Let’s talk about energy.

In a year that has seen virtually everything explode higher, energy stocks have really lagged. The Energy Select SPDR ETF (XLE), which tracks the performance of the energy stocks in the S&P 500, is up about 10% year to date.

Meanwhile, the Technology Select Sector SPDR ETF (XLK) is up a monster 24%, and the broader S&P 500 is up a very above-average 17%.

Given the importance of energy to the AI infrastructure boom, the underperformance is curious… particularly given that even stodgy old utilities are up over 20% this year (and for the second year running).

So, what’s the story?

Have investors simply overlooked the sector? And if so… might there be some gems to uncover, particularly as portfolio managers reposition for the new year?

Let’s do a deeper dive to find out.

Sector X-Ray of the Energy Sector

Energy is near and dear to us in Green Zone Fortunes. We have 15 open positions in the stocks of energy producers, energy infrastructure operators and in companies that generate a significant chunk of their revenues supplying the energy sector. Seven of these positions are sitting on triple-digit gains, with the best performer up over 600%.

So, while the sector as a whole has lagged the market, there are clearly fantastic opportunities to be found.

But that’s exactly the point. You have to know where to look, because the sector as a whole is a mixed bag.

Let’s start with the 21 energy stocks that are part of the S&P 500.

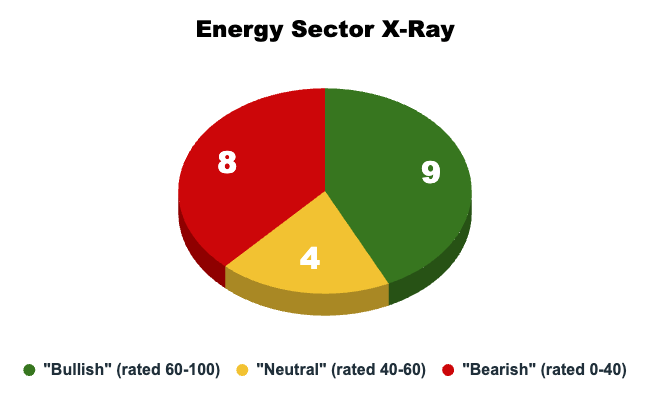

Nine out of the 21 rate as “Bullish” on my Green Zone Power Ratings system, with another four rating as “Neutral.” Eight currently rate as bearish.

This tells us that energy really is a stock picker’s market. Buying the sector as a whole is a recipe for mediocre returns. To do well in energy, you need to be selective.

Let’s dig a little deeper to see where energy stocks tend to earn “points” in their Green Zone Power Ratings.

Investors have had a strong preference for growth over the past several years, and particularly anything related to technology or AI. “Old economy” stocks have been mostly ignored.

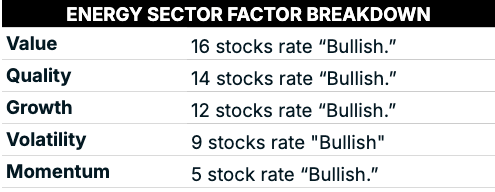

So, it’s not too surprising to see that 16 out of the 21 energy stocks in the S&P 500 rate as “Bullish” on value. 14 also rate “Bullish” on quality. 12 rate “Bullish” on growth and nine rate “Bullish” on volatility.

And of course, given the sluggish performance of energy stocks relative to the rest of the market this year, it’s understandable that only five rate as “Bullish” on momentum. As I mentioned earlier, investors have largely overlooked the sector over the past few years.

All of this is looking in the rearview mirror, realize. We want to look ahead, into 2026.

As I see it, the market appears to be in the early stages of a regime change.

After years of outperformance, growth stock valuations are stretched far beyond “normal” ranges, and investors are rotating into cheaper and more defensive names. We saw this same trend unfold a quarter century ago when “old economy” stocks beat the pants off of “new economy” stocks between 2000 and 2007.

Energy stocks were one of the best performers in that stretch, returning more than 30% in three separate years and 228% overall.

Cheap, High-Quality and Low-Volatility

If the market really is undergoing a regime change that favors fair valuations, then our focus should be clear. We should be looking for stocks that are reasonably priced, have strong underlying businesses and that tend to be less volatile.

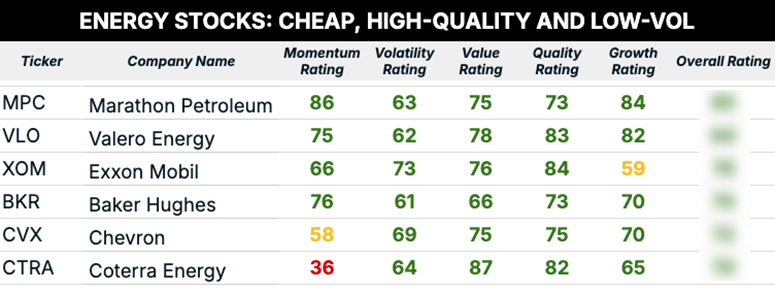

With that as a backdrop, I ran a screen for all S&P 500 energy stocks currently rated as “Bullish” on their value, volatility and quality factors. And to give us a complete picture of the stocks, I included the momentum and growth factor ratings too.

All of these energy stocks rate as “Bullish” in the overall Green Zone Power Rating. But the two refiners – Marathon Petroleum (MPC) and Valero Energy (VLO) – both rate as “Strong Bullish” with ratings over 80.

I would also add that both rate particularly well on their momentum factors. In a market that hasn’t been kind to energy stocks as a whole, Marathon and Valero have both bucked the trend, putting up returns that have crushed the S&P 500 this year.

I mentioned a moment ago that energy was near and dear to us in my flagship service, Green Zone Fortunes …

We don’t limit ourselves to only the stocks making up the S&P 500. In fact, my system has a strong preference for stocks that are smaller or mostly under the radar, including foreign stocks that only trade in the U.S. as ADRs.

Well, today I’m going to do something I don’t normally do. I’m going to share with you one of the top-rated energy stocks currently in the Green Zone Fortunes portfolio.

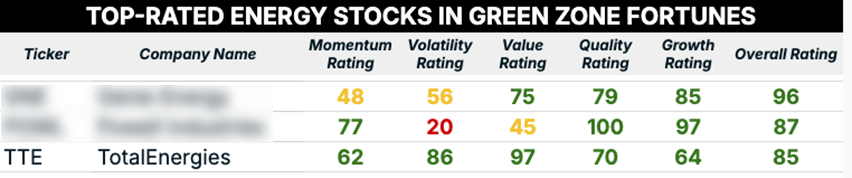

Take a look at French energy major TotalEnergies (TTE).

It’s one of the most attractively priced stocks on the market with a value rating of 97. It’s also a low-volatility workhorse, with a “Strong Bullish” rating of 86 on its volatility factor and a “Bullish” 70 on its quality factor.

TotalEnergies may be low-volatility, but it’s far from boring. It rates as “Bullish” on its growth and momentum factors as well. And its overall rating is a “Strong Bullish” 85.

As an added bonus, the stock also pays a dividend of close to 6%.

So, if you’re looking for a quality, low-drama stock priced to outperform, TotalEnergies is worth a close look.

If you’d like access to more picks like these – and full access to my Green Zone Power Ratings system – take Green Zone Fortunes for a spin. Apart from our profitable energy investments, my latest recommendation is a market-leading beverages company poised to profit from a boom in South American consumer spending.

To good profits,

Adam O’Dell

Editor, What My System Says Today