Have you looked at your 401(k) lately?

No, I’m not talking about checking the balance as the stock market swings to-and-fro. What I mean is: Do you have a real 401(k) strategy?

Many don’t.

I’ll admit I was guilty of this for a long time. I thought simply meeting my employer match was enough.

But then I started digging into it a little more.

The average balance in Fidelity 401(k) accounts was $112,300 in the fourth quarter of 2019. That’s a decent chunk of change that’s nothing to sneeze at.

With a little bit of time and research, you can craft a 401(k) strategy that fits your retirement and investing goals better.

If you’re younger and want to take on more risk — go for it. Older and want to lock in gains?

There’s a plan for that, too.

Let’s look at some ways you can make your 401(k) work for you.

The first thing to note is not all 401(k) plans are the same. You’ll have to see what your employer offers. Some companies may not have as many investment options as others.

And remember, there isn’t a one-size-fits-all 401(k) strategy. You have to take your personal situation into account to make sure you aren’t stretching yourself too thin while also saving enough.

Pick the Right 401(k) Strategy for You

One of the most common investment vehicles for a 401(k) is the target-date fund. We wrote about them a bit a few weeks ago here.

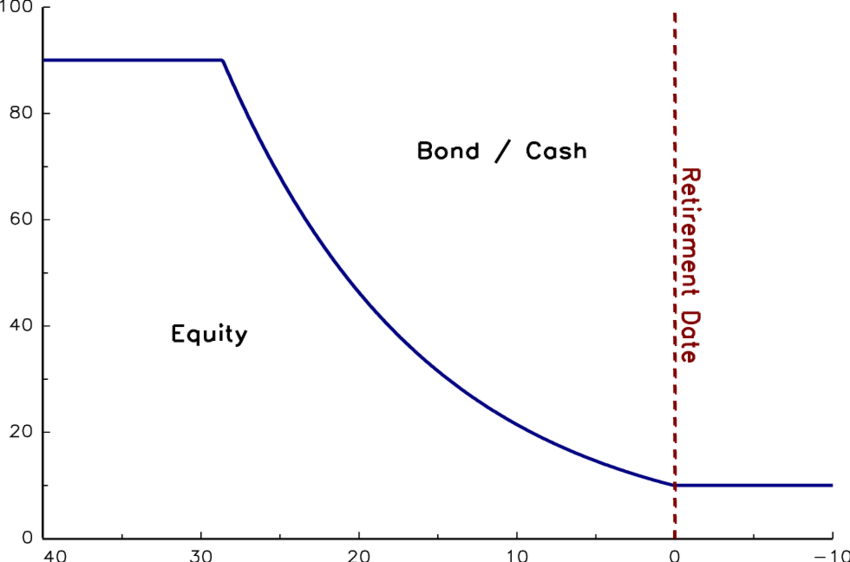

Target-date funds are great if your approach to investing for retirement is to set it and forget it. Pick any year (like when you plan to retire) and the fund manager will shift out of risk as that date approaches.

By the time the fund matures (or maybe a few years after), it will be made up almost entirely of conservative investments like bonds and other fixed-income streams. Check the fund’s glide path to see how it shifts. Here’s a basic example of what one may look like:

There are ways you can manipulate these a bit. For one, choosing a different date will change the nature of the fund. If you are OK with taking on a bit more risk in your early years of retirement, consider choosing a target-date fund with a later date.

But maybe a target-date fund isn’t for you at all.

If you want a little more control over your 401(k) strategy, you may consider a target-risk fund. These types of funds are usually labeled by risk level.

For example, an “aggressive” target-risk fund may be heavily weighted in growth or small-cap stocks. These invest in companies with a lot of potential for gains — but they also run the risk of massive losses.

The fund manager’s goal is to keep that level of risk constant through investments in equities and bonds.

If this 401(k) strategy is up your alley, you will likely want to revisit it at least once a year to make sure the fund suits your current level of risk.

Going Your Own Way

The two options above are great if you want automatic diversification without getting too deep in the weeds.

The two options above are great if you want automatic diversification without getting too deep in the weeds.

But what if you want a 401(k) strategy that is a little more involved?

You could create your own risk portfolio by investing in a variety of funds offered by your company.

A conservative approach would invest in more money market funds and bond funds. Weight your 401(k) portfolio more heavily into equities if you feel safe taking on risk.

Going this route means you will have to rebalance your risk more often. Once a year is a good guideline.

If you are split 70/30 between stocks and bonds, consider shifting equity gains into safer holdings after a good year of growth so you keep that ratio steady.

This is a great way to diversify, and you may avoid some fees associated with other fund options.

Being engaged in your 401(k) strategy and revisiting it every once in a while will likely reveal opportunities you had not seen before.

That will pay dividends down the road when you need to start withdrawing in retirement.