As the stock market continues to work its way to recovery, there are a few high-dividend ETFs to buy now that will help provide you with income as you wait for things to get back to some semblance of normalcy.

Recently we wrote about ways to make money while you wait for the market to recover from the coronavirus pandemic lockdown.

In that, we mentioned four tips you can follow that allow you to keep making money, no matter what the market is doing.

One way to capitalize is to look at dividend-paying exchange-traded funds, or ETFs. There are a few high-dividend-yield ETFs that are certainly worth a look.

Best High-Dividend ETFs to Buy Now

1. Vanguard High Dividend Yield ETF

Managed Assets: $24.3 billion

Fund Family: Vanguard Group

60-Month Beta: 0.94

Management Fee: 0.06%

Annual Dividend Yield: 3.63%

One of the best performing ETFs that focus on providing income is the Vanguard High Dividend Yield ETF (NYSEARCA: VYM).

Operated by the Vanguard Group, this ETF tracks the FTSE High Dividend Yield Index. It has nearly 400 stocks that produce high dividend yields.

According to its website, the fund holds about 16% in health care stocks, 15% in financials and another 15% in consumer goods. Its 10 largest holdings make up about 28% of its total net assets.

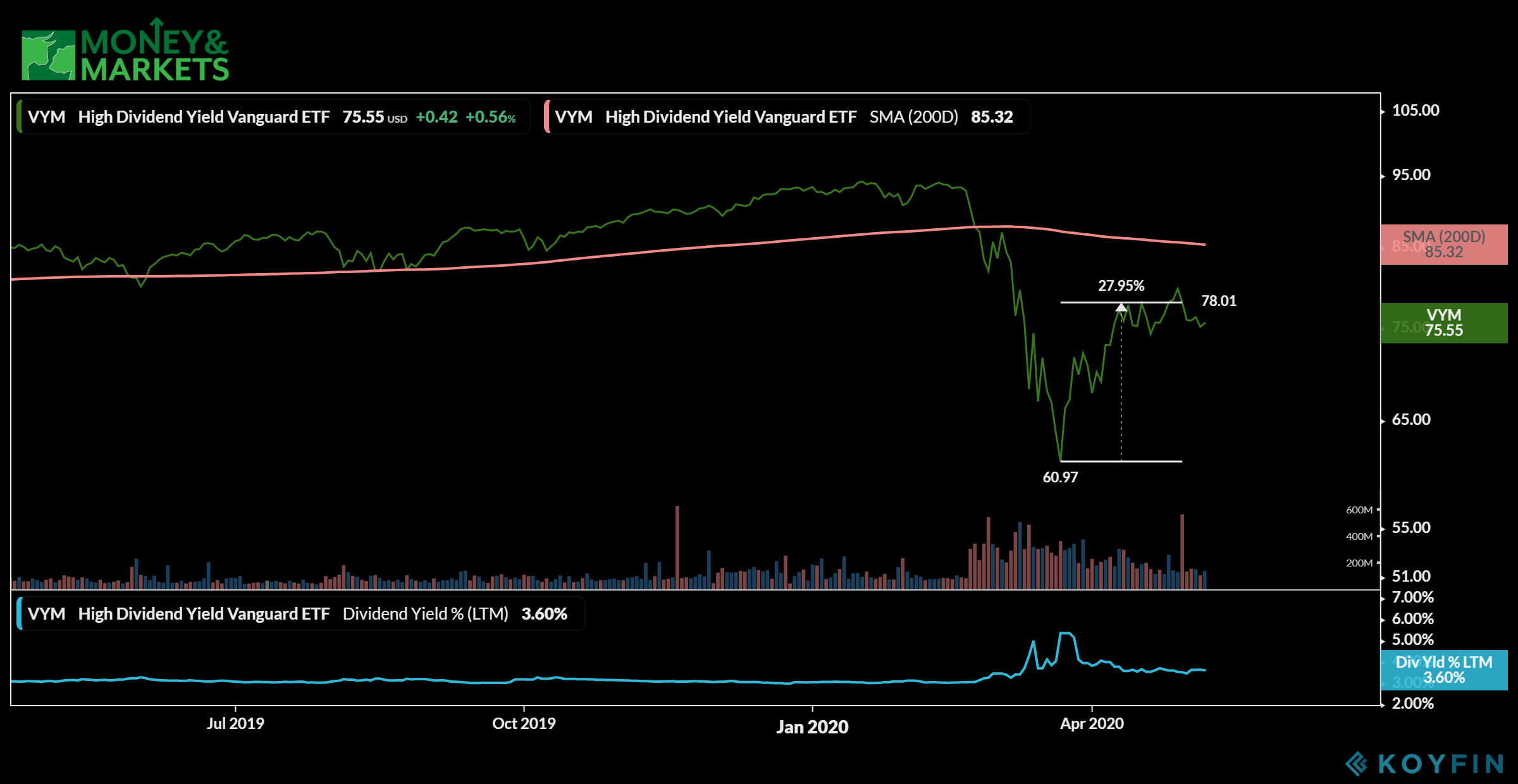

The ETF was trading slightly higher before a big dip in February 2020. Since then, the stock has recovered about 30% of its losses.

It currently trades at about $75 per share, which is about $10 lower than its 200-day moving average. Plus, it has a rock-bottom management fee of 0.06%.

One thing about this particular ETF is it pays a lofty dividend. In March 2020, its dividend payment was $0.55 per share. That’s lower than the $0.77 per share it paid in the last quarter, but still solid.

That solid dividend is why the Vanguard High Dividend Yield ETF is one of the best high dividend yield ETFs to buy now.

2. Select Dividend iShares ETF

Managed Assets: $12.4 billion

Fund Family: BlackRock iShares

60-Month Beta: 0.96

Management Fee: 0.39%

Annual Dividend Yield: 4.79%

Another strong performer in terms of dividend yield is the Select Dividend iShares ETF (Nasdaq: DVY).

It is operated by BlackRock iShares and has about 92 holdings in its portfolio.

As with most equities, DVY took a major tumble in February to a low of around $62 per share. Since reaching that low point, it has climbed to around $78 — still below its 200-day moving average of $94.

With a portfolio containing companies like Qualcomm Inc. (Nasdaq: QCOM), A&T Inc. (NYSE: T) and Target Corp. (NYSE: TGT), it has a lot of dividend potential.

