcare labor market slowing down indicates that we are on the down slope economically and population growth.

However, what’s interesting is that 100,000 shortfall happened almost all in the first four months, and in fact, the most recent data has been pointing to a stabilization.

So I’ve set the stage. Essentially, if we look at healthcare, it is a true signal for what’s going on in this economy when it comes to the population growth and working population growth. And building on that, this year we saw sharp cuts in the beginning of the year and more stability. Now, what does that really mean?

Well, it really means that what we have seen is an overreaction to Trump.

In the first part of the year, there was panic, there was layoffs, nobody knew what was going on, and so companies hit the brakes, as did some consumers. Bottom line: hiring froze. However, companies have realized that the economy’s actually remaining pretty robust and is likely to get stronger going into the next year, and so they’re now having to pivot.

Instead of no longer hiring, they’re now starting to rehire.

How do I know this? Again, let’s look at the healthcare spending itself.

Here’s some charts showing you monthly hiring, going back in time and more recently of healthcare companies, for example, United Healthcare, Cardinal, you name it, a handful of companies. And what you’re seeing is, sure enough, starting in the May-June timeframe, or I should say let’s back up. You can see starting last year there was a hitting of the breaks when it comes to hiring for these companies and then starting in May and June, there’s a reversal.

Suddenly we’re seeing a lot more hiring, a lot more movement up when it comes to these companies, in essence, at least in the short term, worst case scenario, what we’re saying is companies overreacting when it came to payrolls and managing their staffing, and now they’ve got to replenish their staffing. They’ve got to grow a little bit.

So in the short term, maybe it’s just a reaction to overreacting.

We’re seeing the zig to the zag, but I think instead it’s a building moment. I think what’s going to happen is we’re going to get into a positive feedback loop, and companies are going to realize that the economy’s actually going to grow next year. And so they’ve got to not just replenish, but build even more. So be prepared for an economy growing further. And as always, as I’ve been saying since the beginning of this year, you want to be long and strong in the market.

The economy’s taking off, the stock market’s going to continue to take off.

We’re in it to win it. Zatlin out.

Andrew Zatlin

Editor, Moneyball Economics