In fact, its last dividend payment was $0.94 per share on March 25, 2020 — one of the highest dividends among ETFs.

That dividend has fluctuated between $0.75 per share and $0.94 per share, but it is still a strong, high-dividend ETF.

Because of that high dividend payment, the Select Dividend iShares ETF is one of the best high-dividend yield ETFs to buy now.

3. KBW High Dividend Yield Financial Investco ETF

Managed Assets: $177 million

Fund Family: Investco

60-Month Beta: 1.4

Management Fee: 1.58%

Annual Dividend Yield: 15.95%

The smallest ETF on our list is the KBW High Dividend Yield Financial Investco ETF (Nasdaq: KBWD).

Operated by Investco, KBWD focuses on stocks of companies in the financial sector — most of which are small-cap stocks. It holds about 40 different companies.

While KBWD is the cheapest on the list — currently trading at around $13 per share — it is also one of the most volatile — with a 60-month beta of 1.4.

Its volatility is primarily because of the fact it holds a number of small-cap stocks in its portfolio.

KBWD’s current price is about $6 off its 200-day moving average as it tracks the Nasdaq Financial Sector Dividend Yield Index. It does have few large-cap and mid-cap stocks among its holdings as well.

Since its February 2020 drop, the ETF has gained back around 33% and continues to trend upward.

It has a higher management fee — 1.58% — than the others on our list, but it does provide an annual dividend yield of 15.95%.

The last dividend payment for shareholders of KBWD was $0.16 per share, which has been consistent over the last year. While that may seem a bit low, you have to consider the fact that the ETF pays that dividend monthly, not quarterly.

That monthly payout makes the KBW High Dividend Yield Financial Investco ETF one of the best high-dividend yield ETFs to buy now.

In this list, you have a mix of ETFs that hold a variety of companies.

Because they are ETFs, they give your portfolio instant diversification on top of impressive dividends that can help provide any investor with a solid stream of income, no matter what the rest of the market is doing.

That’s why they are one of the best high-dividend-yield ETFs to buy now.

Editor’s note: Want to learn how to profit from stock market volatility and grow your money 10 times over with just two simple investments? Sign up for The 10X Switch, a free webinar with Money & Markets Chief Investment Strategist Adam O’Dell on Thursday, May 14, at 8 p.m. EDT. You’ll also receive a free copy of Adam’s report, “The Simplest Investing Strategy Ever,” just for registering. Sign up here and reserve your spot!